Changes-in-organisational

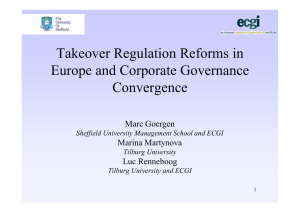

advertisement

BUSS 4: (4.7) Managing Change Organisations operate in a changing environment and change creates opportunities and threats. Candidates should understand how businesses plan for and manage change, and how external and internal change is linked. Specification section Contents Amplification Internal Causes of Change • change in organisational size • new owners/leaders • poor business performance Changes in organisation size may come about due to mergers, takeovers, organic growth and retrenchment. What changes do businesses face? Internal • Change in size • Internal/organic growth • Merger/takeover • retrenchment • Change in owner/leader • Poor business performance Can you give me an example of each of these recently? External • Change in economic environment • Change in political and legal environment • Influence of technology • Competition • Change in the social environment Change in organisational size… Internal (organic) growth External growth Internal change – change in size • Owners of many businesses are content with remaining small, so why do companies want to grow? Change in size – organic growth • Also known as internal growth • What does it mean • Examples include: External growth Sometimes a business will see internal growth as too slow – how else may they grow? Link to pre-release http://www.tutor2u.net/business/blog/royal-mail-goes-for-external-growth-to-help-e-commerce-deliver Types of integration Vertical integration Examples? Examples? External Coming together growth of firms in the same industry but at different stages of the production process Vertical integration Types of integration... Coming together of firms in the same industry but at the same stage of the production Horizontalprocess & in the same market integration Conglomerate integration The coming together of firms operating in unrelated markets Poundland http://www.tutor2u.net/business/ blog/problems-at-poundland Cadbury and Ansoff Ansoff’s Matrix for Cadbury Schweppes takeovers 2000 – 2007 a) Snapple (fruit-based soft, non-fizz drink, US-based) bought for £900 million in 2000 b) Slush Puppie (frozen soft drink) bought for £7.5 million in 2000 c) Dandy chewing gum (main brand Stimerol, Europe-based) bought in 2002 for £200m d) Adams chewing gum (brands: Trident, Dentyne, US-based) bought in 2002 (after Dandy) for £1.5 billion e) Green & Blacks (premium-priced organic chocolate, UK-based) bought in 2005 for £25 million Reasons for external growth • Growth often the overriding factor. Growth without takeover or merger is generally slow • Examples • Synergy • Means working together, the idea that the whole is greater than the sum of the parts • Revenue synergies • Cost synergies Synergy – revenues • Synergies after a takeover/merger can mean increased revenues of the combined group: Deeper learning: Further Enquiry Resources you have: • Historic takeover stories & mini case studies (A02) • Success or failure? (A03, A04) • What step of the process did they trip up on? • Find a recent takeover story? http://www.tutor2u.net/business/t opics/takeover • Top 10 associated keywords? • Make FMOP links? Pre-release link: EBay and PayPal