Lean Thinking

advertisement

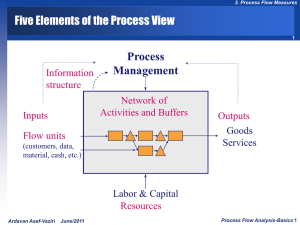

Systems Thinking and the Theory of Constraints Complex solutions do not work, the more complex the problem the simpler the solution must be. Eli Goldratt. The Read Cost of Inventory Inventory adversely affects all competing edges (P/Q/V/D) Has cost Physical carrying costs Financial costs Cause obsolescence Due to market changes Due to technology changes Leads to poor quality Feed back loop is long Hides problems Unreliable suppliers, too much scrap, large changeover times, machine breakdowns. long flow time Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 2 Theory of Constraints (TOC) Lean evolved from the collective effort of a number of individuals. TOC owes its origin to Eli Goldratt, an Israeli physicist. The basic idea originated in 70s and was published in The Goal (1984). Like the links of a chain working together to lift objects, the processes within a supply chain work together to generate profit. The ability of the chain is limited by the strength of its weakest link. The goal of an enterprise is to make more money, now and in the future. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 3 Bottleneck Resources Every system of interdependent processes has one or, at most few bottlenecks that limits system performance. If you can focus on maximizing the productive use of the bottleneck and schedule it accordingly, then you will maximize your productive output. The other resources can be schedule subsequently since they have available capacity by definition. Any loss of output at the bottleneck resource(s) results in a loss of revenue for the enterprise. Any local optimization to improve the performance of other resources does not increase the throughput. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 4 Systems Thinking LEAN SUPPLY CHAIN PRINCIPLE 10 Time lost at a bottleneck resource results in a loss of productivity for the entire supply chain. Time saved at a non-bottleneck resource is a mirage. Integrated decision making “Big Picture” Thinking Thinking “Globally” rather than “Locally” Understanding how localized decision making can affect the overall goal Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 5 Traditional Decision Making In practice, it is harder for managers to see the forest for the trees because of the traditional management metrics they have to work with How are investment decisions usually made? Usually based on cost considerations (right)? “The Cost-World” Perspective Consider how the cost-world perspective affects the push towards parts per million (PPM) quality and “Zero” inventory Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 6 The Cost World Perspective: Cost and PPM Quality Reducing Scrap From To Annual Cost Savings Annual Investment The Cost Needed Judgment 8% 2% $60,000 2% 0.5% $15,000 $20,000 Do It! $20,000 Indifferent $20,000 Do NOT Do 0.5% 0.1% $4,000 Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 7 Is 99.9% Quality Good Enough For You? Doctors in New York State hospitals dropI’ll do better next time! 288 babies per year Post Offices in New York State lose 61,626 pieces of mail per day Chicago O’Hare International Airport has 1,264 unsafe arrivals / departures per year Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 No problem. Everything is OK! 8 Local Optimization Traditional management addresses the problem of optimizing system performance by breaking down the system into smaller pieces. Cost or profit centers achieve/beat targets; if every unit improved locally then the entire enterprise would improve globally. The lack of a systems perspective leads to performance metrics, policies, procedures, organizational structure and functions that promote local rather than global optimization. To improve overall system performance, it is not enough to promote isolated efforts that focus on improving specific functions. Such an approach ignores the interactions between the various functions. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 9 Throughput World An increase in the cost of an engine of $30 would have decreased the cost of the transmission by $80. The center producing the engine was reluctant to do so because it adversely affected that center's profits. The traditional management is based on a cost world perspective; minimizing costs and improving operational efficiencies. TOC presents a set of simple, global measures to achieve enterprise goal of making more money goal. Throughput world perspective; an approach that focuses on meeting the goal through a growth strategy rather than just through cutting costs. