Emerging Issues for Not-for

advertisement

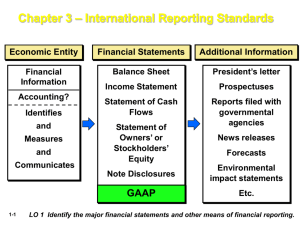

Hot Topics in the Accounting World 2009 Telergee CFO & Controller’s Conference October 14 – 16, 2009 Newcastle, New Hampshire www.telergee.com Presented by: Julie Keim Today’s Goals 1. Discuss new accounting pronouncements that you might not have been aware of. 2. A brief explanation of the pronouncement. 3. An example of how each pronouncement might affect your company. Hot Topics • FASB ASC 810, Consolidation (SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements) • FASB ASC 855, Subsequent Events (SFAS No. 165, Subsequent Events) • SAS 115 • IFRS Common Abbreviations • Financial Accounting Standards Board (FASB) • Accounting Standards Codification (ASC) • U.S. Generally Accepted Accounting Principals (GAAP) • Statement of Financial Accounting Standards (SFAS) • Statements on Auditing Standards (SAS) • International Accounting Standards Boards (IASB) • International Financial Reporting Standards (IFRS) FASB ASC 810, Consolidation • SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements, issued December 2007. • It is effective for fiscal years beginning on or after December 31, 2008. • Applies to all entities that prepare consolidated financial statements, except for not-for-profit organizations (should continue to apply FASB ASC 810 (ARB No. 51). FASB ASC 810, Consolidation What Are the Differences? • It establishes: – accounting and reporting standards for the noncontrolling interest in a subsidiary. – accounting and reporting standards for the deconsolidation of a subsidiary. – and it amends previous consolidation procedures in FASB ASC 810 to be consistent with the requirements of FASB ASC 805, Business Combinations (SFAS No. 141(R)). What is a Noncontrolling Interest? • “A noncontrolling interest is the portion of the equity (net assets) in a subsidiary not attributable, directly or indirectly, to a parent.” • Noncontrolling interests have been called minority interests. Noncontrolling Interest Presentation Balance Sheet • “The noncontrolling interest should be clearly identified and labeled, and classified as equity in the parent’s consolidated financial statements. “ Income Statement • “All intercompany income or loss must be eliminated in the consolidated financial statements.” What else should you know about SFAS No. 160, Noncontrolling Interests? (continued) • It must be applied retrospectively to the financial statement footnotes for all periods presented, including: – The controlling interest should be reclassified to equity. – Consolidated net income should be adjusted to include the net income attributed to the noncontrolling interest. – Consolidated comprehensive income should be adjusted to include the comprehensive income attributed to the noncontrolling interest. – Additional disclosures for deconsolidation or changes in a parent company’s ownership interest. How does SFAS No. 160, Noncontrolling Interests, affect my Company? For most Companies, this pronouncement will primarily be a change in presentation and disclosure, however it could impact a Company with an equity debt covenant. FASB ASC 855, Subsequent Events SFAS No. 165, Subsequent Events, issued May 2009, applies to entities with interim or annual financial periods ending after June 15, 2009. SFAS No. 165, Subsequent Events, Objective The objective to establish accounting and reporting standards for events that occur after the financial statement reporting period, but before the financial statements are issued, or are available to be issued. SFAS No. 165, Subsequent Events, Objective • Definition of when financial statements are issued and when financial statements are available to be issued. • Stating management should evaluate events or transactions that occur during this time period for recognition or disclosure in the financial statements. • Defining events or transactions that an entity should recognize or disclose in the financial statements. Subsequent Events – Financials are issued When financial statements are issued – “financial statements are considered to be issued when they are widely distributed to shareholders and other financial statement users for general use and reliance in a form and format that complies with GAAP”. Subsequent Events Financials are available to be issued When financial statements are available to be issued – “financial statements are considered to be available to be issued when they are complete in a form and format that complies with GAAP and all approvals necessary for issuance have been obtained, for example, from management, the board of directors, and/or significant shareholders”. Two Types of Subsequent Events Subsequent events are events or transactions that occur after the balance sheet date but before financial statements are issued or are available to be issued. The two types are: 1.) Events or transactions that provide additional evidence about conditions that existed at the date of the balance sheet, including the estimates inherent in the process of preparing financial statements (referred to as recognized subsequent events). 2.) Events that provide evidence about conditions that did not exist at the date of the balance sheet but arose after that date (referred to as nonrecognized subsequent events). Examples of Recognized Subsequent Events An entity is required to recognize events or transactions that take place from the period ending date until the issuance (either available or issued) date that impact conditions that existed at the balance sheet date. Common examples of events or transactions to be recognized: -Litigation -Accounts Receivable Examples of Nonrecognized Subsequent Events An entity would not be required to recognize events or transactions that take place from the period ending date until the issuance (either available or issued) date that impact conditions that did not exist at the balance sheet date. Common examples of events or transactions that took place after the balance sheet that should be disclosed: – – – – Business combinations Litigation Natural disasters Commitments How does