CHAPTER 13

Statement of Cash Flows

Slide 13-2

Need for a Statement of Cash Flows

Stakeholders want to know how a company

generates and spends cash

Can the company

Generate enough cash to pay its wages and

bills, including debt payments

Generate cash in order to earn a reasonable

return and pay dividends

Generate enough cash to avoid bankruptcy

Slide 13-3

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Need for a Statement of Cash Flows

Cash flow is not the same as net income

Under GAAP, income is calculated using the

accrual method

The income statement does little to inform

managers and other company stakeholders

of the sources and uses of cash

Slide 13-4

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Need for a Statement of Cash Flows

For the purposes of the cash flow statement,

cash includes both cash and cash

equivalents

Cash equivalents are short term investments

that can be readily converted into cash

Examples include 90 day US Treasury Bills

and money market funds

Slide 13-5

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

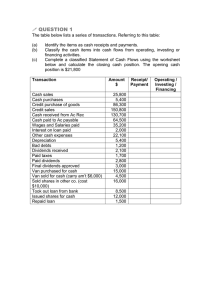

Types of Business Activities

Operating activities

Cash flows related to production and delivery

of goods and services

Reflect the day to day profit oriented activities

of a business

Principal cash inflows are cash sales and

collection of accounts receivable

Major sources of cash outflows include

payments to suppliers, employees and taxing

authorities

Slide 13-6

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Examples of Operating Activities

Slide 13-7

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Types of Business Activities

Investing activities

Cash flows related to buying and selling of

long-term assets

Examples include collections from long term

loans, collections from the sale of equipment

no longer in use, payments to buy securities of

other companies, buying a building and buying

a business

Slide 13-8

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Examples of Investing Activities

Slide 13-9

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Types of Business Activities

Financing activities

Cash inflows related to issuing stock and

issuing long-term debt

Cash outflows related to repurchasing

stock, paying off loans and making

dividend payments

Slide 13-10

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Examples of Financing Activities

Slide 13-11

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Which of the following would be a cash outflow

from operating activities?

a.

b.

c.

d.

Acquisition of operating equipment

Retirement of bonds

Collection of accounts receivable

Payments to suppliers for raw materials

Answer: d

Payments to suppliers for raw materials

Slide 13-12

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Which of the following would be a cash outflow

from investing activities?

a.

b.

c.

d.

Payments to suppliers

Payments to employees

Purchase of land

Payment of dividends

Answer: c

Purchase of land

Slide 13-13

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Which of the following would be a cash outflow

from financing activities?

a.

b.

c.

d.

Payment of dividends

Payments to taxing authorities

Purchase of land

Cash sales

Answer: a

Payment of dividends

Slide 13-14

Learning objective 1: Explain the need for the statement of

cash flows and identify the three types of business

activities presented in a statement of cash flows.

Statement of Cash Flows General

Format

Slide 13-15

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Preparing the Statement of Cash Flows

Two acceptable methods

Direct method

Like an income statement prepared using the

cash basis

Indirect method

Reconciles net income to cash flow from

operations

Preferable under GAAP

Most used in financial statements

Slide 13-16

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Preparing the Statement of Cash Flows

Cash flows from operating activities

Cash collected on sale of merchandise

Cash received (paid) related to interest

income (expense)

Cash received related to dividend income

Cash paid to purchase merchandise

Cash paid for general and administrative

expenses

Cash paid for income taxes

Slide 13-17

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Preparing the Statement of Cash Flows

Cash flows from investing activities

Cash received on the sale of a machine no

longer in use

Cash paid to buy a machine

Cash paid to buy a building

Cash received from selling a building

Cash paid to buy a business

Slide 13-18

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Preparing the Statement of Cash Flows

Cash flows from financing activities

Slide 13-19

Cash received from selling bonds

Cash received from using a line of credit

Cash received from issuing common stock

Cash paid to retire long term debt

Cash dividends paid

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Preparing the Statement of Cash Flows

Direct method

Lists specific cash inflows and outflows from

operating activities

Similar to cash-basis income statement within

the operating activities section

FASB requires separate schedule to reconcile

cash flows from operating activities and net

income

Slide 13-20

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Cash Flows from Operating Activities

(Direct Method)

To determine cash flows using the direct

method

Analyze all balance sheet accounts, other

than cash, to determine how their changes

were affected by cash flows

This analysis will involve information from the

income statement

Slide 13-21

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Cash Flows from Operating Activities

(Direct Method)

Current asset and current liability accounts

The first account is cash received from

customers

Solving the following equation yields cash

receipts of $10,004,825

Beginning balance receivables

Plus sales

Less cash collected

$879,053

10,548,640

?

Equals ending balance receivables

$1,422,868

Slide 13-22

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Cash Flows from Operating Activities

(Direct Method)

Current asset and current liability accounts

The next item is cost of merchandise sold

The following formula yields purchases of

$8,286,993

Beginning inventory

Plus purchases

Less cost of goods sold

Equals ending balance inventory

Slide 13-23

$988,935

?

