Decision-Making

Incremental

Analysis

Managerial Accounting

Relevant Costs Special Order

Second Edition

Make or Buy?

Weygandt / Kieso / Kimmel

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9-1

Next

Slide

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9-2

Next

Slide

Incremental Analysis

Illustration 9-1

Management’s Decision-making Process

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9-3

Next

Slide

Consider both financial and

nonfinancial information.

Nonfinancial information relates to:

• Effect of decision on employee

turnover

• The environment

• Overall image of company in

community.

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9-4

Next

Slide

Incremental Analysis

• Sometimes both costs and

revenues vary.

• Sometimes only revenues

vary.

• Sometimes only costs vary.

Illustration 9-2

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Incremental Analysis

The process of identifying the

financial data that change

under alternative courses of

action.

Retain/Replace

Equipment

Eliminate

segment?

Revenues

Costs

Net income

Sales Mix

Previous

Slide

End

Show

9-5

Next

Slide

Alternative

A

$125,000

100,000

$ 25,000

Alternative

B

$110,000

80,000

$ 30,000

Net Income

Increase (Decrease)

$(15,000)

20,000

$ 5,000

Illustration 9-3

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9-7

Next

Slide

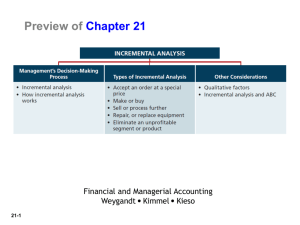

Types of Incremental Analysis

• Accept an order at a special

price.

• Make or buy component parts

or finished products.

• Sell products or process

further.

• Retain or replace equipment.

• Eliminate an unprofitable

business segment.

Illustration 9-4

Accept An Order At A Special Price

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Assume sales of the products in other

markets would not be affected by

special order.

Assume company is not operating at

full capacity.

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9-8

Next

Slide

Revenues

Costs

Net income

Reject

Order

$ -0-0$ -0-

Accept

Order

$22,000

16,000

$ 6,000

Net Income

Increase (Decrease)

$ 22,000

(16,000)

$ 6,000

Illustration 9-5

Make or Buy

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9-9

Next

Slide

Assume sales of the products in other

markets would not be affected by

special order.

Assume company is not operating at

full capacity.

Illustration 9-5

Make or Buy

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Sales Mix

End

Show

9 - 10

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Total manufacturing costs

Total cost per unit ($225,000 25,000)

$ 50,000

75,000

40,000

60,000

$225,000

$9.00

Alternatively, Baron may purchase the

ignition switches from Ignition, Inc., at a

price of $8 per unit.

Eliminate

segment?

Previous

Slide

COST TO MAKE

Next

Slide

Question:

Should Baron make or buy the

ignition switches?

Illustration 9-6

Make or Buy

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Direct materials

Direct labor

Variable manufacturing costs

Fixed manufacturing costs

Purchase price

Total annual cost

Make

Buy

$ 50,000 $ - 0 75,000

-040,000

-060,000

50,000

-0200,000

$225,000 $250,000

Net Income

Increase (Decrease)

$ 50,000

75,000

40,000

10,000

(200,000)

$ (25,000)

Retain/Replace

Equipment

Eliminate

segment?

Decision:

Barton Company will incur $25,000 of additional

costs by buying the switches. Therefore, Barton

should continue to make the switches.

Sales Mix

Previous

Slide

End

Show

9 - 11

Next

Slide

Opportunity cost

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 12

Next

Slide

The potential benefit that may

be obtained from following an

alternative course of action.

Illustration 9-7

Make or Buy - Opportunity Cost

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Assume the company can use the

released capacity to generate $ 28,000

additional income.

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Total annual cost

Opportunity cost

Total cost

Make

Buy

$225,000 $250,000

28,000

-0$253,000 $250,000

Net Income

Increase (Decrease)

$(25,000)

28,000

$ 3,000

Sales Mix

Previous

Slide

End

Show

9 - 13

Next

Slide

Decision:

It is now advantageous to buy the switches. Barton will

save $3,000 worth of costs with this alternative.

