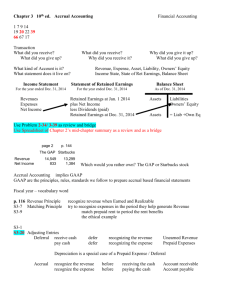

Retained Earnings

advertisement

Chapter 4: Preparing Financial Statements 1 Preparing Financial Statements Chapter 4 is a continuation of Chapter 3. Once the general journal entries have been posted and totaled, and a Trial Balance prepared, additional activities must be considered before preparing financials. The remaining steps in the process are: - Adjusting journal entries - Adjusted Trial Balance - Preparation of financial statements - Closing journal entries - Post-closing Trial Balance 2 Why Use Adjusting Entries? Accrual Basis – recognize revenues in the period they are earned – recognize expenses in the period they are incurred – basis of the matching principle Adjusting Journal Entries (AJEs) align revenues and expenses at the end of the accounting period (month, quarter, year). 3 Adjusting Journal Entries (AJEs) Prepared at the end of the accounting period to align revenues and expenses (matching). Usually NO document flow to trigger recording (internal transaction). Based on the accrual system of accounting which records revenues as earned and expenses as incurred (rather than based on cash flows). 4 Accrual System vs. Accrual AJEs The “accrual system of accounting” and “accrual of revenues and expenses” are both discussed in this chapter. Note that the “accrual of revenues and expenses” is a subset of the AJEs discussed in this chapter. In comparison, the “accrual system of accounting” refers to the entire process of revenue and expense recognition, and relates to the definitions of matching and revenue recognition discussed in this chapter. 5 The Revenue Recognition Principle This principle determines when revenues can be recognized. Revenue recognized when realized (or realizable) and earned. This principle triggers the matching principle, which is necessary for determining the measure of performance. The most common point of revenue recognition is when goods or services are transferred or provided to the buyer (at delivery). 6 The Matching Principle Matching focuses on the timing of recognition of expenses after revenue recognition has been determined. This principle states that the efforts of a given period (expenses) should be matched against the benefits (revenues) they generate. For example, the cost of inventory is initially capitalized as an asset on the balance sheet; it is not recorded in Cost of Goods Sold (expense) until the sale is recognized. 7 Types of AJEs 1. Accrual of expenses 2. Accrual of revenues 3. Prepaid (deferred) expenses 4. Unearned (deferred) revenues Most AJEs fit into one of these four categories. 8 1. Accrual of Expenses Probably the most common type of AJE. Ex: accrue interest at the end of the period: Interest Expense xx Interest Payable xx Note: this is a “skeletal” journal entry, where the “xx” simply indicates values to be calculated later. The focus here is on the account and direction. Other examples of expense/payable include wages, rent, taxes, insurance. 9 1. Accrual of Expenses - Example 1 Raider Company borrowed $10,000 on October 1, 2008. The note included a 5 percent annual interest rate, payable each September 30, starting Sept. 30, 2009. How much interest must Raider accrue at Dec. 31, before financial statements are prepared? Calc: Principal x rate x time P x R x T AJE: 10 2. Accrual of Revenues For revenues that have not yet been recorded at the end of the period. Ex: accrue interest revenue: Interest Receivable xx Interest Revenue xx Another example of receivable/revenue accruals relates to rent revenue, where the rental payment has not yet been received. 11 2. Accrual of Revenues - Example 2 Raider Company leases out part of its office building to Tu Company for $2,000 per month. At the end of the year, Tu owes Raider for December’s rent. Prepare the AJE for Raider Company: 12 3.Prepaid (Deferred) Expenses This category of AJE relates to the concept of asset capitalization and the matching principle. Asset capitalization occurs when a cost (with future economic benefit) is incurred. An asset is recognized at that time. Examples include supplies, prepaid Insurance, inventory, and long term assets like equipment. As the asset is “used up” in the generation of revenue, the related cost is recognized as an expense (matching). Some expenses are deferred for a short period of time (supplies expense), and some expenses are deferred and allocated over many years (depreciation expense). 13 3. Prepaid Expenses Example: Purchase 1-year insurance policy. General JE at time of purchase: Prepaid Insurance xx Cash xx AJE at end of the period (for the portion that has been used): Insurance Expense xx Prepaid Insurance xx 14 3.Prepaid Expenses - Example 3 Raider Company purchased a 1-year insurance policy on April 1, 2008 at a cost of $2,400 General JE at time of purchase: Prepaid Insurance 2,400 Cash 2,400 Calculation for AJE at December 31 to recognize the portion that has been used up: 15 3.Prepaid Expenses Example: purchase of equipment. General JE at time of purchase: Equipment xx Cash xx AJE at end of the period (for the portion that has been used): Depreciation Expense xx Accumulated Depreciation xx Note: Accumulated Depreciation is a contra asset account and is presented as an offset to Equipment on the balance sheet (expanded coverage in Chapter 8). 16 3.Prepaid Expenses - Example 4 Raider Company purchased equipment in 2006 at a cost of $30,000. The equipment has a useful life of 10 years and no salvage value. Calculation for AJE at December 31, 2008 for the current year’s depreciation. 