Year_10_Revision_Booklet_with_Revision_Qs

advertisement

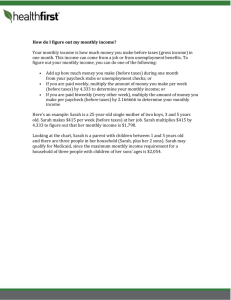

Business Customer Consumer Ms Sarah 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. Business Activity and Purpose Added Value Classification of Business 9Primary, Secondary and Tertiary) Industry in the UAE Business Growth The Economy Aims and Objectives Stakeholders Government Objectives The Trade Cycle E-Commerce International Trade Exchange Rates Business Ownership – sole traders, partnerships. Limited companies, franchises, joint ventures Multi-National Companies Organisational Charts Communication Sources of Finance Cash Flow Profit and Loss Balance Sheets Ratios Costs, Revenues and Profits Ms Sarah 24. Business Activity is needed to satisfy people’s needs and wants. 25. A need is a good or service essential for living. E.g. food and water 26. A want is a good or service which people would like to have but is not essential for living. E.g. cars, takeaway etc. Wants are unlimited (this means people want lots of different things). 27. The economic problem results from there being unlimited wants but limited resources to produce the goods and services to satisfy those wants. This creates scarcity. 28. Scarcity is the lack of sufficient resources (factors of production) to fulfill everyone’s wants. 29. The factors of production are the key resources that businesses use to produce goods and services. There are four factors of production they are land, labour, capital and enterprise. All natural resources provided by nature. E.g. fields, forests, oil, gas etc. Land This is the skill and risk taking ability of the person who brings the resources together. They are called entrepreneurs. Enterprise Factors of Production Labour This is people needed to make products and sell services. Capital This is the finance, machinery and equipment needed to make products and services. Ms Sarah Resources are limited and therefore we have to decide which wants we will satisfy and those which we won’t. All choices involve giving up something and this is called OPPORTUNITY COST. Examples 1. Individual Car or Holiday?? 2. Business Machine A or Machine B??? 3. Government New Road or New School??? Ms Sarah Specialisation Division of labour is when the production process is split up into different tasks and each worker performs these tasks. It is also known as specialisation. Advantages Workers are trained to specialize in one area making them very good at their job and increasing output and efficiency. Disadvantages Workers have to do the same thing which can be boring. Also if one worker is absent there may be no other workers who can do the job. Added Value Businesses add value. This is the increased worth a business creates for its products. It is the difference between what it cost the business to have the product made and the price they sell it for. E.g. if we bought something for 10AED from a supplier and sold it to a customer for 15AED the added value is worth 5AED. Source of added value Explanation Convenience The easier something is to use or if it makes a customer’s life easier the more they will pay for it. For example people will pay a little bit extra for ready meals because they reduce the need to cook. Speed and quality of service In today’s world customers expect high quality service. They may therefore be more willing to pay a higher price to a business that can deliver a high level of service. For Ms Sarah example if you go to stay at the Ritz Hotel in London you would expect to pay more because of the level of service. Branding This is a named product which customers see as being different from other similar products. The brand image therefore relates to the idea/image the customer has in their mind about the brand. For example Kellogg’s have built up a brand image which helps them sell their cereals. Design and Formulation Having a unique design or a unique recipe or formula means customers will pay more. For example because of Apple computers unique design people are willing to pay a higher price. Unique selling point (USP) This is something that makes a product different to other similar products. This could be anything as long as it makes the product unique. For example polo’s are unique because they are a mint with a hole. Quality The better quality a product is the more likely people will pay more for it. For example people are willing to pay more for Duracell batteries. You need to add value to survive. The most successful businesses are the ones that achieve high levels of added value. Aims and Objectives Aims are the long term goals of the enterprise. Objectives are the specific, measurable targets to help a business achieve an aim. They are usually short to medium term. Objectives need to be SMART. Specific – a clear statement about what you will do. Measurable – how will the achievement be checked? Achievable – it needs to be attainable Realistic – it should be sensible and have a chance of being achieved Time-Constrained – it should include a date/time for achievement or review Examples of SMART objectives: To have achieved my target grade in enterprise by the end of year 12. /To increase sales in the business by 10% by the end of the year. /To reduce waste at the school by 50% by 2014. Ms Sarah Survival When a business first starts this is likely to be a key objective for the first year. Also when trading is difficult some businesses may be making little or no profit and therefore be focused on this aim as well. Break Even This is a key aim linked to survival as it involves covering all costs. However it also means the business doesn’t make anything either. They are said to not have made a profit or a loss. This is often a key aim for new businesses in the first few years of trading. Increasing Sales This means trying to sell as much of your product as service as possible. It can lead to higher profit but not always. For example using 2 for 1 schemes is a good way to create more profit but doesn’t mean the business will make more money. Profit Maximisation Most privately owned businesses have this as a main aim. Making profit is important as it helps the business grow and also means owners and shareholders are making money. Profit maximisation means making as much profit as possible. Environment Having the environment as a key aim means a business is trying to ensure that it is not endangering either the planet or the local community/environment. It could involve try to cut back on waste or trying to encourage others to take a more environmental approach. E.g. a school encouraging its pupils to recycle. Increasing Market Share This means getting more customers compared to your competitors. The bigger your share of the market the more customers you have. Being ethical This means doing the morally right thing. An enterprise that is ethical won’t just do the minimum that's expected of them they will try to go that step further. For example the Fair-trade Foundation ensures producers get paid more than minimum wage. Growth Many businesses want to sell more every year and focus on expanding the business. They may plan to open more branches or start selling more products. Ms Sarah Stakeholders Stakeholders are any person or organisation who has an interest in a business and its activities. Owners Workers Managers Consumers Government The community Suppliers Banks (if they have lent the business money) Stakeholders can be internal, connected or external. Internal These are stakeholders within the organisation. E.g. workers, owners, managers Connected These are stakeholders who are closely linked. E.g. customers, suppliers, shareholders External These are stakeholders who outside. E.g. banks, local community, the government Conflicting Objectives