surplus requirements for insurance companies

advertisement

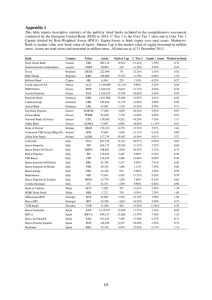

Capital Allocation for Insurance Companies Stewart C. Myers James A. Read, Jr. Casualty Actuarial Society of the American Risk and Insurance Association Marco Island, Florida May 20, 2003 Bentley\General\8060\docs/PRS-PROP/SCM/Marco.Island-FL_5-03 Surplus for Insurance Companies Capital = Surplus Insurance companies hold capital (surplus) so that possibility of default is remote. Surplus equals assets minus default-free liabilities. But surplus is costly: Double taxation of investment income Agency and information costs Insurance companies operate in many lines. Need to allocate costs for pricing, performance evaluation, etc. Regulators may also have to allocate costs or to set surplus requirements line-byline. 2 The Surplus Allocation Problem Conventional wisdom: Surplus can not (should not) be allocated to lines of insurance. For a given configuration, the risk capital of a multi-business firm is less than the aggregate risk capital of the businesses on a stand-alone basis. Full allocation of riskcapital across the individual businesses of the firm therefore is generally not feasible. Attempts at such a full allocation can significantly distort the true profitability of individual businesses. (Merton, R. C. and A.F. Perold, 1993, “Theory of Risk Capital in Financial Firms,” Journal of Applied Corporate Finance, 6, 16-32.) We show how surplus can (should) be allocated, given the line-by-line composition of business. 3 Surplus Allocation Example Line 1 Line 2 Line 3 Total Default Value PV(Losses) Marginal Surplus Requirement Surplus Allocation $100 $100 $100 38% 50% 63% $ 38 $ 50 $ 63 $300 $0.93 (0.31%) $150 Default Value = Cost (PV) of complete credit backup 4 Surplus Allocation Example Set each line’s surplus requirement so that its marginal contribution to default value is the same (0.31% of PV(Losses)). Suppose PV(Losses) for line 3 increases to $101: Line 1 Line 2 Line 3 Total Default Value PV(Losses) Marginal Surplus Requirement Surplus Allocation $100 $100 $101 38% 50% 63% $38.00 $50.00 $63.63 $301 $0.933 (0.31%) $150.63 5 Surplus Allocation Example Surplus allocations for diversified firms are generally less than stand-alone surplus requirements. Default Values = 0.31% of PV (losses) Company 1 Company 2 Company 3 Total PV(Losses) Surplus Percentage Surplus Required $100 $100 $101 43% 56% 72% $43 $56 $72 $171 Stand-alone requirements cannot be used to allocate surplus requirements in multiline companies. (Here we agree with Merton and Perold.) 6 Surplus Allocation Example The surplus allocations for the three-line company are not correct for a two- or four-line company. Two-line Company PV(Losses) Line 1 Line 2 Line 3 Total Default Value $100 $100 — $200 Marginal Surplus Requirement Surplus Allocation 40% 52% — $40 $52 — $92 $0.62 (0.31%) (Here we agree with Merton and Perold.) 7 Examples of Surplus Allocations Panel A shows marginal surplus requirements for three lines of insurance. Surplus allocations based on these marginal requirements add up to the total surplus carried by the firm. Panel B shows the stand-alone surplus requirements for each line. Panel C shows the total surplus required by each line, given the other two lines. In all cases default value is held constant at 0.31% of PV(losses). Panel A: Marginal Surplus Requirements for Three Lines of Insurance PV(Losses) Marginal Surplus Requirement Line 1 $100 38% Line 2 $100 50% Line 3 $100 63% Total $300 Default Value $0.93 Default Value/PV(Losses) 0.31% Panel B: Stand-Alone Surplus Requirements for Each Line PV(Losses) Line 1 $100 Line 2 $100 Line 3 $100 Total $300 Panel C: Total Surplus Required for Each Line, Given the Other Two Lines PV(Losses) PV(Losses) Line 1 Line 2 Case 1 $0 $100 Case 2 $100 $0 Case 3 $100 $100 Total $200 $200 Default Value $0.62 $0.62 Default Value/PV(Losses) 0.31% 0.31% Surplus Allocation $38 $50 $63 Stand-Alone Surplus Requirements $43 $56 $72 $171 PV(Losses) Line 3 $100 $100 $0 $200 $0.62 0.31% Required Surplus $115 $104 $ 92 Reduction from Panel A $35 $46 $58 8 Preview Given the line-by-line composition of business: Marginal default values add up to firm-wide default value. Set surplus requirements so that every line’s marginal default value is the same. Use these line-by-line surplus requirements for pricing, calculating required overall surplus, etc. 9 The Default Option Limited liability implies equity has option to default Assets (V) PV Losses (L) Default Option (D) Equity (E) ~ ~ ~ ~ ~ ~ E max 0, V L V L D ~ ~ ~ D max 0, L V Default is an exchange option—an option to exchange assets for liabilities 10 Value of Default Option Consider the default option in a one-period (two-date) setting, assuming distribution of asset/liability values is lognormal* Default value for company (d D/L) depends on Surplus ratio (s S/L) Variance of losses (L2) Variance of asset returns (V2) Covariance of losses and asset returns (LV) *This assumption is convenient but not necessary for our results. 