CONTENT CHAPTER DESCRIPTION INTRODUCTION TO

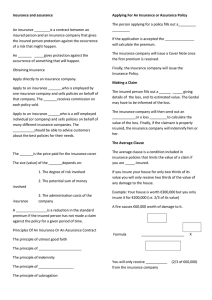

advertisement