Stakeholder conflict occurs when stakeholders have different objectives. Different stakeholders have different objectives. The interests of different stakeholder groups can conflict. For example: Owners generally seek high profits and so may be reluctant to see the business pay high wages to staff. A business decision to move production overseas may reduce staff costs. It will therefore benefit owners but work against the interests of existing staff who will lose their jobs. Customers also suffer if they receive a poorer service. Ms Sarah 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. List two needs. (2) List two wants (2) Explain what is meant by scarcity (2) List the four factors of production (4) Explain two examples of opportunity cost (4) Explain two benefits to society of business activity (4) What is meant by business objectives? (2) Explain two business objectives a business might have. (4) Define added value(2) Explain 2 ways a business might add value (4) List two examples of stakeholders in a business (2) Using examples, explain two reasons why conflict might occur between the stakeholder groups you listed in qs 11. (4) Case Study – Purbeck PLC Purbeck PLC owns and manages a major leisure complex. The directors of the company are considering demolishing the new complex and building a shopping Centre, the directors have different opinions about the plan. The Human Resources manager says that too many groups of people would suffer from the plan. He thinks that the plans should be dropped. The Chief Executive says that his main responsibility is to the owners of the business and that profit should come first. 1. Explain 2 ways the workers at the leisure Centre would be affected by the decision. (4) 2. Do you agree with the Chief Executive that profits should be the main aim of the business? Explain your answer (6) Ms Sarah Types of Industry Primary This stage involves the earth’s natural resources. Farming, fishing, forestry, mining etc. Secondary This stage involves taking the materials and resources from the primary sector and changing them into a good. Manufacturing and construction Tertiary This stage involves providing services to both consumers and businesses. It is often known as the service sector. Retail, transport, banking, leisure, hotels etc. Chain of Production Ms Sarah Business Size Businesses can vary greatly in size. Business size can be measures in a number of ways. Method Number of Employees Explanation This method is easy to understand, it just measures a business’s size on the amount employees they have. By Value of Output and Sales This is a common way of comparing businesses in the same industry. It looks at how much a business has produced or how much it has sold. The more it has produced or the more sales it has the bigger it is. By Capital Employed This looks at the total capital invested into the business. By Profit Profit looks at how much money a business has made after it has paid all its costs. Problems This doesn’t always give a true picture of the size of a business. For example many larger businesses use machinery and have cut back on staff but they are still large businesses. A business like Ferrari may only sell 1000 cars a year whereas a business like Nissan may sell 10,000. Ferraris though sometimes can be millions of dhs and therefore even they have made and sold less Ferrari may have still made more money. A company employing lots of workers may have not spent much on ‘capital’ this does not mean though it isn’t a large business. Profit depends on more than just the size of the business. It also depends on the efficiency and skills of the managers. Some large businesses make low profits because they are badly managed. There is no perfect way of comparing the size of a business. It is quite common for more than one method to be used. Ms Sarah Business Growth Businesses can expand by two main ways: Internal Growth This involves growing from within. For example opening more stores or expanding your product range. External Growth This involves takeovers and mergers with other businesses. Types of External Growth Ms Sarah Ms Sarah 1. 2. 3. 4. 5. 6. Explain the difference between primary, secondary and tertiary industry (6) Explain two methods a business might use to measure its size. (4) What is the difference between a takeover and a merger? (4) Explain the difference between internal and external growth (4) Explain what horizontal integration of business means. (2) Explain the difference between forward vertical integration and backward vertical integration. (4) Case Study – Hairdressers The owner of a small hairdressing business asks for your advice. She is planning on expanding the business. New branches will be opened and many more staff will be employed. She asks you to make a list of the possible advantages and disadvantages. 1. Explain if this is an example of internal or external growth (2) 2. Explain the advantages and disadvantages of the owners decision (6) Ms Sarah When setting up as an enterprise there are different structures you can take. Type of enterprise Advantages Disadvantages Sole Trader This is an enterprise owned by 1 person. Easy to start. Get to keep all the profit. Get to make all the decisions. You have unlimited liability. Lack of specialisation. The hours will be long. Partnership This is an enterprise owned by 2 to 20 people. Limited Companies This is an enterprise owned by shareholders. There are 2 types of limited company private (LTD) and public (PLC) Spreads the risk. More people with different specializations. May be disagreements and conflict. Unlimited liability Limited liability. Easier to raise finance. Tend to be large well recognized enterprises. Not as easy to set up as a sole trader – there are more regulations. You have to pay 2 types of tax. Limited Liability Franchise This is an enterprise in which a sole trader can pay an existing business to use their name and sell their product for a fee. 88% of franchises are profitable. You get support from the franchisor when you start the enterprise. The enterprise may already be well known. Limited Liability Co-operatives These are enterprises that are either workers by the workers or the customers. People working/using the business will also be the owners as well and therefore they may work harder to make the enterprise a success. Sharing of costs Sharing of risk Local knowledge You have to pay a % of your profit each year to the franchisor. You cannot choose what you sell. The more well known the enterprise is the more expensive the start-up fee will be. Decision making can be slow. The owners may lack the skills needed to run an enterprise. The profits have to be shared Disagreements may occur Different business cultures Each business has their own liability depending on their ownership structure. A joint venture This is when two or more businesses agree to start a new project together, sharing the capital, the risks and the profits. Unlimited/ Limited Liability Unlimited liability Limited Liability Ms Sarah 1. Sole trader (Key Words) Specialisation – the skills that the sole trader has. 2. Partnership (Key Words) Deed of partnership – the document that the partners complete so they know how much control and what % of the profit each partner is entitled too. 3. Limited Companies (Key Words) Private limited company – a company whose shares are not sold on the stock market. Public limited company – a company whose shares are sold on the stock market and anyone can buy them. Memorandum and Articles of Association – the two documents that must be completed before the limited company can start trading. Shareholders – these are the owners of the business. They own a ‘share’ of the company. The bigger their share the more control that they have. Dividends – this is the reward given to shareholders if the business makes a profit. 