Handout 1 - CA Sri Lanka

advertisement

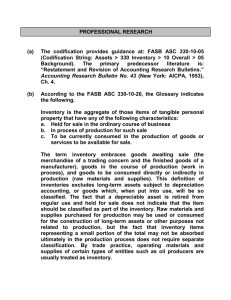

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF SRI LANKA POSTGRADUATE DIPLOMA IN BUSINESS AND FINANCE 2015/2016 Principles of Financial and Cost Accounting Thilanka Warnakulasooriya B.Com Special (Col), ACA, MBA Fin ( Col) LKAS 2 INVENTORIES LKAS 2 - Objective and Scope What costs are recognized as inventory costs and when these costs are transferred to the income statement as expense But excludes construction work-in-progress, inventories of financial instruments, and biological inventory assets related to agricultural activity and agricultural products at the point of harvest 3 DEFINITIONS OF KEY TERMS Inventory. An asset that is 1. Held for sale in the normal course of business 2. In the process of production for such sale 3. In the form of materials or supplies to be used in the production process or in the rendering of services Net realizable value. The estimated selling price in the normal course of business less estimated cost to complete and estimated cost to make a sale. MEASUREMENT OF INVENTORIES Inventories are measured at the lower of cost and net realizable value (LC and NRV) LC and NRV example: Cost Selling price Cost to complete Cost to sell Rs 100 Rs 90 Rs 5 10% of SP Measure the stock as per LKAS 2 COST OF INVENTORIES The cost of inventories comprises all 1. Costs of purchase 2. Costs of conversion 3. Other cost incurred in bringing the inventories to their present location and condition Costs of Purchase The costs of purchase constitute all The purchase price Import duties Transportation costs Handling costs directly pertaining to the acquisition of the goods Trade discounts and rebates are deducted when arriving at the cost of purchase of inventory Costs of Conversion of Inventory • Direct labor, indirect variable and fixed production overhead costs • Variable production overhead: allocate to inventory based on actual usage • Fixed production overhead: allocate to production based on normal operating capacity (except when abnormally high production) Other Costs in Valuing Inventories Other Costs in Valuing Inventories Other costs in valuing inventories include those costs that are incurred in bringing the inventories to their present location and condition i.e costs of designing products for specific customer needs. Excluded Costs from Inventory Valuation Certain costs are not included in valuing inventory. They are recognized as expenses during the period they are incurred. Examples of such costs are 1. Abnormal amounts of wasted materials, labor, or other production costs 2. Storage costs unless they are essential to the production process 3. Administrative overheads that do not contribute to bringing inventories to their present location and condition 4. Selling costs Ex: Following information extracted from Nice Furniture Company which imports & trading furniture in Sri lanka Cost of Purchases 20 Mn PAL & NBT 5 Mn VAT 2.4Mn Freight and insurance on purchases 5 Mn Other handling costs relating to imports 2 Mn Salaries of stores department 1 Mn Brokerage commission payable to indenting agents for arranging imports 3Mn Sales commission payable to sales agents 1.5Mn After-sales warranty costs 2.4Mn TECHNIQUES FOR MEASUREMENT OF COSTS COST FORMULAS - Assign recent costs to ending inventory - Correspond closely with the actual physical flow of the goods and services - Three permitted: Specific identification First-in, first-out (FIFO) and weighted average Specific identification: For inventory items that are not ordinarily interchangeable For goods and services produced and segregated for specific projects FIFO and weighted average: FIFO – The FIFO method assumes that the inventories that are purchased first are sold first, with the ending or remaining items in the inventory being valued based on prices of most recent purchases. Weighted average – weighted average cost of all goods available for sale ends up in both ending inventory and cost of goods sold The information about the inventory balance at the beginning and purchases made during the year 2014 are given below: Jan 1 Beginning balance: 400 units @ 18 per unit 7,200 April 12 Purchases: 600 units @ 20 per unit 12,000 Oct. 17 Purchases: 800 units @ 22 per unit 17600 Dec. 15 Purchases: 200 units @ 24 per unit 4,800 Available during the year 2014 ———— ———- 2,000 units 41,600 ———— ———- On 31st December 2014, 600 units are on hand according to physical count. Required: Compute the following using first-in, first-out (FIFO) method: 1.Cost of ending inventory at 31 December 2014. 2.Cost of goods sold during the year 2014. Ex 2 The following are the purchases and sales made by Global trading Ltd(as a newly set up company, has no beginning inventory): Purchases ◦ Jan 200 @ Rs.200 ◦ April 100 @ Rs. 150 ◦ September 100 @ Rs. 175 Sales ◦ Feb 150 ◦ December 200 ◦ Determine the value of the Inventory as at 31st December under the weighted-average cost method RECOGNITION OF EXPENSE When inventory is sold, the carrying amount of inventory should be recognized as an expense when the related revenue is recognized. Moreover, the amount of any inventory written down to net realizable value is recognized as an expense. DISCLOSURE Accounting policies adopted for measuring inventories and the cost flow assumption (i.e., cost formula) used Total carrying amount as well as amounts classified as appropriate to the entity Carrying amount of any inventories carried at fair value less costs to sell Amount of inventory recognized as expense during the period Amount of any write-down of inventories recognized as an expense in the period Amount of any reversal of a write-down to net realizable value and the circumstances that led to such reversal Circumstances requiring a reversal of the write-down Carrying amount of inventories pledged as security for liabilities