Sell or Process Further?

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 14

Next

Slide

Illustration 9-8

A, Inc. makes tables. The cost to manufacture an

unfinished table is $35.

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Total manufacturing costs

$ 15

10

6

4

$35

Unfinished units sell for $50. Finished tables sell for $60

each. For a finished table direct materials and direct labor

costs will increase $2 and $4, respectively. Variable

overhead will increase by $2.40 (60% of direct labor).

There will be no increase in fixed overhead.

Question: Should A, INC. sell the unfinished

tables or process them further?

Sell or Process Further?

Sales per unit

Cost per unit

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Total

Net income per unit

Illustration 9-9

Sell

$50.00

Process

Further

$60.00

Net Income

Increase (Decrease)

$10.00

15.00

10.00

6.00

4.00

$35.00

17.00

14.00

8.40

4.00

$43.40

(2.00)

(4.00)

(2.40)

-0$(8.40)

$15.00

$16.60

$ 1.60

Process further as long as the

incremental revenue from such

processing exceeds the incremental

processing costs.

Joint costs

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 16

Next

Slide

For joint products, all costs

incurred prior to the point at

which two products are

separately identifiable.

Illustration 9-10

Sell/Process Further-Multiple Products

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Use Incremental Analysis to Decide.

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 17

Next

Slide

Sunk cost

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 18

Next

Slide

The book value of the old machine is a

sunk cost which is a cost that cannot

be changed by any present or future

decision. Sunk costs are not relevant

in incremental analysis.

Retain or Replace Equipment

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Jeffcoat Company has a factory machine

with a book value of $40,000 and a

remaining useful life of four years. A new

machine is available for $120,000 and is

expected to have zero salvage value at the

end of its 4-year useful life. If the new

machine is acquired, variable

manufacturing costs are expected to

decrease from $160,000 to $125,000

annually and the old unit will be scrapped.

Sales Mix

Previous

Slide

End

Show

9 - 19

Next

Slide

Question:

Should Jeffcoat Company retain

or replace the machine?

Illustration 9-14

Retain or Replace Equipment

Variable manufacturing costs

New machine cost

Total

Retain

$640,000a

$640,000

Replace

$500,000b

120,000

$620,000

Net Income

Increase (Decrease)

$140,000

(120,000)

$ 20,000

a(4

years x $160,000)

b(4 years x $125,000)

Decision:

It would be to the company’s advantage to replace the equipment. The

lower variable manufacturing costs due to replacement more than offset the

cost of the new equipment.

Eliminate An Unprofitable Segment

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Often fixed costs allocated to the

unprofitable segment must be

absorbed by the other segments.

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 21

Next

Slide

It is possible for net income to

decrease when an unprofitable

segment is eliminated.

Illustration 9-15

Eliminate An Unprofitable Segment

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Martina Company manufactures tennis racquets in

three models: Pro, Master, and Champ. Pro and

Master are profitable lines, whereas Champ operates

at a loss. Condensed income statement data are:

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales

Variable expenses

Contribution margin

Fixed expenses

Net income

Sales Mix

Previous

Slide

End

Show

9 - 22

Next

Slide

Pro

$800,000

520,000

280,000

80,000

$200,000

Master

$300,000

210,000

90,000

50,000

$ 40,000

Champ

$100,000

90,000

10,000

30,000

$(20,000)

Total

$1,200,000

820,000

380,000

160,000

$ 220,000

Question:

Should the Champ segment be eliminated?

Illustrations 9-15&9-16

Eliminate An Unprofitable Segment

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sales

Variable expenses

Contribution margin

Fixed expenses

Net income

Pro

$800,000

520,000

280,000

80,000

$200,000

Master

$300,000

210,000

90,000

50,000

$ 40,000

Champ

$100,000

90,000

10,000

30,000

$(20,000)

Total

$1,200,000

820,000

380,000

160,000

$ 220,000

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 23

Next

Slide

ELIMINATE CHAMP?

