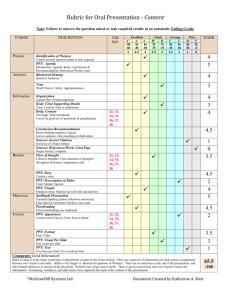

PPT 19

advertisement

COST MANAGEMENT Don R. Hansen Maryanne M. Mowen PPT 19 -1 Chapter Nineteen Activity Resource Usage Model and Relevant Costing: Tactical Decision Making PPT 19 -2 Learning Objectives Describe and explain the tactical decision- making model. Define ad explain the concept of relevant costs and revenues. PPT 19 -3 Learning Objectives (continued) Explain how the activity resource usage model is used in assessing relevancy. Apply the tactical decision-making concepts in a variety of business situations. PPT 19 -4 The Tactical Decision-Making Process Tactical decision making consists of choosing among alternatives with an immediate or limited end in view. Tactical cost analysis is the use of relevant cost data to identify the alternative that provides the greatest benefit to the organization. PPT 19 -5 The Tactical Decision-Making Process (continued) Recognize and define the problem. Identify alternatives as possible solutions to the problem, and eliminate alternatives that are not feasible. Identify the predicted costs and benefits associated with each feasible alternative. Eliminate the costs and benefits that are not relevant to the decision. PPT 19 -6 The Tactical Decision-Making Process (continued) Compare the relevant costs and benefits for each alternative, and relate each alternative to the overall strategic goals of the firm and other important qualitative factors. Select the alternative with the greatest benefit which also supports the organization’s strategic objectives. PPT 19 -7 Qualitative Factors How should qualitative factors be handled in the decision-making process? 1. They must be identified. 2. The decision maker should try to quantify them. 3. True qualitative factors should be taken into consideration in the final step of the decision-making process. PPT 19 -8 Relevant Costs Defined Costs that differ across alternatives Costs that deal with future courses of action PPT 19 -9 Irrelevant Cost Sunk costs are past costs. Example: The original cost of a building is a sunk cost when you are selling the building five years later. PPT 19 -10 Activity Resource Usage Model and Assessing Relevancy Flexible Resources Resources Acquired as Needed a. Demand Changes b. Demand Constant Relevant Not Relevant PPT 19 -11 Activity Resource Usage Model and Assessing Relevancy (continued) Committed Resources Acquired in Advance (Short Term) a. Demand Increase < Unused Capacity b. Demand Increase > Unused Capacity c. Demand Decrease (Permanent) 1. Activity Capacity Reduced 2. Activity Capacity Unchanged Not Relevant Relevant Relevant Not Relevant PPT 19 -12 Some Types of Decisions Illustrated Make or Buy Keep or Drop Special Order Sell or Process Further Important: Short-term Perspective PPT 19 -13 Activity and Cost Information Part Activity Expected 34B Activity Activity Units of Activity Using materials Cost Driver Units Cost Formula Capacity Y = $0.5X As needed Usage 100,000 Usage 100,000 Purchase 1 Using direct labor Providing Units Number of Y = $2X Y = $300,000 As needed 15 100,000 15 100,000 3 1 3 supervision Moving materials lines Number of Y = $250,000 250,000 240,000 40,000 25,000 Providing power moves Machine + $0.60X Y = $3X As needed 30,000 30,000 1 Inspecting hours Inspection Y = $280,000 16,000 14,000 2,000 2,000 products Setting hours Setup hours + $1.50X Y = $600,000 60,000 58,000 6,000 2,000 up equipment Providing space Square feet Y = $1,000,000 50,000 50,000 5,000 50,000 Units Y = $0.50X 120,000 100,000 100,000 15,000 Equipment depreciation PPT 19 -14 Make-or-Buy Decisions Assume the following cost data related to the decision to produce 12,000 units of a product or buy from an external source: Total Costs Unit Cost Rental of equipment $15,000 $1.25 Equip. depreciation 3,000 .25 Direct materials 12,000 1.00 Direct labor 24,000 2.00 Variable overhead 9,000 .75 Fixed overhead 36,000 3.00 Total $99,000 $8.25 ====== ==== Purchase price from an outside vendor is $5.50 per unit PPT 19 -15 Make-or-Buy Decision (continued) Alternatives Differential Make Buy Cost to Make Rental of equip. Direct materials Direct labor Variable overhead Purchase cost $15,000 5,000 24,000 9,000 ------------$66,000 $15,000 5,000 24,000 9,000 ($66,000) Relevant costs $53,000 ====== $66,000 ====== ($13,000) ====== Decision: Manufacture parts in-house PPT 19 -16 Keep-or-Drop Decisions Assume the following: Sales units Sales revenue Less variable expenses: Variable cost of sales Variable selling & admin. Contribution margin Less direct fixed expenses: Direct fixed costs Product margin Less common fixed costs Net income Regular Deluxe Total 400 $200,000 200 $150,000 600 $350,000 96,000 10,000 $ 94,000 60,000 7,500 $ 82,500 156,000 17,500 $176,500 30,000 $ 64,000 ======= 85,000 $ (2,500) ======= 115,000 $ 61,500 30,000 $ 31,500 ======= Should the Deluxe product line be eliminated? PPT 19 -17 Keep-or-Drop (continued) Keep Sales $150,000 Variable expenses (67,500) Contribution margin $ 82,500 Direct fixed expenses (85,000) Relevant benefit/loss Drop ------------- Differential Amount to Keep $150,000 (67,500) $ 82,500 (85,000) $ (2,500) ====== Decision: Drop the Deluxe product line but investigate alternative use of facilities. This analysis provides a benchmark for future decisions. PPT 19 -18 Special-Order Decisions Assume the following price quotation sheet for the XYX Company who has received an offer buy at $38 per unit. Direct materials Direct labor Variable overhead Variable selling and administrative Fixed manufacturing Total Markup--50% Target selling price $12 14 4 2 20 $52 26 $78 === Important: XYZ Company has idle capacity and can produce the special order without affecting its current production. PPT 19 -19 Special-Order Decisions (continued) Decision Rule: The “floor” for establishing a price for a special order is incremental cost(variable cost in this case). Incremental Costs: Direct materials Direct labor Variable overhead Variable S & A Total $12 14 4 2 $32 === Sales price Incremental costs Additional income $38 32 $ 6 per unit === Question: What impact is this decision likely to have on existing customers? PPT 19 -20 Joint Products Joint products have common processes and costs of production up to a split-off point. The point of separation is called the split-off point. PPT 19 -21 Decisions to Sell or Process Further Product A Joint Input Should the company process further? Joint Costs Split-off point Separate Processing Product B Joint products Separate Processing PPT 19 -22 Decisions to Sell or Process Further (continued) Sell or process further decision: Products A Sales value at split-off Sales value after additional processing Allocated joint product costs Cost of further processing $240,000 320,000 160,000 100,000 B $300,000 480,000 200,000 120,000 Incremental revenue from processing $ 80,000 $180,000 Cost of additional processing 100,000 120,000 Profit (loss) from further processing $(20,000) $ 60,000 Decision Sell at split-off Process further Joint costs are irrelevant PPT 19 -23 End of Chapter 19 PPT 19 -24