4. Franchises (Key Words) Franchise – a type of enterprise in which a sole trader can pay an existing business to use their name and sell their product for a fee. Franchisee – the sole trader who runs the franchise. Franchisor – the business who allows the sole trader to use their name and sell their products/services. Ms Sarah 1. Which forms of ownership do you think are the most suitable for the following businesses? Explain your answer. (6) a. A number of workers have been made redundant (lost their jobs) following a business failure. They agree to put some of their savings together to buy an old factory. They plan to make bicycles to export. They want everyone to have equal rights in running the business. b. A young student is planning on offering his services to his neighbours as a gardener. He will purchase cheap tools to start with. c. The owner of a business fixing cars wants to expand and grow. He wants to protect his personal assets though before he expands. 2. Explain two disadvantages of a partnership. (4) 3. Explain two benefits to a sole trader of becoming a limited company (4) 4. Explain three possible disadvantages of changing a private limited company into a public limited company? (2) 5. State two reasons why two businesses might decide to set up as a joint venture? (2) 6. Explain what is meant by a franchise. (2) Case Study – Ownership Tom has just gained a qualification in food catering. He wants to run a small fast food outlet. He is not sure whether to run it as a sole trader or look for a franchise opportunity. 1. Explain one advantage and one disadvantage for Tom if he decides to run the business as a sole trader. (4) 2. Recommend whether Tom should run his business as a sole trader or as a partnership. (8) Ms Sarah The following table outlines some of the benefits and drawbacks of business activity. Benefits to society Production of useful goods and services Creation of jobs Improves living standards Pay tax to governments Produce goods for exports Drawbacks to society Managers aiming to lower costs might offer very low wages and unsafe working conditions Pollution Certain goods produced can be dangerous Monopolies Advertising may mislead customers Governments and the economy The government’s objectives are: 1. 2. 3. 4. Achieve low levels of inflation Achieve low levels of unemployment Gain economic growth Create a surplus on the balance of payments Objective Inflation Low inflation encourages businesses to expand and it makes it easier for a country to sell its goods abroad. Unemployment Low unemployment helps increase output and improves workers standard of living. Gross Domestic Product It is a measure of the national income and output for the country's economy. Definition This is the increase in the average price level of goods and services over time Why Inflation occurs when prices rise. If prices rise too quickly this causes problems. Workers’ wages will not buy as many goods as before. Prices of goods will be higher than those in other countries Businesses will be unlikely to want to expand or create jobs. The living standards of the country are likely to fall. This exists when people who are able and willing to work don’t have a job. This occurs when people who can work cannot find a job. Unemployed people do not produce goods or services meaning the output of the country will fall. The government will have to pay benefits to unemployed people meaning money cannot be spent on other things like schools, hospitals etc… Ms Sarah Economic Growth This relates to the Trade Cycle. Countries want to be in a ‘boom’ and avoid recession. Balance of Payments This is when the country’s GDP (Gross Domestic Product) increases. This records the difference between a country’s imports and exports. Countries want a surplus on their balance of payments as this means they are making money from exports. An economy is said to grow when the total level of output of goods and services in the country increases. The value of goods and services is called GDP. If GDP is falling there are problems: Fewer workers are needed which leads to unemployment The standard of living in the country will decrease Businesses will not expand as people have less money to spend If a country has a ‘deficit’ on its balance of payments then this can cause problems. The country may end up in debt if it spends more on imports then it makes from exports. Its currency may lose value making foreign goods more expensive. The Trade Cycle (The Business Cycle) Everyday people make decisions to buy goods and services. Businesses provide the goods and services that we want to buy. Economic activity relates to the amount of buying or selling that takes place in a period of time. Rises in the amount of economic activity is called economic growth and is this is measured by sales over a period of time. We can also look at this using the ‘Trade Cycle’. Ms Sarah Ms Sarah Government Policies Governments have a great deal of power. They raise taxes and spend this money on a wide range of services and benefits for the people living in their country. The main way that governments influence the economy is through ‘economic policies’. The main economic policies are: 1. Fiscal policy 2. Monetary policy 3. Supply side policy Interest Rate – The cost of borrowing money. Direct Taxes – These are taxes paid directly from peoples/businesses incomes Debt – this is when you owe money usually to a bank. Indirect Taxes - These are taxes that are added to the price of goods. Disposable Income – this is the level of income a person has after paying their direct taxes. Efficient - Achieving maximum productivity with minimum wasted effort or expense. Ms Sarah Government Policy Fiscal Policy This is any change by the government to taxes or government spending. Monetary Policy This is changes in interest rates by the government and the central bank of a country. Supply Side Policy These are policies used by governments to improve the efficient supply of goods and services in their countries. Explanation Governments raise money to spend on things such as schools, hospitals and roads from taxes on individuals and businesses. This is known as Fiscal Policy. Other Information The main taxes are: 1. Direct taxes Income tax Corporation tax 2. Indirect taxes VAT Import Duties and Tariffs An interest rate is the cost of borrowing money. Monetary policy is used to set the interest rate. Changing the interest rates can help control spending (and this means helping reduce inflation if it’s too high or encourage economic growth if it has slowed down) Increasing interest rates: Consumers and Business will spend less as their debts will be more expensive reducing their disposable income. This reduces inflation as there is less demand. Consumers and Businesses will borrow less as borrowing money becomes more expensive. This means they will buy less. Decreasing interest rates: Consumers and Businesses will spend more as their debts will be cheaper meaning they have more disposable income. This helps economic growth. Consumers and Business will morrow more as borrowing money becomes cheaper. This means they have more money to spend (particularly on large items) Privitatisation – moving government industries into the private sector (e.g. In the UK electricity and gas services used to be owned by the government, in the 1990’s the government let private businesses (limited companies) run them. Improve training and Education – The government can improve the skills of the workers in its country by changing school curriculums and offering grants for people to go on courses to learn new skills. Increase competition – governments make it