SFAS No. 165, Subsequent Events, affect my Company? It should not result in significant changes in subsequent events that an entity reports. It introduces the concept of financial statements being available to be issued and requires disclosure of the date which an entity has evaluated subsequent events. This allows users of the financial statements to be aware of the date which an entity has evaluated through. SFAS No. 165, Subsequent Events, Additional Disclosures As part of the financial statement footnotes, the Company will disclose date through which subsequent events have been evaluated. An example of the disclosure could be: Management has reviewed the events occurring through XXX, XX, 2010, the date the financial statements were available to be issued, and no subsequent events occurred requiring accrual or disclosure (or reference note if events have occurred). Communication of Internal Control Related Matters Identified in an Audit Statement on Auditing Standards No. 115 (SAS 115) supersedes SAS No. 112 and: • Defines the terms deficiency in internal control, significant deficiency, and material weakness. • Provides guidance on evaluating the severity of control deficiencies. • Requires the auditor to communicate in writing to Those Charged with Governance significant deficiencies and material weaknesses. SAS No. 115 Deficiency in Internal Control – exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent, or detect and correct misstatements on a timely basis. SAS No. 115 Significant Deficiency – is a deficiency, or a combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to bring to the attention of Those Charged with Governance. SAS No. 115 Material Weakness – is a significant deficiency, or combination of significant deficiencies, that results in a more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected. Example - Deficiency in Internal Control Payroll Department - Segregation of Duties We noted internal control deficiencies resulting from the lack of segregation of duties in certain accounting areas. For example, a sole employee is responsible for numerous payroll functions, including the review of time cards, the preparation of the payroll data for submission to the data processing service bureau, the reconciliation of the payroll bank account and the distribution of payroll checks. To improve internal controls over payroll, we recommend the payroll duties be segregated between two or more employees, as follows: (a) departmental supervisors should be responsible for reviewing and approving employee time cards, (b) payroll records should be reviewed by a member of management, who is independent of the payroll function and (c) payroll checks should be distributed by an employee independent of the payroll function. Example - Significant Deficiency Authorized Signers During our review of the cash confirmations received from local banks, we noted inconsistencies in the authorized signers for certain accounts of the Company. In some instances, there were signers listed that were no longer employed by the Company. The inconsistencies were noted primarily on accounts that are used infrequently. Although there are compensating controls in place to help identify unauthorized access to these funds, we recommend that a review of authorized signers be performed for all accounts of the Company and its subsidiaries and that a current list of signers for all accounts be developed. We also recommend that this list should be approved by the Board of Directors. Example - Material Weakness Financial Reporting As part of our audit of financial statements, we assist management in the preparation of the financial statements in accordance with U.S. generally accepted accounting principles (GAAP). Although management reviews and approves the financial statements, there is not a system of internal control in place at the Company to assure that the financial statements comply with GAAP in all material respects. This is because there is not a trained accountant with the skills needed for this function employed at the Company. Based on discussions with the president of the Company, we understand management and the Board of Directors are aware of this issue, and believe it is not economically feasible to have an employee with the necessary skills for this function. While our assistance in the preparation of financial statements complies with GAAP, those standards also require that we report this material weakness in control over financial reporting to those with governance responsibilities. What is IFRS? International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB) that is becoming the global standard for the preparation of public company financial statements. Who is the IASB? “The IASB is an independent accounting standardsetting body, based in London. It consists of 14 members from nine countries, including the United States. The IASB began operations in 2001, when it succeeded the International Accounting Standards Committee, established in 1973.” www.iasb.org How many countries have adopted IFRS? Is the U.S. one of them? • Over 100 countries have adopted IFRS, including 27 member states of the European Union. • Other countries scheduled to follow include: Argentina, Brazil, Canada, Chile, Korea, Singapore, Mexico and Japan. GAAP and IFRS - What Are the Differences? Examples (not meant to be all-inclusive): • IFRS does not permit Last In, First Out (LIFO). • IFRS uses a single-step method for impairment writedowns rather than the two-step method used in U.S. GAAP, making write-downs more likely. • IFRS has a different probability threshold and measurement objective for contingencies. • IFRS does not permit debt for which a covenant violation has occurred to be classified as non-current unless a lender waiver is obtained before the balance sheet date. IFRS Update • On September 14, 2009 – SEC chief accountant, James Kroeker, said that: unifying U.S. GAAP with IFRS will be a priority for regulators in the “coming weeks and months”. Conclusion Enjoy the Fall in New England! Thank you! Questions? jkeim@bdmp.com (207) 541-2282