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 10 Standard Cost Accounting TOC provides two groups of techniques: a Five-Step Focusing Process and a more generic problem solving approach referred to as the Thinking Process. How managers decide Sales dept to accept a new customer order? Operations dept what products to schedule and what batch size to run? Controller to approve purchase of new equipment? Based on a standard set of guidelines and operating procedures Standard cost accounting system. Products costs have three components: direct labor, direct material, and overhead costs. Overhead costs are difficult to trace to specific products. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 11 Standard Cost Accounting The rise of the US industry coincided with the rise of cost accounting as the primary decision-making tool. Allocating overhead costs to determine product cost was not a major problem because they were relatively low and typically only a few products were produced. The cost world directs the manager to think locally. The throughput world forces the manager to think globally. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 12 National Pontoons, Inc. Assumptions: Only 1 product – (Black Vinyl Steering Wheels) Raw materials cost $10/unit – (Blanks) Uses two resources to machine and fabricate the product – (Resource A & Resource B) 6 minutes processing at Resource A 9 minutes processing at Resource B Run’s 2 shifts 10 hours long, 25 days each month Employs 4 direct laborers across the 2 shifts Therefore: Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 13 National Pontoons Data Processing time at resource A = 0.1 hour/unit Processing time at resource B = 0.15 hour/unit Direct Labor 10 hours per day, 25 days per month, $10 per hour = $2500 per month per worker, 4 workers $10,000 per month, $120,000 per year. The manufacturing overhead costs were $225,000 Selling, General and Administrative costs were $200,000 Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 14 Direct Labor Costs Direct labor costs at Resource A; 10(0.1) = $1.0/ unit Direct Labor costs at Resource B; 10(0.15) = $1.50/ unit Total Direct Labor Costs = $2.50 Average Demand = 48,000 steering wheels Demand (year 2003) = 30,000 steering wheels Direct Labor Costs = 30,000(2.50) = $75,000 Actual Labor Costs = $120,000 Direct labor is a Fixed Cost (FC) because it does not rise or fall with production like the raw material cost which is variable cost (VC). Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 15 Labor Efficiency Variance, Overhead Rates The difference between actual wages paid and the overhead labor attached to the units produced $120,000 - $75,000 = $45,000 That means $45,000 of direct labor was not accounted for in product costs Overhead Rate in terms of direct labor hours or costs 225,000/75,000 = $3.00 per each dollar of direct labor 3.00(2.50) = $7.50 per unit The finished product cost is $10 (direct material) + $2.50 (direct labor) + $7.50 (overhead) = $20.00 Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 16 Valuing Inventory Costs Cost Category Cost per Unit Raw Material $10.00 Direct Labor Cost at Resource A $1.00 Manufacturing Overhead allocation at Resource A $3.00 Direct Labor Cost at Resource B $1.50 Manufacturing Overhead allocation at Resource B $4.50 Total Cost $20.00 The raw material in front of resource A; $10.0/unit. WIP between the two Resources; $14.0 (10+1+3). The finished goods inventory is valued at 14+6 (1.5+ 4.5) = $20! Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 17 Standard Cost Accounting SCA allocates manufacturing-related expenses (depreciation, indirect labor and utilities) proportional to the time at the individual resources. SG&A are also allocated based on product costs. Absorbing costing and variance reports lead to behavior that runs counter to enterprise goals. Ex. Since every item processed on a resource increases the value of the product, shop supervisor pushes products through the resources as quickly as possible. Products may not be needed downstream. But he/she is measured based on overhead absorption and meeting targets. End-of-the-month syndrome ( hockey-stick effect). Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 18 Standard Cost Accounting Because supervisors are evaluated based on how efficiently they utilize their resources, they are given incentives to create production schedules that operate the individual work centers work at close to 100%. Lead to higher levels of inventory when the output from the work centers is not consistent with the requirements downstream. The local optimization mindset, combined with the cost world idea of adding value to the raw material cost as it progresses to become finished goods inventory can lead to other bizarre outcomes. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 19 Activity Based Costing (ABC) The standard cost accounting uses a simple formula to allocate indirect costs. Ex. the overhead costs are allocated based on direct labor costs. It was fine when labor was the biggest factor in production, and the products were not too different. Standard cost accounting products consume overhead costs. ABC activities consume costs and products consume activities (activities may or may not add value to the product). ABC identifies the specific activities that go into making a specific product and attempts to figure the cost of those activities. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 20 ABC Cost Drivers standard cost accounting driver: direct labor cost. ABC cost drivers: unit-level, batch-level, productlevel, and facility-level cost. Unit-level: activities performed for each product unit. Ex. cost of a tool changeover to continue producing the same product unit after a fixed number of units are produced. Batch-level activities: activities that are performed once for each batch of products, independent of the number of units in a batch. Ex. Wages of production supervisors, machine setup costs not traceable to specific products, and material handling costs. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 21 ABC Cost Drivers Product-level activities: They do not depends on the number of batches. Ex. engineering support costs, and costs of equipment dedicated to a product line. Facility-level costs: Accounting, HR, Administration, Sales, and Plant Maintenance functions. Using different cost drivers to allocate costs reduces the overhead costs that are allocated arbitrarily. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 22 ABS at National Pontoons QC inspects the product at the same level of detail: $63,000/30,000 = $2.10/unit. Unit-level cost; using production volume as the cost driver. Depreciation is also applied at unit level; 12,000/30,000=$0.40/ unit. National Pontoons is promoting its wood-trim wheels. The plant manager: 25% vinyl wheels and 75% wood-trim wheels. Allocation made at the product level. Overhead allocation: 0.25(120,000)/25,000= $1.50 for a vinyl wheel 0.75(120,000)/5,000= $22.50 for a wood-trim wheel. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 23 Standard Cost Accounting vs. ABC Cost Category Raw Material Direct Labor Depreciation MFG OH QC Inspector Plant Manager Product Cost SC Vinyl Wood $10.00 $10.00 $2.50 $2.50 $0.40 $0.40 ABC Vinyl Wood $10.00 $10.00 $2.50 $2.50 $0.40 $0.40 $2.10 $2.10 $5.00 $5.00 $20.00 $20.00 $2.10 $2.10 $1.50 $22.50 $16.50 $37.50 Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 24 Cost Drivers ABC needs additional information. High cost of information gathering. Arbitrary cost drivers. The choice of cost drivers has behavioral implications as well. Purchase department Cost driver # of purchase orders functional units fewer orders larger order size higher cycle inventory opposite of what the enterprise would like to see. Instead, cost driver # of SKUs development of products that utilize common parts positive impact. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 25 Cost Drivers Cost drivers allocate cost or quantify some measure of past performance. Encouraging appropriate behavior is more important than measuring some aspect of past actions. ABC did help provide a way to allocate overhead costs among the products more equitably based on the activities involved, these costs may drive behavior that runs counter to enterprise goals. Ex. ABC made the wood-trim wheels so much more expensive. Yet, this is the product National Pontoons wants to promote: and at this price, the customer is less likely to buy it and may instead settle for the cheaper vinyl wheel or shop elsewhere for a wood-trim wheel. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 26 Summary ABC suffers from arbitrariness with regard to how to allocate. The choice of a cost driver is more difficult when costs are shared by more than one product. No single cost driver can reflect all the relevant activities that take place in the Accounting Department. The problem becomes worse regarding costs that are unrelated to a particular product or a particular customer. Ex. CEO's salary and building and grounds maintenance. Leading one to conclude that, in general, there is no such thing as a true product cost. It is simply a result of a number of arbitrary assumptions. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 27 Summary ABC systems can become difficult and expensive to maintain because the information requirements are significantly large. As we observed from the National Pontoons example, the allocation can sometimes make a product that the enterprise wishes to promote, prohibitively expensive to the customer, making it even harder to sell the product. So, though ABC has its uses in terms of determining where costs are incurred, its use for determining product costs, determining which products are truly profitable, and setting product selling prices become questionable. Theory of Constraints: 1- Cost Accounting Ardavan Asef-Vaziri Jul-09 28