11 Default Risk for Multi-Line Companies For companies that write insurance in more than one line, variance of aggregate losses depends on Variance of losses by line (i2) Correlation of losses across lines ( ij ) Composition of business (xi Li/L) M 2 L i 1 M x i x j i j ij j 1 12 Default Risk for Multi-Line Companies (continued) Covariance of losses with asset returns depends on Variance of losses by line (i2) Variance of asset returns (V2) Correlation of losses by line with asset returns ( iV ) Composition of business (xi) M σ LV xi σ i σ V ρiV i 1 13 Default Values for Lines of Business Marginal default values (di D/Li) for lines of business depend on marginal surplus requirements and risk Surplus contribution for line (si) Covariance of losses with losses on other lines (ij) Covariance of losses with returns on assets (iV) Composition of portfolio (xi) d d 1 2 di d s s i iL L iV LV s 14 Marginal Default Values Add Up Covariances of portfolio components add up: M x i 1 i iL L2 iV LV M x i 1 i Weighted marginal default values add up to default value for company: M xd i 1 i i d Therefore default values can be allocated uniquely to lines of business. “Adding up” result assumes losses and investment assets have well defined market values. If so, result holds for any joint probability distribution of losses and investment returns. 15 Retail Insurance In retail insurance markets, default risk is absorbed by an industry pool Surplus requirements are typically the same for all lines of insurance, so marginal default values vary by line d 1 2 di d iL L iV LV This implies that the pool subsidizes high-risk lines of business Insurance companies “collect” default insurance with value equal to default value for own portfolio Companies “pay” default value for pool 16 Surplus Allocation All policy holders bear the same default risk. The correct formula for surplus allocation is obtained by setting marginal default values equal to default value for firm (di = d). 1 d d 1 2 si s iL L iV LV s Eliminates intra-firm cross subsidies. 17 Default Value and Surplus Allocations Risky Assets, Base-Case Correlations Panel A: Portfolio Assets & Liabilities Line 1 Line 2 Line 3 Liabilities Assets Surplus Ratio to Liabilities Standard Deviation Line 1 33% 33% 33% 100% 150% 50% 10.00% 15.00% 20.00% 12.36% 15.00% 1.00 0.50 0.50 0.74 -0.20 $100 $100 $100 $300 $450 $150 Lognormal Results Asset/Liability Volatility Default/Liability Value Delta Vega 21.63% 0.31% -0.0237 0.0838 Normal Results Standard Deviation of Surplus Default/Liability Value Delta Vega 28.18% 0.43% -0.0380 0.0826 Correlations Line 2 0.50 1.00 0.50 0.81 -0.20 Line 3 0.50 0.50 1.00 0.88 -0.20 Covariance with Liabilities Covariance with Assets 0.0092 0.0150 0.0217 0.0153 -0.0030 -0.0045 -0.0060 -0.0045 0.0225 Panel B: Line-by-Line Allocations Default/Liability Value (Uniform Surplus) Line 1 Line 2 Line 3 Liabilities Surplus/Liability Value (Uniform Default Value) Lognormal Normal Lognormal 0.02% 0.30% 0.62% 0.31% 0.18% 0.42% 0.68% 0.43% 38% 50% 63% 50% Normal 41% 50% 59% 50% 18 Default Value and Surplus Allocations Safe Assets Case Panel A: Portfolio Assets & Liabilities Line 1 Line 2 Line 3 Liabilities Assets Surplus $100 $100 $100 $300 $450 $150 Lognormal Results Asset/Liability Volatility Default/Liability Value Delta Vega 12.36% 0.00% -0.0004 0.0022 Normal Results Standard Deviation of Surplus Default/Liability Value Delta Vega 12.36% 0.00% 0.0000 0.0001 Ratio to Liabilities Standard Deviation Line 1 33% 33% 33% 100% 150% 50% 10.00% 15.00% 20.00% 12.36% 0.00% 1.00 0.50 0.50 0.74 0.00 Correlations Line 2 Line 3 0.50 1.00 0.50 0.81 0.00 0.50 0.50 1.00 0.88 0.00 Covariance with Liabilities Covariance with Assets 0.0092 0.0150 0.0217 0.0153 0.0000 0.0000 0.0000 0.0000 0.0000 Panel B: Line-by-Line Allocations Default/Liability Value (Uniform Surplus) Line 1 Line 2 Line 3 Liabilities Surplus/Liability Value (Uniform Default Value) Lognormal Normal Lognormal -0.01% 0.00% 0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 23% 49% 78% 50% Normal 29% 49% 72% 50% 19 Default Value and Surplus Allocations Geographic Diversification