David Hoelscher - Deposit Insurance and Credit Guarantee

Global Practices in Bank Resolution

David S. Hoelscher

Role of Deposit Insurance in Bank Resolution

Framework – Lessons from the Financial Crisis

November 13-16, 2011

JODHPUR, INDIA

Outline

• Evolving Safety Net After Crisis

• Effective Insolvency Regimes

• Institutional Framework for Resolution

• Future for DIA

• Conclusions and Policy Implications

Evolving Safety Net After Crisis

The crisis brought several long term developments into focus :

Financial stability is at the center of policy making

Depositor protection is now sharply higher and will remain so

Risk mitigation responsibility of expanded and strengthened safety net

The three safety net functions must be better integrated

Supervision, depositor protection, problem bank resolution

Less distinction between stable and crisis policies

The role of deposit insurance in that safety net is changing

Effective Insolvency Regimes

Effective insolvency regime critical to financial stability

Critical elements of effective insolvency

• Early intervention before insolvency

• Speed of intervention/resolution

• Ability to transfer or merger a banks’ operations

• Effective write-down of shareholders

• Protection of on-going business

Benefits of a special bank bankruptcy regime

Effective Insolvency Regimes

Resolution of small and medium sized banks

• Ensure adequate and similar tool kit

– P&A

– Bridge bank

– Nationalization as last resort

• Ensure shareholders can be written down

Resolution of systemically important institutions

• Prepare SIFIs for failure

– Contingent capital—bail in creditors

– Living wills

• Difficulties of resolving NBFI

• Special cross border resolution issues

– Ring fencing verses universality

– Need for coordination

– Different insolvency triggers

Institutional Framework for Resolution

Before crisis: agnostic on effective institutional framework

• Policy makers were unsure which agency was best to decide on options

• Different responsibilities of safety net agencies

• Role of deposit insurer varied widely across jurisdictions

After the crisis: some consensus about role deposit insurers

• Deposit insurer given expanding role in case of small and medium banks

– Use of deposit insurance financing generated few objections

– Deposit insurer has more appropriate incentives for deciding resolution options

– Some jurisdictions considering expanded powers

• Safety net partners collaborate to address systemically important firms

– Macro-prudential or systemic oversight joint safety net

Institutional Framework for Resolution

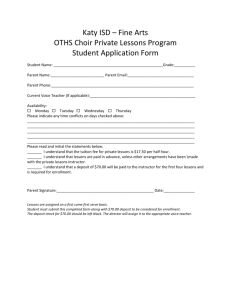

Resolution Authority of Deposit Insurers

(Percent with broad mandate)

2005 2011

Africa 5 60.0% 60.0%

America

Asia

Total

18

77.8%

13

58.3%

Europe 41

41.5%

Middle East 6

50.0%

83

52.4%

94.4%

69.2%

53.7%

50.0%

64.3%

Institutional Framework for Resolution

Expanded mandate

• Expanded role in countries most affected by crisis

• Emergency measures adopted:

– Providing guarantees and liquidity support by DIS

• Jurisdictions turned to DIA for funding

• Expansion of authority to provide liquidity, restructure

• Brazil, Germany, Netherlands

– Limited expansion into resolution

Institutional Framework for Resolution

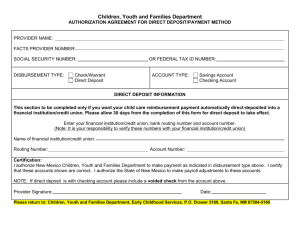

DIA Role InBank Resolution

(End 2010)

Payout Supervision Resolution

Argentina

Australia

Brazil

Canada

France

Germany

Hong Kong

India

Indonesia

Italy

Japan

Korea

Mexico

Yes

Yes

Yes

Netherlands Yes

Russia Yes

Singapore

Spain

Yes yes

Switzerland No

Turkey

UK

USA yes

Yes yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

Yes

No

No

No

No

No

Yes

Yes

Yes

No

No

No

No

No

No

No

No

Yes

1/ Mainly provides financing for restructuring/mergers.

2/ A new Act will give DIA role in funding resolution

Yes

Yes

Yes

No 2/

Yes

No

Yes

No

Yes

Yes 1/

Yes

Yes 1/

No

Yes 1/

Yes

Yes

No

No

Yes 1/

Yes 1/

Yes 1/

Future Directions

The role of deposit insurers in resolution will evolve

:

• Immediate goal: greater control over own resources

– Incentive to protect the fund

– Prevent supporting failed banks

• Measureable objective: speedy payout

– Will help identify appropriate resolution options

– Reduce tendency for forbearance

• Appropriate incentives: ability to “cost” resolution options

– Use of resources in resolution measured against payout option

Future Directions

Design implications for expanded resolution role

• Political consensus on importance of insolvency

• Legal and regulatory reforms

• Strengthening funding structures

– Must protect depositor funding

– Government support may be needed

• Better coordination within safety net

– Information sharing

– Coordinated diagnosis and viability assessment

– Agreed triggers

• Staffing to meet expanded skills

– Use of existing resolution tools

– Resolution of NBFIs

• Rules and procedures for systemically important firms

Conclusions and Policy Implications

The changing role of deposit insurance:

Financial stability a major policy objective for deposit insurance

High protection levels are unlikely to fall

Safety net participants will be more closely coordinate.

The design of deposit insurance systems is changing

Less concern about moral hazard from high coverage

The mandate of deposit insurance systems are expanding throughout world

Financing

Choosing restructuring options/least cost

Resolution options should be ranked by cost

Explicit treatment of “too-big-to fail” institutions