Meeting 10/12/14

advertisement

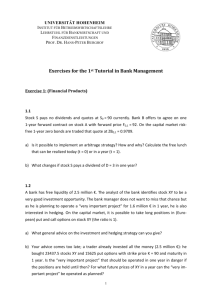

THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION DISCUSSED DURING HAWKTRADE MEETINGS. Past performance does not guarantee future results. Investment returns and principal value will fluctuate, so that investors' shares, when sold, may be worth more or less than their original cost. Investing in any financial instruments does not guarantee that an investor will make money, avoid losing capital, or indicate that the investment is risk-free. There are no absolute guarantees in investing. HAWKTRADE and its members do not bear any responsibility for losses or gains made by members trading on their personal accounts based on analysis from HAWKTRADE meetings. Administrative Info Bonds Bonds Bonds Current Market Events We meet every Sunday at 7:15PM – 8:15PM at W151 in PBB Membership Dues: $25/semester Food/Drinks every meeting Investment information and education Great trading tips and strategies Investment Competition: $15/semester Best way to gain experience and learn Past prizes include iPads, Apple TVs, gift cards Fun Discussion atmosphere, member involvement Roughly 8 members who have an interest in expanding their knowledge of capital markets Responsible for following one economic sector and presenting to the club Great resume experience Will write for the HawkTrade blog on the Motley Fool (www.fool.com) Platform: Wall Street Survivor League: HawkTrade Competition Link: http://www.wallstreetsurvivor.com/league/Ha wkTradeCompetition $15 fee to join Ability to win great prizes!!! League Settings: Start Date: 9/15/2014 End Date: 12/ 05/2014 Portfolio Size: $100,000 Maximum Trade Position: 25% Able to trade derivatives and options If you have any questions, comments, or concerns, contact me: danielmuggee@uiowa.edu Pick a stock. Tweet the stock ticker symbol to @HawktradeUI or email it to studorghawktrade@uiowa.edu. Top 3 gainers on the week win a Chipotle giftcard. http://iowahawktrade.com/ Twitter - @HawktradeUI The Fixed Income Market A debt investment in which an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period of time at a fixed interest rate. Bonds are used by companies, municipalities, states and U.S. and foreign governments to finance a variety of projects and activities. Coupon – the interest rate that an investor receives for lending the principal, quoted annually but often times paid semi-annually Principal – Also know as face value, amount which will be repaid to bondholder at maturity, generally ($1000) Maturity – date at which the principal will be repaid to the bondholder Secured/Unsecured – whether or not the bond is backed by collateral, in the case that the issuer defaults Liquidation Preference – In the case of a bankruptcy, money is returned to debt holders/equity holders in accordance with seniority Taxability – Municipal bonds are tax-exempt Callability – Bond can be called before maturity Credit/Default Risk – the risk associated with the issuer not being able to make interest payments or repay the principal on a bond Prepayment Risk – typically through a call provision, risk of missing out on interest payments through early repayment of principal Interest Rate Risk – the risk of interest rates dramatically changing Three main bond rating agencies: S&P, Moody’s, and Fitch Issuer ratings for Corporations, Municipalities or Governments based on likelihood to default Also issue ratings on specific debt instruments, secured debt typically has higher rating than unsecured Yield to maturity (YTM) is the most commonly cited yield measurement. It measures what the return on a bond is if it is held to maturity and all coupons are reinvested at the YTM rate. Because it is unlikely that coupons will be reinvested at the same rate, an investor's actual return will differ slightly. Coupon Rate > Market Interest Rate Bond is sold at Premium Coupon Rate < Market Interest Rate Bond is sold at Discount Yield Price - Price - Yield A measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Higher duration: longer maturity, lower coupon Lower duration: shorter maturity, higher coupon Corporations – repaid by cash flows, backed by assets US Government – assumed to be risk-free Municipalities – backed by taxing power or project revenue Sovereign Governments – taxing power Significant free cash flow generation Sufficient collateral to insure investment Strong leverage Total Debt/EBITA(R) Strong interest coverage ratios Funds from Operations/Interest Expense Industry metrics, competition, macro factors Technology The technology sector can be broken down into four mega sectors Semiconductors Software Networking and Internet Hardware Stagnant growth over the last six month\ Software and IT grew the fastest PC markets has been struggling 2013 301.8 227.2 CAGR: 2009–13 SOURCE: MARKETLINE 4.4% 4.1% M AR KE TL IN E Figure 1: North America IT service s industry value: $ billion, 2009–13 SOURCE: MARKETLINE M AR KE TL IN E The technology industry is characterized by high premiums High expenditures in research and development Above average of companies that have not reported positive cash flows Investors have done well by investing in product leaders and firms that challenge the status quo Spin-Offs Companies are trimming down and focusing their operations Notably this week are household names: Hewlett-Packard & Co (HPQ) Symantec Corp (SYMC) eBay Inc. (EBAY) New Technologies The smart phone market is saturating, and companies are shifting towards wearable devices 3D printing continues to gain attention, Cloud storage and data security are hot topics CEO Meg Whitman will give in to Street and split HP into two divisions: Corporate computing services PC and printing Comes after experiencing prolonged of stagnant growth Provides security, backup and availability solutions Security: $4.2 billion Information Management: $2.5 billion Tax-free distribution to shareholders Split will come at a cost to employees The IMF World Economic Report & Oil Overall negative tone of the report sent equities tumbling Reported stated that valuations are “frothy” Criticized the banking system, saying that the largest banks could not support financial recovery Called for changes in banking business models Over supply continues to drive oil prices lower. Domestic oil production bodes well for GDP growth, in the short term. Lower oil prices is good for consumers at the pumps. Shows possible signs of economic weakness.