illegal for businesses to run monopolies. This helps ensure there is competition. Ms Sarah International Trade The level of development of a country affects its imports and exports. Imports – what a country buys from abroad Exports – what a country sells abroad Average incomes in high income countries are tens of times higher than low income countries. This helps explain why high income countries (UK, USA etc.) spend more on imports. E.g. in the UK they buy clothes made in China, toys made in India, take holidays abroad, buy foreign cars etc. …. For the UK, European and American businesses this also means that they are more likely to sell goods to developed countries with higher incomes. Wages and Prices – UK, European and American businesses and consumers can take advantage of low wages paid to workers in developing countries. Companies like Primark and Topshop can then offer very low prices. Therefore developing countries are a source of cheap imports. Quality and Technology - Price is one factor that influences a consumer’s decision to buy. The quality and level of technology of the product is important too. Many products made in developing countries are poor quality and have little technology. This means that often consumers in richer countries choose not to buy them. In comparison developing countries tend to buy high quality, high technology products from developed countries. Import Protection and Export Subsidy – Nearly every country in the world operates protectionist policies. These are measures designed to reduce the amount of imports coming into a country. 4. Import Protection – These are measures designed to reduce imports. They are usually taxes that which are put on goods that are imported into a country which will make them more expensive for buyers to discourage them from buying abroad. The main types are: a. Tariffs – a tax on an imported good. b. Custom Duties – a physical limit to the amount of a product that can be brought into the country 5. Export Subsidies - These are measures that reduce the price of goods sold abroad. This will then hopefully make a country’s exports more price competitive. Export subsidies can include: reduction in tax, grants and subsidies. Ms Sarah E-commerce E-commerce is short for ‘electronic commerce’. Using E-commerce gives businesses access to customers all over the word. This is known as ‘The global market’ which is reached by means of a website. Advantages of E-Commerce to Businesses Access to the global market means the business will be better known A business using e-commerce can get ahead of its rivals Increased sales, leading to increased profit Savings on expensive showrooms Reduced advertising costs Increased sales leads to ‘economies of scale’ Business is open 24/7 Advantages of E-Commerce to Consumers Customers have a huge range of goods to choose from They can ‘shop around’ the ‘web’ for the best bargain Internet prices are often lower than in shops Customers can shop from the comfort of their own home ’24/7’ Disadvantages of E-Commerce to Businesses Disadvantages of E-Commerce to Consumers Being part of the global market means the business is in competition with lots of others Designing and keeping the website up-to-date is expensive and requires specialists Market research needs to be very detailed to meet the needs of customers in such a wide market Packing and distribution of products can be very costly and involve long distances Not all the businesses target customers have access to the internet. Customers need to own or have access to a computer and be on-line and know how to use the Internet. It is not easy to assess the quality and suitability of many products on the screen. Inconvenience of returning unwanted goods. Customers usually have to have a credit card to make Internet purchases Security risks of buying on-line Ms Sarah 1. 2. 3. 4. 5. 6. 7. 8. 9. Explain three government objectives (6) Explain two disadvantages to a country’s economy arising from rapid inflation (4) Define economic growth (2) Define GDP (2) Draw a labeled diagram of the trade cycle (6) Explain the difference between a boom and a recession (4) What does a ‘deficit’ on the balance of payments mean? (2) Explain the difference between indirect and direct taxes (4) How would the government’s decision to lower interest rates affect the demand for luxury foreign holidays? (2) Case Study – Ownership Two managers are comparing details about their businesses. Firm A produces DVD players. Many of these are exported. The business has expanded recently has borrowed large sums of money from banks. Firm B produces flour for bakeries. It buys it wheat from other countries. Both managers are discussing the following recent changes in government policy: Increased interest rates Higher tariffs on imports Raised income taxes 1. Which business do you think will be more affected by these changes? Explain your answer (12) Ms Sarah Costs, Revenues and Profit Sales Revenues (sometimes called sales turnover) Costs Profit The amount of money made from selling goods before costs. The bills and debts the business has to pay. The money the business makes from selling goods after all the costs have Fixed Costs – these are the costs that stay the same no matter how much you make or sell. They must be paid. E.g. Rent, salaries etc. … Variable Costs – these are the costs that vary depending on how much you make or sell. E.g. Materials and supplies i. Total Revenue – This is calculated using the following formula: Price x Quantity ii. Costs – there are 3 types of costs: a. Fixed Costs – These are the costs that stay the same no matter how much you make or sell. E.g. rent, salaries, business rates. They still have to be paid even if the business makes no money b. Variable Costs – These are the costs that change according to how much you make/sell. E.g. materials, production costs. Variable costs are calculated using the following formula: Total Variable Costs = Variable Cost x Quantity c. Total Costs – this is the fixed and variable costs added together. You can’t work this out until you know both the fixed and variable costs. It is calculated by using the following formula. Total Costs = Fixed Costs + Variable Costs (Variable Cost x Quantity) iii. Profit - Profit is the difference between your revenue and your costs, whatever you have left is your profit. It is calculated using the following formal: Profit = Total revenue – Total costs Ms Sarah Case Study Ben the Barber’ has decided to set up in a small shop in a mobile unit on a empty piece of land near the Sheik Zayed Road as barber. He plans to offer barber services to people on their way to work. Having been a hairdresser in a conventional shop he found the costs were getting larger and larger and he was struggling to cope. He therefore decided to run a mobile shop to reduce his costs and increase his revenue and hopefully his profit. Ben has worked out that he will have a number of costs. The costs that he will have to pay each month include: heating and lighting, business insurance and the wages of one member of staff. He estimates that these costs will equal 50,000dhs a year. He will also have costs that related to the amount of customers he sees. These include shampoo and material costs. He estimates that these will be about 5dhs per customer. Ben has worked out that over the year he will see 4,000 customers a year working 5 days a week. He also estimates that on average each customer will pay around 20dhs . Questions 1. Explain what a fixed cost is. (2) 2. List Ben’s fixed costs. (3) 3. Explain what a variable cost is. (2) 4. List Ben’s variable costs. (2) 5. How many customers does Ben think he will see in a year? (1) 6. What is the average price that will be paid by customers? (1) 7. What