NOV 2010 ALABANY IT from Ulster - AARP Tax-Aide

advertisement

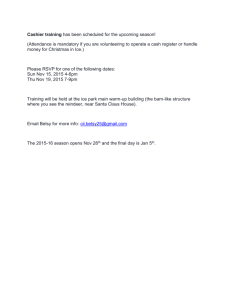

MORTGAGE DEBT FORGIVENESS RELIEF ACT NOV 2010 ALABANY IT from Ulster 1 MORTGAGE DEBT FORGIVENESS RELIEF ACT Enacted in 2007 and expires end of 2012. Allows taxpayers to exclude from income certain cancelled debt on their principal residence May be eligible for exclusion of gain upon sale NOV 2010 ALABANY IT from Ulster 2 DEFINTIONS NOV 2010 ALABANY IT from Ulster 3 Definitions(continued) NOV 2010 ALABANY IT from Ulster 4 Mortgage Actions Mortgage modification(workout): refinancing to change principal, interest rate, or term for use in main home or other areas Debt Reduction: Reduction in mortgage indebtedness from renegotiation – Homeowner keeps possession NOV 2010 ALABANY IT from Ulster 5 Possible Lender Transactions Lender issues: Form 1099-A upon either Foreclosure(lender) or Abandonment(Borrower) and/or Form 1099-C Upon Debt Cancellation Same calendar year: Debt canceled in conjunction with Foreclosure or Abandonment Lender has option to issue only Form 1099-C Short Sale and Deed in Lieu of Foreclosure equivalent to Foreclosure Lender not required to accept and/or cancel debt Typically may occur prior to formal FORECLOSURE NOV 2010 ALABANY IT from Ulster 6 Possible Lender Transactions(continued) Most mortgages are recourse debt BOX 5 , Form 1099-A indicates recourse or nonrecourse If lender issues Form 1099-C instead: implies a recourse loan NOV 2010 ALABANY IT from Ulster 7 FORM 1099-C NOV 2010 ALABANY IT from Ulster 8 FORM 1099-A NOV 2010 ALABANY IT from Ulster 9 CAUTION Most mortgages are recourse debt Some states have anti-deficiency laws Prevent lenders from pursuing the borrower for deficiency after foreclosure Mortgages may be classified as nonrecourse debt subject even if loan contains a promise by borrower to repay the loan NOV 2010 ALABANY IT from Ulster 10 NY STATE One action state; Lender must choose: (1) Foreclosing on property (2) Sue to collect debt NOV 2010 ALABANY IT from Ulster 11 Possible Taxpayer Transactions Debt canceled, abandonment, foreclosure Form 982 Reduction of Tax Attributes Due to Discharge Indebtedness….. Gain or loss on sale Schedule D: Worksheet 2 SALE of (MAIN)Home and/or Section 125 EXCLUSION may apply for Gain Schedule D Loss on principal residence is always ZERO(0) NOV 2010 ALABANY IT from Ulster 12 EXCEPTIONS Eliminate Income Amounts otherwise excluded from Income (Gifts & Bequests) Certain student loans Deductible debt (e.g. home mortgage interest on SCH-A) Price reduced after purchase (e.g. debt on solvent TP’s property is reduced by seller; basis of property must be reduced) No listed EXCEPTION is IN SCOPE !!!!! NOV 2010 ALABANY IT from Ulster 13 Exclusions Eliminate Income Discharge of qualified principal indebtedness Other areas OUT of SCOPE NOV 2010 ALABANY IT from Ulster 14 ONLY ONE AREA IS IN SCOPE Discharge of qualified principal indebtedness Mortgage covers only the principal residence The residence is the only security for the loan Provides relief from personal liability Handles tax attributes of mortgage loan to eliminate/minimize reporting income items NOV 2010 ALABANY IT from Ulster 15 FORECLOSURE OR MORTGAGE DEBT REDUCTION Rules for everyone: Mortgage debt taken out must be to build, buy, or substantially improve the principal residence. Funds cannot have been used to purchase a car, pay off credit card debt, vacations, etc. Taxpayer can only have one principal residence at a time Rental properties not eligible Taxpayer cannot have filed bankruptcy NOV 2010 ALABANY IT from Ulster 16 SCREENING SHEET for 1099-C NOV 2010 ALABANY IT from Ulster 17 SCREENING SHEET for 1099-C NOV 2010 ALABANY IT from Ulster 18 SCREENING SHEET for 1099-C NOV 2010 ALABANY IT from Ulster 19 SCREENING SHEET for 1099-C NOV 2010 ALABANY IT from Ulster 20 MORTGAGE WORKOUT Taxpayer/homeowner retains ownership Mortgage debt is reduced-partially forgiven Only principal debt is IN SCOPE ALL other elements OUT OF SCOPE No taxable gain or loss Basis (cost) of home-Taxpayers cost is reduced NOV 2010 ALABANY IT from Ulster 21 MORTGAGE WORKOUT(continued) Taxpayer receives Form 1099-C BOX 2 DEBT CANCELED Complete Form 982 for (Qualified PRINCIPAL RESDENCE elements) Check Box 1e Discharge of qualified principal residence indebtedness Form 1099-C Box 2 entry amount Line 2 Total amount of discharged indebtedness excluded from gross income Line 10b Applied to reduce the basis of your principal residence NOV 2010 