17 4.Unearned (Deferred) Revenues Cash is received from customer before goods/services are delivered (before revenue can be recognized). Ex: Received subscription in advance (other examples include rent received in advance, and advance collections for gift cards). General JE at time cash received: Cash xx Unearned Revenues xx AJE at end of the period (for portion earned): Unearned Revenues xx Subscription Revenues xx 18 4.Unearned Revenues - Example 5 Raider Company received $6,000 on November 30, 2008 for subscriptions to be delivered over the next 12 months, starting in December of 2008. General JE at time cash received: Cash 6,000 Unearned Revenues 6,000 AJE at end of the period (for portion earned): 19 Class Problem – Prepare Adjusting Entries The trial balance of Mega Company, Inc. at the end of its annual accounting period is as follows: Mega Company Unadjusted Trial Balance December 31, 2008 Cash $ 3,000 Prepaid Insurance 1,600 Supplies 2,100 Equipment 20,000 Accumulated depreciation $ 2,000 Common Stock 10,000 Retained Earnings 7,000 Dividends 1,000 Revenue 33,000 Salaries Expense 18,300 Rent Expense 6,000 ______ Totals $52,000 $52,000 20 Adjusting Entries 1. Unexpired insurance at December 31 was $1,000. 21 Adjusting Entries 2. Unused supplies, per inventory, $800 at December 31. 22 Adjusting Entries 3. Estimated Depreciation for 2008 is $1,000 23 Adjusting Entries 4. Earned but unpaid salaries at December 31, $700. 24 Adjusted Trial Balance The Adjusted Trial Balance reflects totals after the AJEs are posted to the General Ledger. The balance sheet accounts reflect the endof-year balances, and the income statement accounts reflect the proper revenues and expenses to be recognized for the year. This list of accounts and amounts is used to prepare the Balance Sheet and Income Statement. The adjusted trial balance for Mega Company (after posting AJEs) is shown on the next slide. 25 Class Problem – Adjusted Trial Balance Mega Company, Adjusted Trial Balance, 12/31/08 Cash $ 3,000 Prepaid Insurance 1,000 Supplies 800 Equipment 20,000 Accumulated depreciation $ 3,000 Salaries Payable 700 Common Stock 10,000 Retained Earnings 7,000 Dividends 1,000 Revenue 33,000 Salaries Expense 19,000 Rent Expense 6,000 Insurance Expense 600 Supplies Expense 1,300 Depreciation Expense 1,000 ______ Totals $53,700 $53,700 26 Preparation of Financial Statements from the Adjusted Trial Balance The amounts in the Adjusted Trial Balance are used to prepare the Balance Sheet and the Income Statement. Retained Earnings has a unique treatment in this process. The Retained Earnings on the Adjusted Trial Balance is a beginning balance; while the revenues, expenses, and dividends are displayed in the Trial Balance, they have not yet been included in (closed to) Retained Earnings. 27 Financial Statements The Adjusted Trial Balance is used to prepare the financial statements. The financial statements are prepared in the following order: – Income Statement (I/S) – Statement of Retained Earnings (SRE) – Balance Sheet (B/S) Note: The Statement of Cash Flow (SCF) is not prepared from the Adjusted Trial Balance but from a detailed analysis of the cash flow activities of the company. 28 Financial Statements Comments on the preparation of financial statements from Adjusted Trial Balance (ATB): – revenue and expense balances from the ATB are carried to the Income Statement. – net income is carried to the Statement of Retained Earnings. – dividends are carried to the Statement of Retained Earnings. – the ending balance in the Statement of Retained Earnings is carried to the stockholders’ equity section of the Balance Sheet. – asset and liability balances from the ATB are carried to the Balance Sheet. 29 Closing Journal Entries (CJEs) Prepared after the financial statements have been completed. Close temporary (nominal) accounts to Retained Earnings so that the balances in those accounts at the start of the next accounting period will be zero. Temporary accounts include revenues, expenses, and dividends. 30 Closing Journal Entries (CJEs) First, close all revenues and expenses to retained earnings (your text does this in 3 entries, and uses an Income Summary account to break out the components). (Note that the adjustment to RE in this entry carries the effect of net income to retained earnings.) Second, close dividends to retained earnings. After these entries are posted, the temporary accounts are now at zero, and the company is ready to start the next period. Note that the post-closing trial balance will include only the permanent, balance sheet accounts, and the retained earnings account is finally the ENDING retained earnings. 31 Closing Journal Entries (CJEs) - Example Refer to Mega Company Adjusted Trial Balance. Close revenues and expense to retained earnings: Revenue 33,000 Salaries Expense 19,000 Rent Expense 6,000 Insurance Expense 600 Supplies Expense 1,300 Depreciation Expense 1,000 32 Closing Journal Entries (CJEs) - Example Refer to Mega Company. Now close the balance in the Dividends account to Retained Earnings. 33 Closing Journal entries Now post the effects of retained earnings to the RE general ledger account. Retained Earnings 34 34 Post-closing Trial Balance The final Trial Balance after closing will display only permanent, balance sheet accounts. The Retained Earnings in this Trial Balance is the ENDING retained earnings for the period and includes the effects of all the revenues, expenses, and dividends for the period. 35 Class Problem – Postclosing Trial Balance Mega Company, 12/31/08, Postclosing Trial Balance Cash $ 3,000 Prepaid Insurance 1,000 Supplies 800 Equipment 20,000 Accumulated depreciation Salaries Payable Common Stock Retained Earnings ______ Totals $24,800 $ 3,000 700 10,000 11,100 $24,800 36 Review – Accounting Cycle 1. 2. 3. 4. 5. 6. 7. 8. Analyze transactions. Prepare general journal entries, and post to general ledger. Prepare unadjusted trial balance. Prepare adjusting journal entries, and post to general ledger. Prepare adjusted trial balance. Prepare financial statements. Prepare closing journal entries, and post to general ledger. Prepare post-closing trial balance. 37