will be Ben’s total revenue for the year? Show your working. (3) 8. Ben has worked out that his fixed costs will be around 50,000dhs a year and that his variable costs will be 5dhs per customer. Work out Ben’s total costs. Show your working. (3) 9. How much profit will Ben make over the year serving 4,000 customers a year? Show your working (3) 10. Would Ben still make a profit if he only served 2,000 customers in a year? Show your working (12) Ms Sarah Sources of Finance Leasing External Short term Government Grants Mortgage External Long term External Long term Loan External Long term Venture Capital Share capital External Long term External Long term If a business needs equipment but can’t afford to buy it outright they can rent it. The good thing about this source is that if the item breaks then the rental company pays for it not the business. Some new businesses can get start up grants from organisations. These are often available in areas with high unemployment rates. This is a long term loan that is used to buy property. It is paid back with interest. If is not paid the property will be repossessed. This is money that is borrowed from a bank or other financial organisation to start a business or buy an expensive item. It is paid back with interest. This is an individual or a company that invests in a small to medium sized business that is growing fast in the hope that they will eventually be able to sell their part in the business and make a profit. The dragons in the Dragons Den could be described as ‘venture capitalists’. This is when investors can buy a % of the company. This means they take part ownership of the company. The higher % you have the more ownership rights you have. If the business makes a profit the ‘shareholders’ get rewarded with a dividend. This method can only be used by limited companies. Retained Profit Internal This is money that the business saves from profit they have made. It is the cheapest source of finance to use as it belongs to them and they don’t have to pay it back. Factoring External This is a source of finance where a business is able to receive cash immediately for invoices it is waiting for customers to pay. There is a charge for this and the business will have to pay the amount back in 30 days. It is not suitable for all businesses. Short term Overdraft External Short term This involves borrowing money from a bank by taking more money than is actually in the bank account. Interest is charged on the amount and this can be extremely high. Ms Sarah Trade Credit External Short term Sale of Assets Internal Short term When ordering supplies a business may be able to delay payment to the supplier. Normally 30 days is given to pay the bill. This is good for businesses that need supplies to complete the job but don’t get paid till the job is completed. For example a builder or a plumber. This is when a business sells assets and equipment it owns that it doesn’t need or want anymore. When deciding on which source of finance to use an enterprise should consider the following factors: Cost – borrowing money means the business is in debt. It also means they will not only have to pay the amount they have borrowed back but usually the interest as well. Interest is the extra charged when you borrow money. Interest increases the costs and some sources of finance have more interest than others. For example overdrafts usually charge interest on a daily basis making them very expensive if you use them for a long time. Risk – the more money you borrow the higher the risk. For example if you take out a mortgage and can’t pay it back the company that lent you the money will reposes (take away) the property. Availability – not only sources of finance are available to all types of business. For example only limited companies can sell shares and use factoring. Smaller businesses like sole traders and partnerships usually find it much harder to raise finance. Time (short –long) – the amount of time you need the money will also affect the source of finance you need. For example if you only need money for a short period of time to buy some stock then you might use trade credit, whereas if your require a large sum of money to buy an expensive piece of machinery you may need to take out a loan which you can pay back over a longer period of time. Key finance words Credit The ability to obtain goods or services before payment, based on the trust that payment will be made in the future. Creditor A person or company to whom money is owed. Debt Money that is owed. Debtors A person or institution that owes a sum of money. Ms Sarah Investment vs. Saving In finance, investment is putting money into something with the expectation of gaining more back. Most or all forms of investment involve some form of risk. Saving is income not spent. Methods of saving include putting money aside for example in a bank account. It is low risk compared to investment. Saving Investment Advantages Don’t owe any one any money. Less risk. Money will be available for other projects. Could make a lot of money. Could lead to greater success. Disadvantages No gain – your savings stay the same. You can’t run an enterprise if you don’t invest. High risk. Could lose investment and more (especially if there is unlimited liability). You won’t be able to use the money for anything else. Budgets A budget is a plan to show how much money a business will earn and how much they will need or be able to spend. As budgets also set limits for the business, it could set new goals and targets for the business department. As it is a limit, it could also be used to limit business activity which would increase your control of the business and make it easier for you to control the business. Making budgets and making the future plans will include all employees and managers which means that the employees would feel more confident to be involved in such a process which involves the future of a business, and therefore it increases their motivation making them more productive. As budgets are a limit, and a business tries its best to gain profit as it is its main aim, the business will try to not waste money and use it as efficiently as possible, and so we have achieved a more efficient business. The key words used in a budget are: Income/Revenue This is how much money comes into the enterprise. Expenditure/Spending This is how much money the enterprise has to spend. Direct Costs Direct cost is the cost that used to produce a good. E.g. material and labour costs. Ms Sarah Indirect Costs Indirect costs are the cost that not directly related in production of the good. E.g. sales and marketing costs. Overheads In business, overheads refer to an ongoing expense of operating a business; it is also known as an "operating expense". Examples include rent, gas, electricity, and wages. Fixed Costs These are costs that the business has to pay each month/year that will never change depending on how much they make or sell. Profit The money a business has after it has paid all its costs. Surplus The amount left over. Loss If a business spends more than it makes then it will make a loss. Deficit When the business doesn’t have enough money to pay all its expenses and costs. Cash Flow Cash is vital to success. In business cash is – money in the business and money in the bank. A business needs cash to survive on a day-2-day basis. This is because cash is needed to pay bills. If all the cash is tied up in ‘assets’ then it will struggle to pay its expenses. Cash flow = money coming in and out of the business. Ms Sarah A cash flow forecast/statement has the following information: Net cash flow = Receipts (INFLOWS) – Outgoings (OUTFLOWS) Closing bank balance = Net cash flow + Opening bank balance Opening balance = is always the previous months closing balance Example of a cash flow forecast/statement (as part of your revision can you fill in the blanks?): A Negative net cash flow means the business has lost money and a negative bank balance means the business is in debt. Ms Sarah Gross Profit is Sales Revenue – Cost of Sales Profit and Loss £ Less Less £ Sales Revenue 830000 Cost of sales 417000 GROSS PROFIT 413000 This part is called the trading account. Expenses Wages and salaries 145000 Rent and Rates 50000 Heat and Lighting 25000 Telephone and Post 12000 Advertising 15000 Insurance 23000 Other Bills 35000 This part is called the profit and loss account. 