Circular Flow Model

advertisement

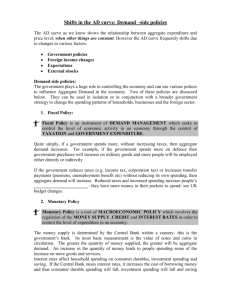

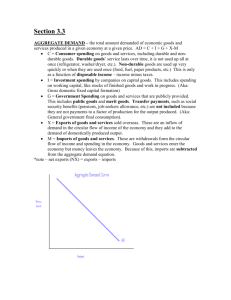

Circular Flow Model and Economic Activity • The circular flow model of the economy illustrates how the Australian economy works and how its different parts are interrelated. • Additionally, it identifies some of the macroeconomic variables affecting our countries economic conditions. Sectors in Australia’s Economic System The household sector • This sector includes nearly 22 million consumers or spenders, making up Australia’s entire population. These households also supply or sell resources to the business sector. The business sector • The business sector consists of all types of firms (e.g. sole traders, partnerships, public companies) that supply or sell goods and services. Sectors in Australia’s Economic System The financial sector • The financial sector consists of organisations like banks, building societies, the stock exchange and life insurance companies. These institutions collect or borrow household savings from individuals and lend these as credit to businesses wanting to undertake expansion through investment spending involving the purchase of new plant and equipment. Sectors in Australia’s Economic System The government sector • The government sector includes the activities of the federal, state and local governments. It collects various types of tax revenue from those earning income and then uses this to help pay for government spending on the provision of goods and services for the community (e.g. public roads, health, education, transport and housing). Sectors in Australia’s Economic System The overseas sector • The overseas sector involves spending on imports of goods and services by Australians, and spending by overseas countries on our exports of goods and services. Circular Flow of Economic System Total Production of Goods and Services (GDP) = C + I + G1 + G2 + (X – M) Income (wages, rent, dividends) Household Sector Business Sector Supply resources (natural, labour, capital) L E A K A G E S Private Consumption Expenditure (C) Government Sector Taxation (T) Gov’t Spending (G1 and G2) Savings (S) Financial Sector Investment (I) Imports (M) Overseas Sector Exports (X) I N J E C T I O N S Aggregate Demand • The total amount of expenditure on all goods and services produced in Australia in a given year. Aggregate Demand AD = C + I + G1 + G2 + (X – M) = GDP C = Private Consumption expenditure (60%) I = Private Investment expenditure(20%) G1 = Government Consumption expenditure (17%) G2 = Government Investment expenditure (3%) X (22%) – M(18%) = Net exports (4%) AD = C + I + G1 + G2 + (X – M) = GDP • C: Private Consumption expenditure: household spending on all goods and services. Durable goods (long lasting) and Non – Durable (one use) eg food) • I: Private Investment expenditure. Businesses invest in (purchase new) capital goods to assist in the production process. • G1 : Government Consumption expenditure (Wages, stationery, running costs) • G2 : Government Investment (Capital) expenditure (Building hospitals, roads, schools, buying equipment etc) • X – M: Exports minus Imports. We receive money on the sale of exports Australia produces and we subtract items of C, I, & G that are imported. Effect of AD on Economic Activity • When AD grows strongly firms will experience increased sales, increased orders and falling amounts of stock (inventory) or unsold goods and services. • Businesses will respond by expanding their production or output supplied provided there are available resources • This will lead to decreased unemployment • There will be an expansion in the level of economic activity. Effect of AD on Economic Activity • When AD slows firms will experience falling Sales and rising amounts of stock (inventory) or unsold goods and services. • Businesses will respond by cutting their production or output supplied to prevent further overproduction. • Firms may discount prices of unsold stock which may lead to lower levels of inflation • Firms may reduce workers hours or lay off some workers. • This will lead to increased unemployment • There will be an contraction in the level of economic activity which may lead to a recession. Aggregate Demand Factors • Aggregate demand factors are the influences that determine the cyclical level of spending of AD activity. Factors Affecting AD • • • • • • • • • • Household disposable income Interest rates Consumer confidence Business confidence Overseas world economic growth Exchange rates Terms of trade index Credit growth Population Growth Budgetary policy Disposable Income • Disposable income represents the money available for spending after personal tax has been deducted. • If income tax falls, disposable income increases. • Consumers are likely to increase their spending on goods and services • ↑ private consumption expenditure (C) • ↑ AD • ↑ economic activity Interest Rates • Interest rates are both the cost of borrowing and reward for savings • An decrease in interest rates will decrease debt repayments on mortgages and other loans. An decrease in interest rates will also discourage saving. • ↑ private consumption expenditure (C) • In addition, lower interest rates may encourage businesses to borrow to finance investment in new capital • ↑ private investment (I) • ↑ AD • ↑ Economic activity Consumer confidence • Consumer confidence measures the level of household optimism about future employment and income and the state of the economy. Business confidence • Business confidence measures a firms expectations about future sales and profits Economic Activity Overseas • Economic growth overseas influences the demand for Australia’s exports. • An increase in the GDP of a trading nation such as China means that more production and expenditure is occurring in China. • This will lead to more expenditure on Australia’s exports. The Exchange Rate • The exchange rate is a measure of one nation’s currency against another nation’s currency. • An increase in the value of the AUD against another nation’s currency is known as an appreciation. • An appreciation of the AUD makes our exports more expensive for overseas people to purchase • ↓X • An appreciation of the AUD makes imports cheaper for Australians to purchase • ↑M • ↓(X – M) • ↓AD Aggregate Supply • The total value of goods and services that business in Australia plan on selling in a given time period. Aggregate Supply Side Factors • Cost of production – Wages, fuel prices, import prices, cost of raw materials, interest rates on business loans • Number of productive resources – Increased size of the labour force, higher participation rates, increased land resources, mineral discoveries • Quality of resources – Growth in labour and capital productivity (output/input), better training and education programs, technological progress (ICT) Aggregate supply • Aggregate supply is affected by policies and actions of economy • Labour • Business • Government. in relation to the factors of production in an available in an economy (the “supply”) Labour Productivity • Labour productivity is a measure of the efficiency of labour resources, It measures the amount of output produced for each given labour input, usually hours worked. • An increase in Labour productivity will increase aggregate supply of inputs into the production process. (more output for the same time/cost) Government • Aggregate supply is targeted by government "supply side policies" which are meant to increase productive efficiency and hence national output. • Some examples of supply side policies include: education and training, research and development, supporting small/medium entrepreneurs, decreasing business taxes, making labour market reforms to diminish frictions that may hold down output, and investing in infrastructure.