Chapter 5

advertisement

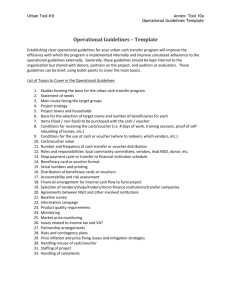

LESSON 5-1 Vouchers and Voucher Registers CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning Info on Unit 2 This business is not departmentalized as in Unit 1 so accounts are not divided by departments Uses Vouchers Payable instead of Accounts payable Only one Income Summary account because not departmentalized Operating expenses are divided into two categories: Selling Expenses and Administrative Expenses CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning A Voucher System – General Info All businesses implement procedures to control and protect their assets. Cash asset is most likely to be misused because its ownership is easily transferred. Procedures to protect cash include: Storing in safe place Making regular bank deposits Approving all cash payments Should be approved before payment to ensure the goods or services were ordered, have been received, and amount due is correct. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning A Voucher System – General Info Small businesses, owner or manager approves payment Large business may have several people authorized to approve payment Many larger businesses and some small businesses use the Voucher System to control cash In a voucher system, no check can be issued without a properly authorized voucher In a voucher system, an account called Vouchers Payable replaces the account called Accounts Payable CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning A Voucher System – General Info On a voucher, there are three dates: Date – date voucher was prepared Due Date – when payment must be received Payment Date – when check should be written (book uses the example of writing checks 2 days before due) Some vouchers are actually envelopes in which related documents may be placed Voucher forms must be pre-numbered as another facet of the control system CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning A Voucher System – General Info Unpaid vouchers are filed according to Payment Date in Unpaid Vouchers File (not A/P ledger) Paid vouchers are filed according to Payee When an Invoice is checked for accuracy, a verification form is stamped on the invoice (page 146) Vouchers have 5 Parts (page 147) Payee Information Accounts Affected Voucher Approval Where the Voucher is Recorded Payment information (date, check #, etc.) CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 7 TERMS REVIEW page 149 Voucher – a business form used to show an authorized person’s approval for a cash payment voucher system – a set of procedures for controlling cash payments by preparing and approving vouchers before payments are made voucher register – a journal used to record vouchers CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-1 8 VERIFYING AN INVOICE CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 145 LESSON 5-1 9 A VOUCHER page 145 August 1. Purchased merchandise on account from O’Riley Company, $3,500.00. Voucher No. 647. Purchases 3,500.00 Voucher’s Payable 3,500.00 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-1 10 PREPARING A VOUCHER FROM AN INVOICE page 146 Section 1—Payee Information Section 2—Accounts Affected Section 3—Voucher Approval Section 4—Information about where the voucher is recorded Section 5—Information about the payment of the voucher CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-1 11 VOUCHER REGISTER pages 147 and 148 August 1. Purchased merchandise on account from O’Riley Company, $3,500.00. Voucher No. 647. 1 2 3 4 5 1. Write date. 2. Record payee. 3. Write voucher number. 4. Enter credit amount. 5. Record debit amount. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-1 12 VOUCHER REGISTER page 147 and 148 August 2. Received invoice for sales miscellaneous expense from Glenhill Company, $40.00. Voucher No. 648. 1 2 3 1. Write date. 2. Record payee. 3. Write voucher number. 4 5 4. Enter credit amount. 5. Record debit amount and write the title of the account to be debited. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-1 LESSON 5-2 Voucher Check and Check Registers CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 14 TERMS REVIEW page 153 voucher check – form used to write a check and details of the payment check register – form used to record all checks written in the voucher system CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-2 15 PREPARING A VOUCHER CHECK page 150 1 2 3 6 4 5 1. Enter voucher number. 2. Enter payee’s invoice number. 3. Enter amount of invoice. 4. Enter amount of discount. 5. Enter net amount. 6. Prepare check to payee for net amount of invoice. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-2 16 JOURNALIZING CASH PAYMENTS page 151 3 1 2 4 5 6 7 1. Write date. 2. Record payee. 3. Write check number. 4. Record voucher number. 5. Enter debit amount. 6. Write credit amount(s). 7. Calculate and record new balance. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-2 17 PROVING, RULING, AND POSTING A CHECK REGISTER CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 152 LESSON 5-2 18 STARTING A NEW PAGE OF A CHECK REGISTER CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 152 LESSON 5-2 LESSON 5-3 Selected Transactions in a Voucher System CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 20 PURCHASES RETURNS AND ALLOWANCES page 155 August 12. Issued Debit Memorandum No. 98 to Ramsey, Inc. for return of merchandise purchased, $85.00. Cancel Voucher No. 652. Voucher No. 655. 1. Cancel the original voucher. 2. Prepare a new voucher. 3. In the voucher register, reference the new voucher number. 4. Record the new voucher. 5. File the new voucher by its payment date in the unpaid vouchers file. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-3 21 RECORDING PAYROLL IN A VOUCHER REGISTER pages 156 and 157 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-3 22 A PAYROLL VOUCHER CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 156 LESSON 5-3 23 ADVANTAGES OF A VOUCHER SYSTEM page 158 1. Only a few people can authorize and approve all cash payments. 2. A voucher jacket provides a convenient way to file invoices and related business papers for future reference. 3. Unpaid vouchers are filed by their payment dates to help ensure payment of invoices within the discount periods. 4. An unpaid vouchers file and a paid vouchers file eliminate posting to an accounts payable ledger. 5. A paid vouchers file provides three different and easy ways to find information about a paid voucher. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 5-3