305000 NET PROFIT 108000 Government 30000 Dividends 50000 Retained Profit 28000 This part is called the appropriation account. 108000 Net Profit is: 1. Keeping Records Gross Profit – Total Expenses These two figures should be equal (net profit = total amount in the appropriation Ms Sarah account). What is a profit and loss account? It summarises: a. All the sales revenue for the financial year. b. All the payments and expenses for the same year. It also shows whether the business has made a profit or a loss in that year. The profit and loss account is made up of three parts: Trading account – this is the direct costs of making the product and the money made from selling the product. Profit and loss – this looks at all the costs the business has and if they have made a P/L. Appropriation Account – this shows what the business will do with any profit it has made Part 1 – The Trading Account The first part of the profit and loss account is the trading account. This is record of sales turnover and the cost of sales. It looks at the businesses gross profit Ms Sarah Part 2 – The Profit and Loss Account Part 3 – The Appropriation Account Corporation Tax Public and private limited companies have to pay corporation tax on their net profit. Income Tax Sole traders and partnerships have to pay income tax on their net profit. Ms Sarah Balance Sheets As part of your revision can you complete the balance sheet? Ms Sarah Ms Sarah Ms Sarah Ratios Performance Ratios – these ratios are used to measure how well a business has performed during a financial year. 1. Return on Capital Employed (%) - This ratio is used to prove the value the business gains from its assets and liabilities. The higher the % the more successful the business is. = Operating profit Capital Employed X100 2. Gross Profit Margin (%) – A measure of how well a company controls its costs. The higher the % the more the business has made (before costs). This could be because it has low costs or it is charging customers more. = Gross profit Sales turnover X100 3. Net Profit Margin – This shows how profitable the business has been. The higher the % the more successful the business is. = Net Profit before tax Sales turnover X100 Important Note The reason we times are answer by 100 is that we need to make the answer into a %. Liquidly Ratios – these ratios tell s 1. Current Ratio – The current ratio is a financial ratio that measures whether or not a firm has enough resources to pay its debts. It looks at the ratio of assets to liabilities. If the ratio shows they have more liabilities it means they would struggle to pay their debts. A figure below one means the business does not have enough current assets to pay off its debt. A figure between 1 and 1.5 means they have just enough current assets to pay off their debts and a figure above 1.5 means the business has enough current assets to pay off its debts. = Current assets Current liabilities 2. Acid Test Ratio – This ratio works the same as ‘current ratio’ except it looks at the businesses ‘cash’ only. = Current assets – stocks Current liabilities Ms Sarah Keeping Financial Records Record keeping: Good for your business Keeping records makes sound business sense. It may seem like a challenge, particularly when you're starting out, but keeping good records will bring real advantages to your business. Keeping good records a. b. c. d. e. helps you avoid paying too much tax avoids interest and penalties by making it easier to pay the right tax at the right time gives you the information you need to manage your business and help it grow makes it easier to get a loan helps you budget for tax payments Record keeping in three simple steps There are three steps to remember: 1. Set up a system It doesn't matter whether you use a special account book or a software package as long as you set up some kind of system to keep the information together. 2. Keep records throughout the year Keeping only some of your records is almost as bad as keeping none at all. Update your records regularly, rather than letting the paperwork pile up. 3. Keep your records for as long as required There are minimum periods for which you must keep records, e.g. six years for VAT or five years from the latest date for filing your Why do you have to keep records? The law says that everyone who pays tax must keep the records they need to fill in a tax return. If you don't keep records, how can you show what you've earned and what you've spent? The tax man might decide to look into your tax returns or claims. If they do, they may want to look at your records. It will save you time if you can show that the records you have kept are full and accurate. It can also save you money – we can issue fines if records are not kept properly. What happens if I don't keep proper records? You don’t want to pay too tax. However, if you can't show sufficient evidence of your income and outgoings, you could end up paying more tax than you should. Ms Sarah 1. State two reasons why managers need financial information about their business. (2) 2. Explain the difference between gross and net profit. (4) 3. What does an appropriation account on the profit and loss account show? (2) 4. Explain what a balance sheet tells a business. (2) 5. Distinguish between business assets and business liabilities. (4) 6. What is meant by capital employed? (2) 7. What does return on capital employed of 20% mean? (2) 8. Why would a current ratio of 0.75 be considered too low? (2) Case Study Use performance rations to analyse these accounting results for P&K Ltd which is a building firm. (All in $000’s). Has their financial position improved from 2011 to 2012? (12) Gross Profit Expenses Capital Employed Sales Turnover 2011 ($000’s) 15 6 70 100 2012 ($000’s) 16 9 80 120 Calculate the acid test ratio for both 2011 and 2012. (All in $000’s). (6) Current liabilities Stocks Debtors Cash 2011 ($000’s) 15 3 12 5 2012 ($000’s) 18 4 8 4 Ms Sarah Hierarchy – This is when businesses are organised according to authority. The person with the most authority is at the top of the organisation. The flatter the structure the less layers of employees there are. Removing layers is called ‘delayering’. Hierarchy Flat Structure Chain of command – this is the order in which information is passed down the organisation. Usually it is from top to bottom. a. Long chain of command – this means there is lots of layers/people that information has to pass through (this means messages may get lost) b. Short chain of command – this means there is only a few layers/people that the information has to get passed through. Chain of Command Problems of a long chain of command Disagreements may occur Information get altered/lost Information misunderstood Information slow to be passed down Hard to take information back once it’s in the organisation Benefits of a short chain of command The opposite of the problems of having a long chain Span of control – this is the number of people an employee is responsible for. a. Wide span of control – this means you are responsible for managing a lot of people. b. Narrow span of control – this means you are responsible