ALABANY IT from Ulster 22 MORTGAGE WORKOUT(continued) Taxpayer with nonrecourse debt do not have ordinary income from cancellation unless lender Offered a discount for the early payment of the debt, or Agreed to a loan modification that resulted that resulted in the reduction of the principal of the debt Amount of the principal reduction is canceled debt whether recourse or nonrecourse unless VALID EXCEPTIONS or EXCLUSIONS apply NO ORDINARY INCOME on 1040 line 21 NOV 2010 ALABANY IT from Ulster 23 Form 982 Key Entries CHECK: Line 1e Discharge of qualified principal residence indebtedness Line 2 total amount of discharged indebtedness Form 1099-C Box 2 Line 10 b Applied to reduce the basis…… from 1099-C box 2 (amount of debt canceled) for Mortgage Workouts NOV 2010 ALABANY IT from Ulster 24 EXAMPLE: MORTGAGE WORKOUT Tom and Grace were having difficulty making heir mortgage payments in 2009 after Tom became ill. Rather than go through the expense of a foreclosure, the lender agreed to reduce the principal on their loan. The principal balance before the 11/1/2009 workout was $130,000 and the lender reduced the loan to $110,000. None of the loan proceeds were used for any purpose other than to buy, build, or substantially improve the principal residence. Form 1099-C Box 1 Date canceled: 11/01/2009 Box 2 Amount of debt canceled: $20,000 Box 5 Was the borrower personally liable for repayment of the debt? NOV 2010 ALABANY IT from Ulster 25 Tom & Grace Part I Form 982 NOV 2010 ALABANY IT from Ulster 26 TOM & GRACE Form 982 Part II 10b NOV 2010 ALABANY IT from Ulster 27 FORECLOSURE REAL PROPERTY Recourse Debt – Debtor responsible for amount not satisfied by property Debt forgiveness income (1099-C) Debt forgiveness income Capital gain possible Non-recourse Debt – Debt satisfied by surrender of property No income due to cancelled debt – no 1099-C will be issued Possible gain due to “sale” of property (1099-A) NOV 2010 ALABANY IT from Ulster 28 FORECLOSUREHOMEOWNER LOSES POSSESSION Results in sale of property to lender-Taxpayer receives Form 1099-A: maybe 1099-C Loss is not deductible Gain may be taxable-gains highly unlikely If taxable, gain must be entered on Schedule D manually- does not transfer NOV 2010 ALABANY IT from Ulster 29 SCH D Elements NOV 2010 ALABANY IT from Ulster 30 SCHEDULE D RECOURSE NONRECOURSE Form 1099-A BOX 5 CHECKED BOX 5 BLANK SALES PRICE Lesser of BOX 2 BOX 2 or BOX 4 Form 1099-C BOX 5 CHECKED BOX 5 BLANK SALES PRICE BOX 7 BOX 7 VERIFY ELEMENTS WHEN BOTH FORMS EXIST NOV 2010 ALABANY IT from Ulster 31 EXAMPLE 1 Mary Smith purchased her main home in June 2003 for $175,000. In 2009 she lost her job and was no longer able to make her payments on this recourse mortgage. In July, Mary moved out of the home to live with relatives. On July 15, 2009 the bank foreclosed on the home and canceled the remaining amount owed on the home. The fair market value at the time was $100,000 because of the poor housing market, but Mary still owed $150,000 on the mortgage. None of the loan proceeds were used for any purpose other than to buy, build, or substantially improve the principal residence. NOV 2010 ALABANY IT from Ulster 32 FORM 1099-A 150,000.00 MARY SMITH 100,000.00 X 1111 LOST DRIVE Your City, YS, ZIP NOV 2010 ALABANY IT from Ulster 33 MARY SMITH FORECLOSURE SCHED D, WORKSHEET 2 NOV 2010 ALABANY IT from Ulster 34 MARY SMITH FORECLOSURE CAP GAIN WORKSHEET - LOSS MUST OVERRIDE to 0 NOV 2010 ALABANY IT from Ulster 35 MARY SMITH FORECLOSURE SCHED D ENTRY – LOSS SCH D must be filed with return NOV 2010 ALABANY IT from Ulster 36 EXAMPLE 2: FORECLOSURE GAIN WITHIN EXCLUSION Mary Smith purchased her main home in June 2003 for $175,000. (From 1st Example) Change purchase price to $80,000 NOV 2010 ALABANY IT from Ulster 37 MARY SMITH FORECLOSURE SCHED D, WORKSHEET 2 - GAIN NOV 2010 ALABANY IT from Ulster 38 MARY SMITH FORECLOSURE NON-TAXABLE GAIN F3 TO “GET RED OUT NOV 2010 ALABANY IT from Ulster 39 MARY SMITH FORECLOSURE NON-TAXABLE GAIN SCH D must be filed 2ND Entry Required to Record Exclusion -= Zero out Gain NTTC TRAINING 2009 40 Debt Cancelation Determine EXCEPTION or Exclusion Complete Form 982 1099-C Box 2 to Line 2 Determine appropriate Part I item (a, b ,f) If ORDINARY INCOME (IN SCOPE) 1099-C Box 2 to 1040 Line 21 (OTHER INCOME) NOV 2010 ALABANY IT from Ulster 41 MORTGAGE DEBT FORGIVENESS RELIEF ACT QUESTIONS? COMMENTS? Like a duck upon the sea serenely paddling unaware of the fathomless depths below NOV 2010 ALABANY IT from Ulster 42