Dominic Rozon - Le relais des jeunes gatinois

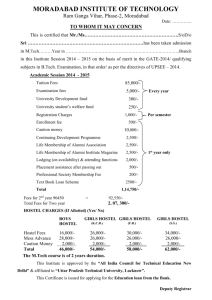

advertisement