564_06_Annual Report..

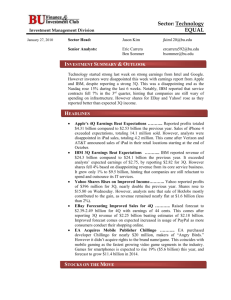

advertisement

• Is the company making money? • How financially healthy is the company? • Do the people running the company seem to know what they are doing? • How does the company view it’s employees and the community in which it resides? • Who are the directors? Secrets of the Annual Report Tips for Reading an Annual Report Some things to consider about the report in general... • Is the report well written, clear, concise and succinct? • Are photos modeled or live? How well do they relate to the text of the report? • How much discussion is there of competition? How clear are product plans? • Could the report be made more interesting, understandable or eyeappealing? • How does it compare with others in same industry? Be careful, not all Annual Reports are what they appear http://www.zpub.com/sf/arl/arl-read.html SEC-required elements include: • Report of management • Auditor's report • Management discussion • Financial statements and notes • Selected financial data Optional elements include: • Financial highlights • Letter to stockholders • Corporate message • Report of management • Board of directors and management • Stockholder information Financial highlights. Probably the most often-read section of any annual report, these highlights give a quick summary of a company's performance. The numbers appear in a short table, usually accompanied by supporting graphs. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Tips: Sales and Marketing Should cover what the company sells, how, where and when. Is it clear where the company makes most of its money presently? Is it understandable? Is the scope of lines, divisions and operations clear? http://www.zpub.com/sf/arl/arl-read.html Letter to stockholders. This letter may be from the chairperson of the board of directors, the chief executive officer, or both. It can provide an analysis and a play-by-play review of the year's events, including any problems, issues, and successes the company had. It usually reflects the business philosophy and management style of the company's executives, and often it lays out the company's direction for the next year. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Corporate message. Some analysts, business executives, and stockholders consider this message an advertisement for the company; others find it useful. However, it almost always reflects how a company sees itself, or how it would like others to see it. Here, the company can explain itself to stockholders, using photographs, illustrations, and text. This message may cover the company's lines of business, markets, mission, management philosophy, corporate culture, and strategic direction. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Board of directors and management. This list gives the names and position titles of the company's board of directors and top management team. Sometimes companies include photographs. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Stockholder information. This information covers the basics the company's corporate office headquarters, the exchanges on which the company trades its stock, the location and time of the next annual stockholder's meeting, and other general stockholder service information. Stockholder information is usually in the back of the annual report. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Auditors' report. This summary of the findings of an independent firm of certified public accountants shows whether the financial statements are complete, reasonable, and prepared consistent with generally accepted accounting principles (GAAP) at a set time. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Report of management. This letter, usually from the board chairperson and the chief financial officer, takes responsibility for the validity of the financial information in the annual report, and states that the report complies with SEC and other legal requirements. The discussion attests to the presence of internal accounting control systems that cover effectiveness of operations, reliability of financial reporting, and compliance with federal laws. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Tips: Chairman of the Board Letter Should cover changing conditions, goals to achieve or achieved or missed, actions taken or not to be taken. Is it well written? Reading between the lines - what is being apologized for? http://www.zpub.com/sf/arl/arl-read.html Management discussion. This series of short, detailed reports discusses and analyzes the company's performance. It covers results of operations, and the adequacy of liquid and capital resources to fund operations. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Financial statements and notes. These statements provide the raw numbers for the company's financial performance and recent financial history. The SEC requires three statements — statement of earnings, statement of financial position, and statement of cash flows — all covered in this Guide. (The statement of stockholders' equity is not addressed here.) These statements include a comprehensive set of related notes that provide explanations, additional detail, and supplementary financial information. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Selected financial data. This information summarizes a company's financial condition and performance over five years or longer. Data for making comparisons over time may include revenue (sales), gross profit, net earnings (net income), earnings per share, dividends per share, financial ratios such as return on equity, number of shares outstanding, and the market price per share. http://www.ibm.com/investor/financialguide/gs/gs3b.phtml Interpreting the numbers Analysts usually begin evaluating a company by studying its financial statements. These sources present recent financial history in a concise format, making it easy to see short-term changes in key numbers. Financial statements are also fairly standard within an industry, making it easy to compare the performance of a company to that of its competitors. Analysts interpret the numbers on each financial statement using a variety of ratios and other comparative measures. Analysis covers: Statement of earnings Statement of financial position Statement of cash flows Analysis: statement of earnings Analysts use the statement of earnings to examine a company's profitability. For example, analysts look at trends in revenue , operating income , and gross profit rates (or margins). Other measures include calculation of return on assets and return on equity . To view IBM's performance over recent years, see the Historical Charts. Analysis: statement of financial position Analysts use the statement of financial position to examine a company's liquidity and to gain insight into the state of the company's debt and inventory . One measure analysts use is the current ratio, a comparison of current assets with current liabilities . Analysts also look at the relationship of this statement with the statement of earnings. For example, they may explore the relationships of accounts receivable with sales, and of inventory with the costs of sales. Collection of accounts receivable is a task financial analysts also watch closely. If customers take long to pay for goods and services, accounts receivable may become large, forcing the company to borrow money (and pay interest) to finance these receivables. The longer it takes to collect accounts receivable the less valuable they are. Analysis: statement of cash flows Analysts use the statement of cash flows to determine how effectively a company generates and manages cash . Analysts look most closely at the cash from operating activities in evaluating a company's potential for long-term success because this figure shows how efficiently the company can produce and sell its primary product or service. Analysts also evaluate cash flows in relation to earnings figures (from the statement of earnings). For example, in some cases, a company can report positive earnings on the statement of earnings and still report a negative net cash flow on the statement of cash flows. This situation may occur when a company is unable to meet the current demand for its products and consequently invests its profits, or even borrows additional money, to expand its manufacturing capability (for example, by purchasing equipment or new facilities). When such a situation occurs, analysts look for the implications. They try to determine if the prospective demand for the company's product is great enough to justify the expenditures and new debt . Calculate a Company’s Health With an annual report and a calculator you can make sense of a company’s vital signs. You’ll find all of the information in the annual report’s profit and loss statement and balance sheet. Just pick out the numbers, use the formula and calculate. 1. Stock Turnover Days: The faster a company can turn over its stock, the faster it earns. Compare this year’s stock turnover with last years and learn if the rate of sales is increasing: STOCK TURNOVER DAYS=(INVENTORY/COST OF SALES)X 365 2. Debt Turnover Days: If collections are lagging, the company could be heading for trouble. Compare this years debt turnover with last years and learn if customers are paying. DEBT TURNOVER DAYS =ACCOUNTS RECEIVABLE / SALES http://www.reportgallery.com/ Business Summary Coca-Cola Bottling Co. is engaged in the production, marketing, and distribution of carbonated and non-carbonated beverages, primarily products of The Coca-Cola Company. The Company produces and markets carbonated soft drink products of The Coca-Cola Company, including Coca-Cola classic, caffeine free Coca-Cola classic, diet Coke, caffeine free diet Coke, Cherry Coke, diet Cherry Coke, TAB, Sprite, diet Sprite, Surge, Citra, Mello Yello, diet Mello Yello, Mr. PiBB, Barq's Root Beer, diet Barq's Root Beer, Fresca, Minute Maid orange, diet Minute Maid orange sodas, and Dasani bottled water. The Company also distributes and markets POWERaDE, Cool from Nestea, Fruitopia and Minute Maid Juices To Go in certain markets. The Company also produces and markets Dr. Pepper in most of its regions, as well as various other products, including Seagrams' products and Sundrop.More from Market Guide: Expanded Business Description Financial Summary Coca-Cola Bottling produces and markets carbonated and noncarbonated soft drink products of the Coca-Cola Company. For the 13 weeks ended 4/1/01, revenues increased 1% to $230.1 million. Net loss fell 9% to $1.8 million. Revenues reflect an increase in net selling prices and increased sales volume for Dasani bottled water. Loss also benefited from lower depreciation costs due to a reduced level of capital spending and lower interest expense due to lower rates. More from Market Guide: Significant Developments Dear Fellow Share Owners, The Coca-Cola Company emerged from the year 2000 reinvigorated and refocused, with solid business results and a strategy that will guide us into our next growth phase. Optimism, pride and fun have been restored in the system. New leadership is in place. New goals have been established. And throughout the world, your management team is working hard to make 2001 a great year for The Coca-Cola Company. Our organization has been redesigned from the ground up, returning to the leaner, decentralized management structure that built Coca-Cola into the world's greatest brand and made us the world's premier relationship company. Local leaders are back where they belong — in charge of local business. Our cost structure is under control. Getting it that way demanded difficult decisions — including workforce reductions — but we now are a healthier, stronger organization. “Our promise is simple, solid and timeless: The Coca-Cola Company exists to benefit and refresh everyone who is touched by our business.” Select topics: What are key issues in nutrition and industry? What are the key industries? What is the competition? What trends do you expect in this industry? How do you expect the stock has performed?