Scenes and Themes of the the Great Depression

advertisement

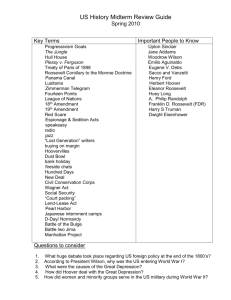

A Monetarist Look at the Great Depression Stock Market Crash Unemployment Bread Lines in New York Prices were either too high or zero. Food Lines in Paris Oklahoma Dust Bowl Make-shift Housing Migrants Going West Migrant Family in California Dorothea Lange's "Migrant Mother," destitute in a pea picker's camp, because of the failure of the early pea crop. These people had just sold their tent in order to buy food. Most of the 2,500 people in this camp were destitute. By the end of the decade there were still 4 million migrants on the road. Despondency 10 years Publication of John Maynard Keynes’s General Theory Query: Was Keynes’s book really a “general theory” or was it a tract for the times? Per-capita GDP Relative to the 1889-1929 Trend 10 years Waning of “animal spirits”? Sticky-Price Spiraling Downward of Income and Expenditures? Per-capita GDP Relative to the 1889-1929 Trend THE NATURAL RATE OF UNEMPLOYMENT This focus suggests two questions in need of an answer: 1. What caused the bust? What was the triggering mechanism? What change in market conditions required adjustments of some kind on an economywide scale? 2. Why did it take so long for markets to adjust to the changed market conditions? If prices, wages, and interest rates needed to adjust, why didn’t they adjust? Monetarism Historically considered Monetarism MV = PQ Monetarism MV = PQ 18-30 months This is the Quantity Theory of Money. Monetarism MV = PQ 18-30 months In the long run, increases in M affect nothing but P (and W). Monetarism 18-30 months MV = PQ In the long run, decreases in M affect nothing but P (and W). Monetarism Abstractly considered MV = PQ 35% 35% Suppose M falls from $45 billion to $30 billion. P must fall proportionally to avoid a recession. Monetarism Historically considered: 1929-1933 MV = PQ 35% 15% 24%25% The phenomenon of bust and depression was observed and argued about long before the Great Depression and long before Keynes wrote his General Theory. A fully satisfying explanation requires that we consider the phenomenon of boom, bust, depression, and recovery. But sorting out the differences between Milton Friedman and Maynard Keynes can be achieved with the narrower focus, i.e., bust and depression. This focus suggests two questions in need of an answer: 1. What caused the bust? What was the triggering mechanism? What change in market conditions required adjustments of some kind on an economywide scale? Keynes claimed it was a waning of animal spirts. Friedman pointed to the collapse in the money supply. 2. Why did it take so long for markets to adjust to the changed market conditions? If prices, wages, and interest rates needed to adjust, why didn’t they adjust? Keynes claimed it was a sticky prices and wage rates. Friedman pointed to perverse government policy. Consider policies pursued by Hoover and Roosevelt: . High-wage policies (Hoover) . Crop-Destruction Program (Roosevelt) . Potatoes, pork, cotton, dairy. “Roosevelt did not forget agriculture. On May 12, 1933, Congress passed the Agricultural Adjustment Act (AAA). The Act had two goals—to raise farm prices quickly and to control production so that prices would stay up over the long term.” “In the AAA’s first year, though, the supply of food outstripped demand. The AAA could raise prices only by paying farmers to destroy crops, milk, and livestock. To many, it seemed shocking to throw away food while millions of people were going hungry.” “The New Dealers claimed the action was necessary to bring prices up.” From an elementary-school history book, The American Journey, 2003, p. 724. Consider policies pursued by Hoover and Roosevelt: . High-wage policies (Hoover) . Crop-Destruction Program (Roosevelt) . Potatoes, pork, cotton, dairy. . . Cartelization of Industry (Roosevelt) Railroads, Steel, Banking . Blue Eagle Program (Roosevelt) . Make-Work Projects (Roosevelt) . WPA, CCC, “Give a Man a Job” Social Security Program (Roosevelt) Undistributed Profits Tax (Roosevelt) CCC Civil Conservation Corp Make-Work Projects New Deal-era promo for the NRA (National Recovery Administration). Producer: Metro-Goldwyn-Mayer Featuring: Jimmy Durante Click the “Blue Eagle” for the 2 min. 49 sec. video. Monetarism Historically considered: 1929-1933 A Summary view: In 1929, the Federal Reserve blundered monumentally in allowing the money supply to fall. Monetarism Historically considered: 1929-1933 A Summary view: Had the blundering not been compounded by further blundering, P (and W) would have fallen and there would have been a short-lived recession (18-30 months?). Monetarism Historically considered: 1929-1933 A Summary view: The Hoover administration instituted a “high-wage policy.” Prices, which reflected high labor costs, were also propped up. Monetarism Historically considered: 1929-1933 A Summary view: The Roosevelt administration further propped up prices through its NRA legislation, involving crop destruction, cartel arrangements, and the “Blue Eagle” program. Monetarism Historically considered: 1929-1933 A Summary view: The Roosevelt administration worked through unions to prop wages up. It was more “successful” in blocking wage declines than in blocking price declines. Monetarism Historically considered: 1929-1933 A Summary view: All told, there was a double blunder with a catastrophic twist: M collapsed; P and W were propped up--W more successfully than P. Monetarism Historically considered: 1929-1933 A Summary view: The “real wage rate” (W/P) rose, and unemployment peaked at 25%. The Great Depression lasted for a decade (1929-1939). Monetarism MV = PQ Policy recommendation: Increase M at a slow, steady rate (2 or 3%) to match the long-run rate of growth. Monetarism MV = PQ With this “Monetarist Rule” in effect (2 or 3%) and a constant V, the rate of inflation would be zero. A Monetarist Look at the Great Depression