for managing only a small group of people Problems of a wide span of control Span of Control People might not understand what they have to do People may feel that the boss doesn’t value them or know who they are It can be difficult to manage and be responsible for lots of people Benefits of a small span of control The opposite of the problems of having a wide span of control Ms Sarah Types of Structure Centralised – most decisions are taken at the centre of the business with little delegation. Decentralised – decisions are not made at the centre of the business and are delegated to smaller parts of the business. Ms Sarah 1. What is meant by organisational structure? (2) 2. What is the chain of command(2) 3. Explain what is meant by the term span of control. (2) 4. Explain two disadvantages of a wide span of control (4) 5. Explain what is meant by organisation by function. (2) 6. What is the difference between a decentralised and a centralized organisation? (4) 7. Explain two advantages of using a decentralised structure. (4) Case Study Within an organisation there are many different roles that staff will undertake. These include a. The Managing director - The Managing Director is the figurehead of the organisation. Managers have the job of organising and controlling resources. Their work is often described as 'getting things done with or through people'. They are likely to have overall control over everyone working at the organisation. b. Senior managers - Senior Managers make top level decisions concerning where an organisation operates and what it makes or does. These decisions require detailed analysis and skilled judgment. They are managed by the directors but they manage all the other staff like the middle and junior managers and the supervisors and operatives. c. Middle managers - Middle Managers organise and control the resource of an organisation within established guidelines. They are often managed by senior managers who pass on information to them from the directors. They will in turn manage a team made up of the junior managers, supervisors and operatives. d. Supervisors - Supervisors are quite often the backbone of the organisation. They are people who know how things should be done at 'ground level'. They work with managers to put plans into action at operational level. They manage day-to-day resources including the supervision of staff. They will be given instructions from the managers in the organisation. e. Operatives - Operatives are at the ground level but their work is still very important. It needs to be carried out with care and precision. In a supermarket the operatives will include the shelf stackers, and checkout operatives. They will be told about their role from supervisors and managers. It is likely that they will not be responsible for anyone in the organisation. Choose three of the roles listed above and answer the following questions: (12) 1. What are the main jobs associated with this role? 2. Who is in charge of them? 3. How important is their role in the organisation. Ms Sarah The Message Communication is the passing on of ideas and information. In business we need good, clear communication. The contact may be between people, organisations or places and can be in a number of forms such as speech, writing, actions and gestures. Organisations need to be structured in such a way as to maximise the benefits of communication processes. This is why team structures are so useful because they open up a multi-flow channel of communications. Noise Noise Noise Noise Receiver Sender Message Receiver Feedback Receiver Noise = This is anything that would stop the message being received. For example: a broken phone, a lost letter, a bad internet connection etc. These are sometimes referred to as ‘barriers to communication’. Barriers to communication can include: Poor explanation Receiver not understanding the message Messages getting distorted Equipment breaking Not enough information Too much information Ms Sarah Types of Communication Verbal Non-Verbal This is spoken communication. This involves things like body language or sign language. Written Visual This is written communication like a letter. This can include graphs, drawings charts, signs and symbols. Verbal communication Written communication Visual communication Advantages Information is given quickly Feedback may be given quickly Body language and tone can reinforce the message. Disadvantages How do you know if people are listening There may be no record of what is said There will be a record Lots of detail can be listed and revisited It can be copied and sent to many people It can be cheap – e.g. emails are cheap to send. Appealing and attractive and can persuade people to act Direct feedback is not always possible There can be misunderstandings with language There is no opportunity for things body language. No feedback unless use written or verbal as well It can help make written communications more interesting Graphs and charts sometimes people don’t understand them Internal communication – communication between people within the business (e.g. a manager and their team). External communication – communication by the business with someone outside the business (e.g. the finance department and a supplier). Formal communication – communication that is professional and through channels that are recognised by the organisation. Informal communication – this involves other forms of interactions between organisational members that are not recognised by the organisation. Ms Sarah Methods of Communication Letters Face-2Face Email/Text Methods of Communication Fax Phone The Direction of Communication a. Horizontal communication – this is communication between employees who work at the same level in an organisation. E.g. two members of the same department talking about their work. b. Vertical communication – this is communication between employees at different levels in an organisation. E.g. a manager outlining what he wants his team to do. Ms Sarah c. Communication on the grape-vine – communication on the grapevine is ‘gossip’. This is usually not related to work. Organisations try to discourage this type of communication. The importance of good communication Good communication is essential to any enterprise. Below are some reasons why it is so important: a. Customers – poor communication leads to problems with the quality of products provided to customers. Customers who are left dissatisfied may not use the organisation again, therefore communication between the enterprise and the customers has to be carefully planned and correct. b. Suppliers – poor communication will suppliers can lead to the wrong goods being brought and delivered. This is wasteful and can lead to problems with production. c. Staff – poor internal communication leads to misunderstandings amongst staff. This leads to problems with the quality of work and also can lead to mistakes being made. Workers therefore become less efficient. d. Motivation – poor communication often leads to demotivated staff. For example workers become frustrated and demotivated if they do not understand what they have to do. They become demotivated if they know the quality of their work is poor. I there were better communications workers would be likely to feel more motivated. Ms Sarah 1. Outline the four features necessary for communication to be effective (4) 2. Explain the difference between internal and external communication (4) 3. List two methods that can be used for written communication (2) 4. Which method of communication would you use if you wanted to: (4) i. Give an instruction to a large number of people. ii. Explain a detailed plan to a few other people. iii. Obtain a very quick reply to your message to another member of staff. iv. Inform all staff about health and safety regulations. 