Lecture 12

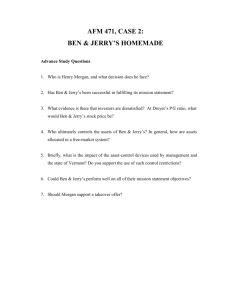

advertisement

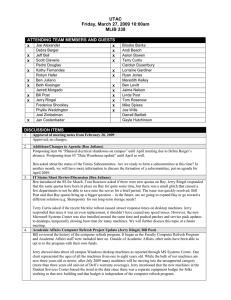

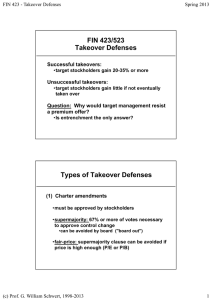

Ben & Jerry’s Homemade • Ben & Jerry’s Case • Student Presentations • Financial Institutions Key Questions • How did Ben & Jerry’s become a target? • What evidence is there that shareholders are dissatisfied with the company’s performance? • Didn’t shareholders know company had other priorities besides profit? • What other stakeholders have an interest in this takeover? ROE Performance Year 1994 1995 1996 1997 1998 1999 ROE -2.6% 7.5 4.7 4.5 6.8 8.9 30 Year T-Bonds 7.9% 6.0 6.6 5.9 5.1 6.5 Common Takeover Defenses Pre-offer • • • • • • • Supermajority Dual class recapitalization Staggered board Poison pill Poison put Golden parachutes Fair-price amendment Common Takeover Defenses Post-offer • • • • • • • Management buyout White knight White squire Greenmail Asset restructuring Liability restructuring Management resignation What is a Fair Value for the Company? • Benchmarks • Comparable firms • Valuations Financial Institutions • Types of institutions – – – – – Banks Insurance companies Pension funds Mutual funds Hedge funds • Payment mechanism • Borrowing and lending • Pooling risk Next Class • Presentation by State Farm Investment Department – Fixed income investing • Review for midterm exam – Exam is Tuesday, March 6, during class