Case Panel A: Portfolio Assets & Liabilities Line 1 Line 2 Line 3 Liabilities Assets Surplus Ratio to Liabilities Standard Deviation Line 1 33% 33% 33% 100% 150% 50% 15.00% 15.00% 15.00% 9.49% 15.00% 1.00 0.10 0.10 0.63 -0.20 $100 $100 $100 $300 $450 $150 Lognormal Results Asset/Liability Volatility Default/Liability Value Delta Vega 20.12% 0.20% -0.0172 0.0639 Normal Results Standard Deviation of Surplus Default/Liability Value Delta Vega 27.04% 0.34% -0.0322 0.0722 Correlations Line 2 0.10 1.00 0.10 0.63 -0.20 Line 3 0.10 0.10 1.00 0.63 -0.20 Covariance with Liabilities Covariance with Assets 0.0090 0.0090 0.0090 0.0090 -0.0045 -0.0045 -0.0045 -0.0045 0.0225 Panel B: Line-by-Line Allocations Default/Liability Value (Uniform Surplus) Line 1 Line 2 Line 3 Liabilities Surplus/Liability Value (Uniform Default Value) Lognormal Normal Lognormal 0.20% 0.20% 0.20% 0.20% 0.34% 0.34% 0.34% 0.34% 50% 50% 50% 50% Normal 50% 50% 50% 50% 20 Default Value and Surplus Allocations Long Tail Case Panel A: Portfolio Assets & Liabilities Line 1 Line 2 Line 3 Liabilities Assets Surplus Ratio to Liabilities Standard Deviation Line 1 33% 33% 33% 100% 150% 50% 15.00% 15.00% 15.00% 14.49% 15.00% 1.00 0.90 0.90 0.97 -0.20 $100 $100 $100 $300 $450 $150 Lognormal Results Asset/Liability Volatility Default/Liability Value Delta Vega 22.91% 0.43% -0.0298 0.1014 Normal Results Standard Deviation of Surplus Default/Liability Value Delta Vega 29.18% 0.52% -0.0433 0.0919 Correlations Line 2 0.90 1.00 0.90 0.97 -0.20 Line 3 0.90 0.90 1.00 0.97 -0.20 Covariance with Liabilities Covariance with Assets 0.0210 0.0210 0.0210 0.0210 -0.0045 -0.0045 -0.0045 -0.0045 0.0225 Panel B: Line-by-Line Allocations Default/Liability Value (Uniform Surplus) Line 1 Line 2 Line 3 Liabilities Surplus/Liability Value (Uniform Default Value) Lognormal Normal Lognormal 0.43% 0.43% 0.43% 0.43% 0.52% 0.52% 0.52% 0.52% 50% 50% 50% 50% Normal 50% 50% 50% 50% 21 Robustness of Marginal Default Values Marginal default values depend on mix of business as well as line-by-line risk. Are they robust to changes in mix? Experiment: Consider surplus allocations for hypothetical companies with N and N+1 identical lines of business. 22 Two-Line Company Surplus Allocations 60.00% Marginal Surplus Requirement 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 0.000 0.025 0.050 0.075 0.100 0.125 0.150 0.175 0.200 0.225 0.250 0.275 0.300 0.325 0.350 0.375 0.400 0.425 0.450 0.475 0.500 -10.00% -20.00% -30.00% Line 2 Liabilities Company Line 2 Line 1 23 Four-Line Company Surplus Allocations 60.00% Marginal Surplus Requirement 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 0.000 0.013 0.025 0.038 0.050 0.063 0.075 0.088 0.100 0.113 0.125 0.138 0.150 0.163 0.175 0.188 0.200 0.213 0.225 0.238 0.250 Line 4 Liabilities Company Line 4 Lines 1 to 3 24 Ten-Line Company Surplus Allocations 60.00% Marginal Surplus Requirement 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 0.000 0.005 0.010 0.015 0.020 0.025 0.030 0.035 0.040 0.045 0.050 0.055 0.060 0.065 0.070 0.075 0.080 0.085 0.090 0.095 0.100 Line 10 Liabilities Company Line 10 Lines 1 to 9 25 Solvency Regulation Define a “base-case” composition of insurance business and asset risk along with marginal surplus requirements consistent with uniform default value. If a company deviates from base-case composition or asset risk, adjust surplus requirements to keep default value constant. 26 The Efficient Composition of Business Diversification provides financial benefits in the form of reduced risk and surplus requirements. Diversification entails real costs. (Diminished focus? Administrative friction?) Efficient composition of business represents a trade-off between financial benefits and real costs. May not be unique May not be sharply defined 27 The Benefit-Cost Trade Off of Marginal Diversification Increased and Reduction Efficient Business administrative Composition operating inSurplus cost costs TheRequired administrative As but Figure Present costs more operating, Trade 2Value lines off of are administrative, costs reduced added, determines diversification surplus and the requirements perhaps efficient decreases agency composition against costs required operating increase. ofsurplus, business. and Present Value of Costs Marginal Operating and Administrative Costs Reduction in Cost of Required Surplus Efficient Composition of Business Increased Diversification 28 Conclusions Surplus can be allocated uniquely. Allocations appear robust for multi-line companies. Computational challenges remain. What about other financial intermediaries? 29 30