5. In each of the cases in question 4, briefly explain the reasons for your choice (8) Case Study Internal communications in your organisation are very poor. Messages are either not being received or not being acted upon. As manager of communications you have been asked to write a report to the Chief Executive. He wants you in your report to answer some key questions. 1. Define barriers to communication (2) 2. Outline 2 barriers to communication that could exist in an organisation (4) 3. Give advice on how you could remove barriers to communication for the business. (6) Ms Sarah Exchange Rates An exchange rate is the price of buying a foreign currency. It tells you how much of the foreign currency you will get for every dh you spend or how many dh you will get if you use a foreign currency. What are imports and exports? Imports = this is the purchase of a good or service from a foreign business. Exports = this is the sale of a good or service to a foreign business or customer. How do we calculate exchange rates? What is the impact of exchange rates on businesses? 2. A fall (depreciation) in the value of the dh - The positives A fall in the value of the dirham is good news for some UAE Businesses. A firm exporting goods will get more foreign customers as their goods will become cheaper. Foreign goods become more expensive as well which means that businesses in the UAE who are competing against foreign businesses will see their goods become cheaper and more competitive. 3. A fall (depreciation) in the value of the dh - the negatives A fall in the value of the dirham can be bad news for some UAE Businesses though. Businesses that use or sell foreign goods will see the cost of them increase. This may means they have to increase the cost of their products or get less profit. 4. An increase (appreciation) in the value of the dh - the positives An increase in the value of the dirham can be good news for some UAE Businesses. Businesses that buy goods from other countries will find them cheaper as they will get more foreign currency for their dirhams. Ms Sarah 5. An increase (appreciation) in the value of the dh - the negatives An increase in the value of the dirham can be bad news for some UAE Businesses though. If they sell goods to other countries then they may find that their goods become more expensive and foreign customers don’t want to buy them. This could mean that they lose profit and customers. Growth of multi-nationals Advantages Jobs will be created which reduces unemployment New investment in buildings and machinery Increases output in the country Can increase exports as some of the goods made by the multi-national may be sold in other countries They pay taxes to the government Disadvantages Often the jobs created are unskilled jobs Local firms may be forced out of business Profits are often sent back to the multinationals home country They use up scarce resources and nonrenewable resources Ms Sarah 1. What is meant by the term exchange rate? (2) 2. Explain the difference between currency appreciation and currency depreciation. (4) 3. How will a currency appreciating affect a firm exporting its goods to other countries? (2) 4. How will a currency depreciating affect a firm importing goods from other countries (2) 5. Explain two reasons why a businesses want to become multi-nationals? (4) 6. Discuss three possible effects on a country of a multinational fast food company setting up in its country. (6) Case Study Should we allow the XYZ Corporation to set up a factory in an overseas country? About the business – The XYZ Corporation is applying for planning permission to build a factory in an overseas country. The factory is expected to be very profitable. One thousand new unskilled jobs will be created for factory workers. Many of the goods made could be sold abroad. Some of the supplies for the factory will come from your country. About your country – In the overseas country unemployment is high, especially amongst skilled workers. The government cannot afford any new building projects. There are several local competitors producing goods similar to XYZ. Import levels are very high. Land for new buildings is very limited. New developments would have to be built in beautiful countryside. 1. List three groups in the overseas country who would benefit from allowing the XYZ Corporation to build the factory. Explain your answers. (6) 2. List three groups in the overseas country who may lose from the building of the factory. Explain your answers. (6) 3. Would you advise the government of the overseas country to allow a new factory to be built? Explain your answer by using your knowledge and evaluating all of the evidence. (8) Ms Sarah Remember there are 2 papers that you will need to complete: Time: 1hr 45minutes Short answer questions and structured/data response questions based on short questions The paper is worth 100 marks and this is split over 5 questions with each question being worth 20 marks in total. Each question will have x2 2mark qs, x1 4mark qs, x2 6mark 1qs A grade candidate Knowledge and understanding An excellent ability to identify detailed facts, conventions and techniques in relation to the content of the syllabus; A thorough ability to define the concepts and ideas of the syllabus. Application A thorough ability to apply knowledge and understanding, using terms, concepts, theories and methods effectively to address business problems and issues; A sound ability to form conclusions from this information and to demonstrate these conclusions clearly and logically. Analysis An excellent ability to classify and comment on information presented in various forms; An excellent ability to distinguish between evidence and opinion. Evaluation A sound ability to make clear, reasoned judgments and communicate them in an accurate and logical manner. Time: 1 hour 45 minutes Based on an unseen case study – this means all the questions will relate back to the business in the case study. The paper in total is worth 100 marks – this is split over 5 questions with each question being worth 20 marks in total. Each question has two parts – part a is worth 8 marks and part b is worth 12 marks. You should spend around 20 minutes on each question (a and b) – this leaves 5 minutes reading time if the case study at the start (though make sure you do go back to it throughout the exam. C grade candidate Knowledge and understanding A sound ability to identify detailed facts, conventions and techniques in relation to the content of the syllabus; A sound ability to define the concepts and ideas of the syllabus. Application An ability to apply knowledge and understanding, using terms, concepts, theories and methods appropriately to address problems and issues; An ability to draw conclusions, and to present these in a clear manner. Analysis A good ability to use and comment on information presented in various forms; A sound ability to distinguish between evidence and opinion. Evaluation An ability to evaluate and make reasoned judgments. F grade candidate Knowledge and understanding some ability to identify specific facts, conventions or techniques in relation to the content of the syllabus; Some familiarity with definitions of the central concepts and ideas of the syllabus. Application A rudimentary ability to apply knowledge and understanding, using terms, concepts, theories and methods appropriately to address problems and issues. Analysis Some ability to classify and present data in a simple way and some ability to select relevant information from a set of data; Some ability to distinguish between evidence and opinion. Evaluation A limited ability to understand implications and make recommendations. Ms Sarah Ms Sarah