Compound Interest

advertisement

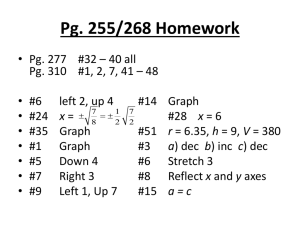

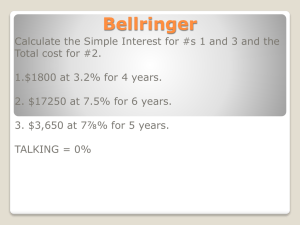

Section 5.1: Simple and Compound Interest Simple Interest Simple Interest: Used to calculate interest on loans…often of one year or less. Formula: I = Prt I : interest earned (or owed) P : principal invested (or borrowed) r : annual interest rate t : time in years Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. a. How much interest will she pay? Simple interest: I = Prt I=? Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. a. How much interest will she pay? Simple interest: I = Prt I=? P = $5,000 r = .065 t =11/12 Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. a. How much interest will she pay? Simple interest: I = Prt I=? P = $5,000 r = .065 I = Prt = (5000)(0.065)(11/12) = t =11/12 a. How much interest will she pay? Simple interest: I = Prt I=? P = $5,000 r = .065 t =11/12 I = Prt = (5000)(0.065)(11/12) = $______ Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. a. How much interest will she pay? Simple interest: I = Prt I=? P = $5,000 r = .065 t =11/12 I = Prt = (5000)(0.065)(11/12) = $297.92 Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. b. What is the total amount to be repaid? Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. b. What is the total amount to be repaid? Amount to Repay = Principal + Interest Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. b. What is the total amount to be repaid? Amount to Repay = Principal + Interest = 5000 + 297.92 Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. b. What is the total amount to be repaid? Amount to Repay = Principal + Interest = 5000 + 297.92 = $ 5,297.92 Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. b. What is the total amount to be repaid? Amount to Repay = Principal + Interest = 5000 + 297.92 = $ 5,297.92 Notice here that we really have: A = P + I … or A = P + Prt = P(1 + rt) Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. b. What is the total amount to be repaid? Amount to Repay = Principal + Interest = 5000 + 297.92 = $ 5,297.92 Notice here that we really have: A = P + I … or A = P + Prt = P(1 + rt) So, if you want a direct formula for A with simple interest, use A = P(1 + rt) Example 1 To buy furniture for a new apartment, Jennifer Wall borrowed $5,000 at 6.5% simple interest for 11 months. b. What is the total amount to be repaid? Amount to Repay = Principal + Interest = 5000 + 297.92 = $ 5,297.92 Notice here that we really have: A = P + I … or A = P + Prt = P(1 + rt) So, if you want a direct formula for A with simple interest, use A = P(1 + rt) and, of course if you only want I, then use I = Prt Alabama will beat Michigan Saturday in Dallas. 1. 2. Yes No Find simple interest $10,502 at 4.2% for 10 months A. B. C. D. $370.66 $367.57 $404.33 $330.81 Compound Interest Compound Interest: more commonly used than simple interest. With compound interest, the interest itself earns interest. Formula: r A P 1 m mt Compound Interest Compound Interest: more commonly used than simple interest. With compound interest, the interest itself earns interest. Formula: r A P 1 m mt Where A is the compound amount (includes principal and interest) Compound Interest Compound Interest: more commonly used than simple interest. With compound interest, the interest itself earns interest. Formula: r A P 1 m mt Where A is the compound amount (includes principal and interest) P is the initial investment Compound Interest Compound Interest: more commonly used than simple interest. With compound interest, the interest itself earns interest. Formula: r A P 1 m mt Where A is the compound amount (includes principal and interest) P is the initial investment r is the annual percentage rate Compound Interest Compound Interest: more commonly used than simple interest. With compound interest, the interest itself earns interest. Formula: r A P 1 m mt Where A is the compound amount (includes principal and interest) P is the initial investment r is the annual percentage rate m is the number of compounding periods per year: Compound Interest Compound Interest: more commonly used than simple interest. With compound interest, the interest itself earns interest. Formula: r A P 1 m mt Where A is the compound amount (includes principal and interest) P is the initial investment r is the annual percentage rate m is the number of compounding periods per year: Compounded annually, m = 1 Compounded semiannually, m = 2 Compounded quarterly, m = 4, etc. Compound Interest Compound Interest: more commonly used than simple