Korea

advertisement

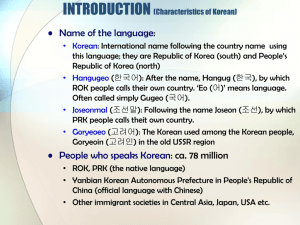

SELECTING PARTNERS FOR SUCCESSFUL INTERNTIONAL ALLIANCES Authors: M.Tina Dacin Michael A.Hitt Edward Levitas EXAMINATION OF U.S. AND KOREAN FIRMS Maria Paccagnani Chiara Porcaro Roberta Vilonna Alliances are the best strategies for firms to enter international markets, but it can represent a challenge for them because there is an high risk to fail, due to several factors. In order to avoid it, managers have to prepare their firms to be willing to cooperate and make the right decisions, before entering in an alliance. One of the main point to be considered is the PARTNER SELECTION and the criteria used in its research. Understanding these criteria can reduce the likelihood of failure and build up a successful alliance. Risk to fail Despite their spread (the number of joint ventures in the U.S. grew by 423% over the period 1986-1995) about 50-60% of alliances fail, due to partner’s incompatibilities in term of goals, skills, decision- making process approach and orientation. The right partner’s research The right partner’s research can be a demanding work in term of time, but it represents the first step to create an alliance and limits the probability to select a partner without the capabilities needed. Often firms select their partners, basing on previous working experiences or after a long courtship to assess partner’s desires and orientation. However, under market pressure, managers don’t spend an adequate time and don’t pay attention in partner selection, so that the alliances go out of business. Take care of these aspects prior to consolidate an alliance lead firms to establish a long term relationship, especially in those set among firms from different countries. The cultural context in which firms are involved, the national economic growth, different government policies, infrastructures and different orientation can affect the outcome of an alliance. SO … Managers have to bear in mind all these features, when they start a new business with another firm. Examining different approaches used by U.S and Korea in partner selection can higlight the difficulty to cooperate in a cross-boarder alliance. CROSS-BOARDER ALLIANCES Firms from developed countries can encounter some problems in forming alliances with firms set in developing countries. Firms from NICs (New Industrialized Countries) such as South Korea, Taiwan , Hong Kong, Singapore, Mexico and Brazil, differ for their cultural heritage, different ideologies and perspectives respect to industrialized countries. In some cases, the alliances between NICs and developed countries are unsuccessful because of their different aims. If firms from developed countries can exploit local knowledges, customs and business practices typical of developed ones, on the contrary, firms from NICs aren’t allowed to gain experiences, or they don’t possess capabilities needed. Main features affecting the Partner Selection: First: CULTURAL HERITAGE Differences in the culture of origin can produce different strategic orientations that may cause the alliance failure. e.g. diverse decision-making processes used by two firms Second: ECONOMIC DEVELOPMENT Firm from developed and developing countries can have different targets and motives e.g. the one decide to establish an alliance in order to find new markets to sell products, but firms from NICs seek access to technologies and export opportunities. Third: GOVERNMENT POLICIES Government support with industrial policies can influence also the firm development and regulations can constrain the pool of available partners and influence the decisions to be made. THE CASE OF KOREA Korea We speak about Korea but we are evaluating only the the southern part of the Korean Peninsula: SOUTH KOREA In fact: South Korea is a presidential republic and is a developed country with the II highest standard of living in Asia and the world's 12th largest economy. The economy is export-driven with production focusing on electronics, automobiles, ships, machinery, petrochemicals and robotics. North Korea is a dictatorship, totalitarian and Stalinist country. The means of production are owned by the state through state-run enterprises and collectivized farms Historical Aspects The 21st century has been referred to as the century of Pacific Asia. Korea has emerged as a major participant in the world market since world war II and, as a result, competition between US and Korean firms in global markets is increasing. No other country has developed so rapidly from a development aid recipient to one of the major donors. Samsung, LG and Hyundai are among the twelve top companies in the world Economic expansion • Korean economic expansion is related to the evolution of Korean Chaebols (large business groupings) and is vigorously supported by government policies. • Alliances with Korean firms can be seen as an entrance into other Asian markets allowing firms to improve their existing partnerships. • No other country has developed so rapidly from a development aid recipient to one of the major