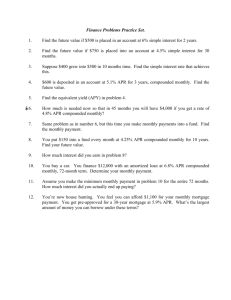

TI Nspire TVM Solver Practice Problems

advertisement

MAP 4C Name_______________________________ TI NSpire TVM Solver To access the TVM Solver: New Document Add Calculator Menu Finance Finance Solver Entering Data Note: Enter the payment as a negative number; the N = Number of payments calculator assumes that the payment is money you are I = Interest rate (as a percent) giving up and the present/future value is money you PV = Present value are getting back (so these are positive) PMT = Payment (dollar value) FV = Future value CpY = compounds per year PpY = payments per year *CpY and PpY have to be the same PmtAt = END (means that payment is made at the end of the compounding period) Leave any unused fields as a ‘0’, including the field you are solving for. To solve for a particular variable, place the cursor in the field and press ‘enter’. Note: In our calculations, you will use either present value or future value, but not both Try the following SOLVED example to ensure you can use the calculator correctly: Victor is planning to do some traveling. He will be gone for 8 months and wants to withdraw $700 at the end of each month, starting 1 month after he leaves. His bank account earns 5.4% per year compounded monthly. How much must Victor save in order to have the funds available for his trip? (Does this scenario deal with present value or future value?) Ans: $5488.28 N= I= PV = PMT = FV = CpY = PpY = PmtAT = How do you know if a question is asking about future value or present value? TVM Solver Practice Problems Use the TVM Solver to solve the following problems. For each problem, first determine whether the situation involves present value or future value. Be sure to write a statement to answer the question(s) being asked. 1. Geneva’s parents saved for her college education by depositing $1200 at the end of each year in a registered Education Savings Plan (RESP) that earns 6% per year compounded annually. a) What is the amount of the annuity at the end of 18 years? b) How much interest is earned? c) How much extra interest would have been earned if the interest rate was 7%? 2. Consider these two annuities: Annuity 1: $100 deposited at the end of each month for 5 years at 4% per year compounded monthly Annuity 2: $300 deposited at the end of each quarter for 5 years at 4% per year compounded quarterly a) Calculate the total deposit and amount of each annuity (you do not need the TVM solver to determine the total deposit) N= I= PV = PMT = FV = CpY = PpY = PmtAT = N= I= PV = PMT = FV = CpY = PpY = PmtAT = b) Why are the amounts different even if the total deposits are the same 3. Terence’s parents want to set up an annuity to help him with college expenses. The annuity will allow Terence to withdraw $300 every month for 4 years. The first withdrawal will be 1 month from now. The annuity earns 3.5% per year compounded monthly. What principal should Terence’s parents invest now to pay for the annuity? 4. Chloe borrowed money from the bank to renovate her home. She will repay the loan by making 24 monthly payments of $64.17 at 12.5% per year compounded monthly. a) How much did Chloe borrow? b) How much will she have to pay back? c) After one year of making payments, Chloe inherits some money and pays off the rest of the loan. How much does she save in interest by doing this? (Hint: Determine the present value of the remaining payments) N= I= PV = PMT = FV = CpY = PpY = PmtAT = N= I= PV = PMT = FV = CpY = PpY = PmtAT = N= I= PV = PMT = FV = CpY = PpY = PmtAT =