7,911,480

$1,364,448

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Cash Flows from Operating Activities

(Direct Method)

Current asset and current liability accounts

Purchases of $8,286,993 are used in the next

calculation, which solves for cash payments for

purchases of inventory of $8,202,703

Beginning balance accounts payable

$575,000

Plus purchases

Less cash paid for inventory purchases

Equals ending balance accounts payable

8,286,993

?

$659,290

Slide 13-24

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Cash Flows from Operating Activities

(Direct Method)

Analyze other current asset and liability

accounts

Use prepaid insurance and insurance

expense to solve for cash payments for

insurance

Use accrued wages and salaries and wages

and salaries expense to solve for cash

payments for wages and salaries

Use income taxes payable and income tax

expense to solve for cash payments for

income taxes

Slide 13-25

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Cash Flows from Operating Activities

(Direct Method)

Long term asset accounts

Use accumulated depreciation, depreciation

expense, book value of equipment sold, and

loss on sale to solve for

Cash proceeds related to sale of equipment,

and

Cash paid for purchases of equipment

Slide 13-26

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Cash Flows from Operating Activities

(Direct Method)

Long term liabilities and stockholders’ equity

Cash paid to reduce debt (or cash proceeds

from borrowing) is the difference between the

beginning and ending balance of long term

debt

Use beginning and ending retained earnings

plus net income to solve for cash payments

for dividends

Slide 13-27

Learning objective 2: Prepare a statement of cash

flows using the direct method.

RS Inc. has the following information:

Taxes payable 12/31/2016: $171,000

Income tax expense 2017: $585,000

Taxes payable 12/31/2017: $150,000

Calculate cash paid for taxes in 2017

Answer:

$171,000 + ? - $150,000 = $585,000

? = 564,000

Slide 13-28

Learning objective 2: Prepare a statement of cash

flows using the direct method.

Preparing the Statement of Cash Flows

(Indirect Method)

The indirect method is much more common

The two methods differ only in terms of the

presentation of cash flows related to operating

activities

There are no differences for inventing activities

and financing activities

Learning objective 3: Prepare a statement of cash

flows using the direct method and interpret information

in the statement of cash flows.

Preparing the Statement of Cash Flows

(Indirect Method)

5 step approach to calculate cash flows from

operating activities – indirect

1. Start with net income

2. Add non-cash expenses such as

depreciation and amortization

3. Subtract gains and add back losses

4. Subtract (add) increases (decreases) in

current assets other than cash

5. Add (subtract) increases (decreases) in

current liabilities

Learning objective 3: Prepare a statement of cash

flows using the direct method and interpret information

in the statement of cash flows.

Preparing the Statement of Cash Flows

(Indirect Method)

The operating activities section is a

reconciliation of net income to cash flows

from operating activities

Current assets

Increases in current assets indicate we must

reduce income to convert to cash basis

Decreases indicate we must increase income

to convert to cash basis

Learning objective 3: Prepare a statement of cash

flows using the direct method and interpret information

in the statement of cash flows.

Preparing the Statement of Cash Flows

(Indirect Method)

Current liabilities

Increases in current liabilities indicate we

must increase income to convert to cash

basis

Decreases in current liabilities indicate we

must reduce income to convert to cash basis

Learning objective 3: Prepare a statement of cash

flows using the direct method and interpret information

in the statement of cash flows.

Indirect Method part 1

Slide 13-33

Learning objective 3: Prepare a statement of cash

flows using the direct method and interpret information

in the statement of cash flows.

Indirect Method part 2

Slide 13-34

Learning objective 3: Prepare a statement of cash

flows using the direct method and interpret information

in the statement of cash flows.

Using the indirect method, changes in current assets

other than cash and current liabilities are used to

adjust net income to determine:

a. Income from operations

b. Net cash from investing activities

c. Net cash provided by operating activities

d. None of the above

Answer: c

Net cash provided by operating activities

Slide 13-35

Learning objective 3: Prepare a statement of cash

flows using the direct method and interpret information

in the statement of cash flows.

Interpreting the Statement of Cash

Flows

In general, the most important part is the cash

flows from operating activities

Unless a company is able to generate cash

from its core operations, it is unlikely to

succeed

If cash flows in this section are low, this

implies that a company must offset them by

changes in investing and financing decisions

Slide 13-36

Learning objective 3: Prepare a statement of cash

flows using the direct method and interpret information

in the statement of cash flows.

Statement of Cash Flows

Slide 13-37

Learning objective 3: Prepare a statement of cash

flows using the direct method and interpret information

in the statement of cash flows.

Copyright

© 2016 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful.

Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use only

and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the

use of these programs or from the use of the information

contained herein.

Slide 13-38