donors. Given these factors, Korean firms are likely candidates for cross-border alliances. Focusing on Korea, peculiarities: • Korean culture is strongly influenced by Confucian ideology. • Koreans’ standard of success and failure are more closely associated with approval or disapproval of others than with inner personal standards or goals. • American culture is individualistic. Korean culture is more concerned with the interests of the community. • Defined relationships between business and government. Korean managers have had to: develop the requisite partnering skills needed to be effective in collaborative ventures. by working in Chaebol networks and their linkages to the system of state government, Korean managers have developed internal capabilities for network. research suggests that Korean managers have a stronger long-term orientation than US managers. Partner selection criteria There are differences in the criteria used by US and Korean executives in strategic decision making. Firms from different countries tend to approach strategic problems in different ways. Based on differences in history, cultural and economic factors. Partner selection criteria (for Korea): 1-Technical capabilities 2-Industry Attractiveness 3-Special skills you can learn from partner 4-Willingness to share expertise 5-Capabilities to provide quality -Industry Attractiveness -Special skills you can learn from partner -Willingness to share expertise -Capabilities to provide quality are of course relevant but the most important criteria are the Technical capabilities: Korean executives in fact place significant emphasis on the financial health of a partner and the peculiar characteristic is that they are specifically searching for partners that have technical capabilities that their firms may not possess but wishes to learn. Strategic alliances…a positive example: “CORNING AND SAMSUNG ” is an American manufacturer of glass, ceramics and related materials, primarily for industrial and scientific applications. is a South Korean multinational company. Products: apparel, chemicals, consumer electronics, electronic components, medical equipment, precision instruments, semiconductors, ships, telecommunications equipment. Corning-Samsung It is a tested collaboration that starts from far, during the 1980s Corning developed a technology for making glass used in LCD. In 1995 Samsung and Corning established the Samsung Corning Precision. In 2013 Corning entered into a series of agreements with Samsung intended to strengthen product and technology collaborations between the two companies. These agreements will allow Corning to extend its leadership in specialty glass and drive earnings growth. http://www.youtube.com/watch?v=ZXTXQvHC_p0 CEO Wendell Weeks discuss Corning’s agreement with Samsung: http://www.youtube.com/watch?v=bn7IbgwhwdQ THE CASE OF US CULTURAL HERITAGE • Individualistic tendency, the US are generally known: to be geocentric to have little interest in the whole community To prefere the free market • Separation between private business and public government Goals and objectives • The US, as a developed country, is not interested in the technical capabilities, but in increasing the financial return of the company. • Interested in the management skills and abilities of the potential partner. Daewoo and GM http://www.youtube.com/watch?v=iJM_quS hBCk DAEWOO AND GM • Failed joint venture • Reason: different orientation and goals • Daewoo seeks growth and access to new markets • GM wants to achieve financial returns • NO financial returns for GM, no more investments for the growth of Daewoo Failure. DAIMLER and CHRYSLER • The Daimer-Benz merger with Chrysler in 1998 is probably the most famous of all international merger that ended in failure. Cultural differences and organizational culture are both acknowledged to have played their part. • Cultural factors just cannot be ignored on a global level, especially not within mergers and acquisition. The Cultural factors that played here: • Differences in corporate cultures and values • Lack of coordination • Severe lack of trust among the employees • All three resulted in communication failures which in turn caused a sharp reduction in productivity. TO CONCLUDE: Building a successful alliance can depend on several factors: 1. Find complementary skills; 2. Expecting differences in firms from different countries; 3. Understand the partner’s desires and have the same objectives; 4. Be willing to cooperate and create a strong relationship; http://en.wikipedia.org/wiki/North_Korea http://en.wikipedia.org/wiki/South_Korea http://www.economist.com/node/371476 http://www.youtube.com/watch?v=bn7IbgwhwdQ http://en.wikipedia.org/wiki/Corning_Inc. http://en.wikipedia.org/wiki/Samsung http://www.corning.com/news_center/news_releases/2013/2013 102201.aspx http://en.wikipedia.org/wiki/Samsung_Corning_Precision_Glass http://www.korea.net/NewsFocus/Business/view?articleId=1040 50 http://www.kwintessential.co.uk/resources/daimlerbenzchrysler-merger.html http://www.youtube.com/watch?v=iJM_quShBCk