State of Texas Travel Voucher completion

advertisement

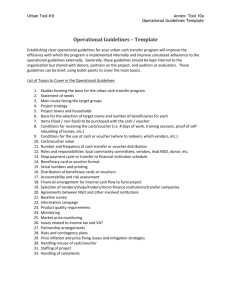

TRAVEL VOUCHER COMPLETION OCTOBER 25, 2012 STATE OF TEXAS TRAVEL VOUCHER 1 COMPTROLLER OBJECT CODES • Identify the purpose of the expense/purchase. • Comptroller Object Codes are how Texas knows what Texas is paying for. 2 COMPTROLLER OBJECT CODES FOR TRAVEL Description of Travel Expense In-State Code Out-of-State Code Public trans-rental car only 3010 3110 Public Trans-Airfare, taxi, other 3011 3111 Mileage rate not to exceed maximum 3016 3116 Actual expenses-Overnight travel 3020 3120 Incidental Expenses 3025 3125 Meals and lodging not to exceed State allowances 3030 3130 Prospective Employee Expenses-All Expenses 3210 Foreign Travel-All expenses 3310 Student travel Expenses 3410 Registration fees 5215 3 SUPPORTING DOCUMENTATION • Must be attached to the travel voucher. • Require all original receipts with the exception of meals receipts. • Purpose of trip description must create a story…The • When • How • What • Where • Why … of the travel. 4 SECTIONS OF THE TRAVEL VOUCHER • • • • • • • Information Accounting Distribution Certification In-State Out-of-State Purpose 5 TRAVEL VOUCHER INFORMATION SECTION 1. 2. 3. 4. 5. 6. 7. 8. Not required Agency Number: 761 Agency Name: Texas A&M International University Current Document Number: assigned by Business Office Effective Date: assigned by Business Office Doc date: 1st date of travel (mm/dd/yyyy) DOC agent: The agency that is preparing the documents FY: current fiscal year 6 TRAVEL VOUCHER INFORMATION SECTION-CONTINUATION 9. Document amount: Amount the employee is claiming. This amount is calculated from 17A & 17B 10. Invoice No: 1st date of travel without dashes/slashes 11. Pmt Due Date: not required 12. Pay to: employee name 13. Title: title of the employee 14. Designated Headquarters: the city considered as the employee’s place of employment 15. Texas Identification Number: 4 digits only. Is always the last 4 of social security number. 16. Service date: last date of travel (mm/dd/yyyy) 17. Traveling to: city employee is traveling to conduct business 7 TRAVEL VOUCHER ACCOUNTING SECTION 17A & 17B. Account Number: account that is funding travel expenses. Expenditure code: travel comptroller object code. Amount: amount that corresponds with that object code. 17C. Agency Use (Business Office Only). 8 TRAVEL VOUCHER DISTRIBUTION SECTION 18. Distribution: this is the distribution of the expenses that were incurred. For meals and/or lodging, start on the 2nd page. 9 TRAVEL VOUCHER CERTIFICATION 19. This statement proves that this is a legal document. The claimant is where the traveler who is seeking reimbursement places their signature and dates the voucher. The supervisor is where the traveler’s supervisor/account manager signs and dates. 20. Contact Name: already assigned by Business Office. 21. Agency use: Business Office use only. 22. Fiscal Officer Approval: Business Office use only. 10 IN-STATE ITEMIZATION SECTION-1 LINE PER DAY a. b. c. d. e. f. g. h. i. j. k. l. Date, hour, minutes, am or pm left headquarters. Date, hour, minutes, am or pm arrived back at headquarters. Not required. Meals per day not to exceed maximum rates. Lodging per day not to exceed maximum rates. Total is calculated from d and e. Only filled out for actual expenses (foreign, Hawaii, Alaska, University President) “ “ “ “ “ “ Not required. Calculated from f. Calculated from i. 11 IN-STATE MEALS AND LODGING ITEMIZATION 12 OUT-OF-STATE ITEMIZATION SECTION1 LINE PER DAY 13 PURPOSE OF TRIP y. Purpose of trip • When • How • What • Where • Why 14 PURPOSE OF TRIP SAMPLE 15 LET’S WORK ONE TOGETHER… Exercise 1 Lucy Donovan (recruiter at the Office of Student Success, last 4 of ssn 1234) attended a college fair at Austin Community College on June 23. Lucy picked up rental car on June 22. She left headquarters at 2pm on June 22 and arrived back at headquarters at 8pm on June 23. The following are the expenses incurred for this trip: Rental June 22-23 $100.90 (includes $25.00 for additional insurance, PAI Gas for rental June 22 $10.00 June 23 $34.10 Meals June 22 $26.45 (includes a $6.00 alcoholic drink and $2.00 tip) June 23 $29.55 Hotel June 22 $105.00 plus $6.30 (6 %) state tax and $11.29 (10.75%) city tax 16 QUESTIONS QUESTIONS 17 THANK YOU!!! • Martha Laura Medina mmedina@tamiu.edu 956-326-2817 • Maria Elena Hernandez merher@tamiu.edu 956-326-2148 18