Sales

Variable expenses

Contribution margin

Fixed expenses

Net income

Pro

$800,000

520,000

280,000

100,000

$200,000

Master

Total

$300,000 $1,100,000

210,000

730,000

90,000

370,000

60,000

160,000

$ 40,000 $ 210,000

Total net income decreases $10,000

($220,000 – $210,000) if the Champ line is

discontinued.

Decision:

Illustrations 9-15&9-16

Eliminate An Unprofitable Segment

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sales

Variable expenses

Contribution margin

Fixed expenses

Net income

Pro

$800,000

520,000

280,000

80,000

$200,000

Master

$300,000

210,000

90,000

50,000

$ 40,000

Champ

$100,000

90,000

10,000

30,000

$(20,000)

Total

$1,200,000

820,000

380,000

160,000

$ 220,000

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 24

Next

Slide

ELIMINATE CHAMP?

Sales

Variable expenses

Contribution margin

Fixed expenses

Net income

Pro

$800,000

520,000

280,000

100,000

$200,000

Master

Total

$300,000 $1,100,000

210,000

730,000

90,000

370,000

60,000

160,000

$ 40,000 $ 210,000

Total net income decreases $10,000

($220,000 – $210,000) if the Champ line is

discontinued.

Decision:

Illustrations 9-17

Eliminate An Unprofitable Segment

Decision-Making

Incremental

Analysis

Total net income decreases $10,000

($220,000 – $210,000) if the Champ line is

discontinued.

Decision:

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

OR

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 25

Next

Slide

Sales

Variable expenses

Contribution margin

Fixed expenses

Net income

Continue

$100,000

90,000

10,000

30,000

$(20,000)

Eliminate

$ -0-0-030,000

$ 30,000)

Net Income

Increase (Decrease

$(100,000)

90,000

(10,000)

-0$ (10,000)

Joint products

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 26

Next

Slide

Multiple end-products

produced from a single raw

material and a common

process.

Sales Mix

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 27

Next

Slide

The relative combination in

which a company’s products

are sold.

Illustration 9-18

Sales Mix

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 28

Next

Slide

Unit Data

Selling price

Variable costs

Contribution margin

Sales mix

VCRs

$500

300

$200

TVs

$800

400

$400

3

1

Illustration 9-21

Limited Resources

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Collins Co. manufactures deluxe and standard pen

and pencil sets. The limited resource is machine

capacity, which is 3,600 hours per month.

Relevant data consists of:

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Contribution margin per unit

Machine hours required per unit

Deluxe

$8

.4

Standard

$6

.2

Sales Mix

Previous

Slide

End

Show

9 - 29

Next

Slide

Question:

Should Collins Co. shift its sales mix toward

deluxe or standard sets?

Illustration 9-22

Limited Resources

Decision-Making

Incremental

Analysis

Relevant Costs Special Order

Make or Buy?

Sell or Process

Further

Retain/Replace

Equipment

Eliminate

segment?

Sales Mix

Previous

Slide

End

Show

9 - 30

Next

Slide

Contribution margin per unit (a)

Machine hours required per unit (b)

Contribution margin per unit of

limited resource (a b)

Deluxe

$8

.4

$20

Decision: Since the standard set has the

higher contribution margin per unit of

limited resource, sales mix should shift

towards that product.

Standard

$6

.2

$30

Decision-Making

COPYRIGHT

Incremental

Analysis

Relevant Costs Special Order

Copyright © 2002, John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Make or Buy?

Section

Sell or

Process 117 of the 1976 United States Copyright Act without the

Further

express written permission of the copyright owner is unlawful.

Retain/Replace

Request for further information should be addressed to the

Equipment

Permissions Department, John Wiley & Sons, Inc. The purchaser

Eliminate

segment?

may make back-up copies for his/her own use only and not for

Salesdistribution

Mix

or resale. The Publisher assumes no responsibility

for errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.

Previous

Slide

End

Show

9 - 31

Next

Slide