interest. With compound interest, the interest itself earns interest. Formula: r A P 1 m mt Where A is the compound amount (includes principal and interest) P is the initial investment r is the annual percentage rate m is the number of compounding periods per year: Compounded annually, m = 1 Compounded semiannually, m = 2 Compounded quarterly, m = 4, etc. t is the number of years Compound Interest Compound Interest: more commonly used than simple interest. With compound interest, the interest itself earns interest. r A P 1 m Formula: mt P1 i n Where A is the compound amount (includes principal and interest) P is the initial investment r is the annual percentage rate m is the number of compounding periods per year: Compounded annually, m = 1 Compounded semiannually, m = 2 Compounded quarterly, m = 4, etc. t is the number of years n = mt is the total # of compounding periods over all t years i = r/m is the interest rate per compounding period Example 2 Suppose that $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if the interest is compounded annually. Example 2 Suppose that $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if the interest is compounded annually. mt r A P 1 m P 1 i n Example 2 Suppose that $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if the interest is compounded annually. mt r A P 1 m P 1 i A = ?; P = 22,000; r = 0.055; m = 1; t = 5 n Example 2 Suppose that $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if the interest is compounded annually. mt r A P 1 m P 1 i A = ?; P = 22,000; r = 0.055; m = 1; t = 5 0.055 A 220001 1 (1)( 5 ) n Example 2 Suppose that $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if the interest is compounded annually. mt r A P 1 m P 1 i A = ?; P = 22,000; r = 0.055; m = 1; t = 5 0.055 A 220001 1 (1)( 5 ) $28,753.12 n Example 2 Suppose that $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if the interest is compounded annually. mt r A P 1 m P 1 i A = ?; P = 22,000; r = 0.055; m = 1; t = 5 0.055 A 220001 1 Find the amount of interest earned. (1)( 5 ) $28,753.12 n Example 2 Suppose that $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if the interest is compounded annually. mt r A P 1 m P 1 i A = ?; P = 22,000; r = 0.055; m = 1; t = 5 0.055 A 220001 1 (1)( 5 ) $28,753.12 Find the amount of interest earned. Compound Amount (A) = Principal (P) + Interest (I), so I=A–P n Example 2 Suppose that $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if the interest is compounded annually. mt r A P 1 m P 1 i A = ?; P = 22,000; r = 0.055; m = 1; t = 5 0.055 A 220001 1 (1)( 5 ) $28,753.12 Find the amount of interest earned. Compound Amount (A) = Principal (P) + Interest (I), so I=A–P = 28,753.12 – 22,000 = $ 6,753.12 n Example 3 If $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if interest is compounded monthly. (Round answer to nearest dollar.) Example 3 If $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if interest is compounded monthly. (Round answer to nearest dollar.) r A P 1 m mt P 1 i n Example 3 If $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if interest is compounded monthly. (Round answer to nearest dollar.) mt r n A P1 P 1 i m A = ?; P = 22,000; r = 0.055; m = 12; t = 5 Example 3 If $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if interest is compounded monthly. (Round answer to nearest dollar.) mt r n A P1 P 1 i m A = ?; P = 22,000; r = 0.055; m = 12; t = 5 0.055 A 220001 12 (12)( 5 ) Example 3 If $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if interest is compounded monthly. (Round answer to nearest dollar.) mt r n A P1 P 1 i m A = ?; P = 22,000; r = 0.055; m = 12; t = 5 0.055 A 220001 12 (12)( 5 ) $28,945 to the nearest DOLLAR Example 3 If $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if interest is compounded monthly. (Round answer to nearest dollar.) mt r n A P1 P 1 i m A = ?; P = 22,000; r = 0.055; m = 12; t = 5 0.055 A 220001 12 Find the amount of interest earned. (12)( 5 ) $28,945 to the nearest DOLLAR Example 3 If $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if interest is compounded monthly. (Round answer to nearest dollar.) mt r n A P1 P 1 i m A = ?; P = 22,000; r = 0.055; m = 12; t = 5 0.055 A 220001 12 (12)( 5 ) $28,945 to the nearest DOLLAR Find the amount of interest earned. Compound Amount (A) = Principal (P) + Interest (I), so I=A–P Example 3 If $22,000 is invested at 5.5% interest. Find the amount of money in the account after 5 years if interest is compounded monthly. (Round answer to nearest dollar.) mt r n A P1 P 1 i m A = ?; P = 22,000; r = 0.055; m = 12; t = 5 0.055 A 220001 12 (12)( 5 ) $28,945 to the nearest DOLLAR Find the amount of interest earned. Compound Amount (A) = Principal (P) + Interest (I), so I=A–P = 28,945 – 22,000 = $ 6,945 Find the compound amount $9000 At 3% compounded semiannually for 5 years A. B. C. D. $10,444.87 $10,433.47 $10,350.00 $9,695.56 Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: A r P 1 m mt .08 1 1 4 4 (1) Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: A A r P 1 m 1.02 4 mt .08 1 1 4 1.0824 4 (1) Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: A A r P 1 m 1.02 4 mt .08 1 1 4 4 (1) 1.0824 So $1 would turn into $1.0824 in 1 year. Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: A A r P 1 m 1.02 4 mt .08 1 1 4 4 (1) 1.0824 So $1 would turn into $1.0824 in 1 year. Now use A = $1.0824 in the simple interest formula & solve for r. (This will be the EAR.) Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: A A r P 1 m 1.02 4 mt .08 1 1 4 4 (1) 1.0824 So $1 would turn into $1.0824 in 1 year. Now use A = $1.0824 in the simple interest formula & solve for r. (This will be the EAR.) A = P(1+rt) Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: A A r P 1 m 1.02 4 mt .08 1 1 4 4 (1) 1.0824 So $1 would turn into $1.0824 in 1 year. Now use A = $1.0824 in the simple interest formula & solve for r. (This will be the EAR.) A = P(1+rt) 1.0824 = 1[1 + r(1)] Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: A A r P 1 m 1.02 4 mt .08 1 1 4 4 (1) 1.0824 So $1 would turn into $1.0824 in 1 year. Now use A = $1.0824 in the simple interest formula & solve for r. (This will be the EAR.) A = P(1+rt) 1.0824 = 1[1 + r(1)] 1.0824 = 1 + r Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: A A r P 1 m 1.02 4 mt .08 1 1 4 4 (1) 1.0824 So $1 would turn into $1.0824 in 1 year. Now use A = $1.0824 in the simple interest formula & solve for r. (This will be the EAR.) A = P(1+rt) 1.0824 = 1[1 + r(1)] 1.0824 = 1 + r r = .0824 Example 4: Effective Rate The Effective Annual Rate (EAR) is the rate that would be paid using simple interest in order to be equivalent to a stated compounded rate. Financial institutions are usually required by law to provide the effective rate so that consumers can easily compare ‘apples to apples’. Ex. Find the effective annual rate corresponding to a rate of 8% compounded quarterly. This question is easy to answer if we notice a simplifying fact: The interest rate doesn’t change based on the principal or the amount of time. So, in our formulas, we can just calculate using $1 for 1 year. First see how much would be earned with compounding: A A r P 1 m 1.02 4 mt .08 1 1 4 4 (1) 1.0824 So $1 would turn into $1.0824 in 1 year. Now use A = $1.0824 in the simple interest formula & solve for r. (This will be the EAR.) A = P(1+rt) 1.0824 = 1[1 + r(1)] 1.0824 = 1 + r r = .0824 So, the EAR is 8.24% Example 4: Effective Rate If you would rather have a formula for EAR, here it is: The effective rate corresponding to a stated rate of interest r compounded m times per year is m r re 1 1 m This formula gives the same answer that you would get if you just ‘figured it out’ as we did earlier. Try it yourself and see! Example 5 A family plans to retire in 15 years and expects to need $300,000. Determine how much they must invest today at 12.3% compounded semiannually to accomplish their goal. Example 5 A family plans to retire in 15 years and expects to need $300,000. Determine how much they must invest today at 12.3% compounded semiannually to accomplish their goal. r A P 1 m mt Example 5 A family plans to retire in 15 years and expects to need $300,000. Determine how much they must invest today at 12.3% compounded semiannually to accomplish their goal. r A P 1 m A = $300,000 mt P=? r = 0.123 m=2 t = 15 Example 5 A family plans to retire in 15 years and expects to need $300,000. Determine how much they must invest today at 12.3% compounded semiannually to accomplish their goal. r A P 1 m A = $300,000 mt P=? r = 0.123 0.123 300000 P1 2 m=2 ( 2 )(15) t = 15 Example 5 A family plans to retire in 15 years and expects to need $300,000. Determine how much they must invest today at 12.3% compounded semiannually to accomplish their goal. r A P 1 m A = $300,000 mt P=? r = 0.123 0.123 300000 P1 2 P = $50,063.51 m=2 ( 2 )(15) t = 15 How much of this did you understand well today? 1. 2. 3. 4. 5. All or most A lot of it About half of it Not too much of it None or hardly any of it

![Practice Quiz Compound Interest [with answers]](http://s3.studylib.net/store/data/008331665_1-e5f9ad7c540d78db3115f167e25be91a-300x300.png)