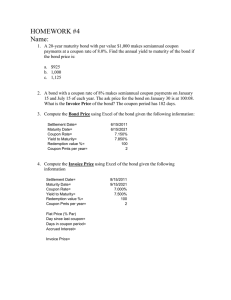

Bond Valuation Tutorial

advertisement

Bond Valuation Tutorial 1a. Show the cash flows for the following four bonds, each of which has a par value of $1,000 and pays interest semi-annually. Bond Coupon Rate(%) Number of Years to Maturity Price W 7 5 $884.20 X 8 7 $948.90 Y 9 4 $967.70 Z 0 10 $456.39 1.b Calculate the Rate of return on these bonds for the present year 𝑹= 𝑪𝒐𝒖𝒑𝒐𝒏 + 𝑪𝒂𝒑𝒊𝒕𝒂𝒍 𝑮𝒂𝒊𝒏 𝑷𝒖𝒓𝒄𝒉𝒂𝒔𝒆 𝑷𝒓𝒊𝒄𝒆 2. What is the cash flow of a 8-year bond that pays coupon interest semi-annually, has a coupon rate of 6%, and has a par value of $100,000? 3. What is the cash flow of a 4-year bond that pays no coupon interest and has a par value of $1,000? 4. Give three reasons why the maturity of a bond is important. 5. Government Gilts are not selling well in Europe, countries like Spain, Italy and Greece are finding it very difficult to sell treasury bonds and are relying on money from the Eurozone. Using the supply and demand theory of Bonds, explain this situation using Graphs. 6. You are a financial consultant. At various times you have heard comments on interest rates from one of your clients. How would you respond to each comment? (a) Respond to: “The yield curve is upward-sloping today. This suggests that the market consensus is that interest rates are expected to increase in the future.” (b) Respond to: “I can’t make any sense out of today’s term structure. For short-term yields (up to three years) the spot rates increase with maturity; for maturities greater than three years but less than eight years, the spot rates decline with maturity; and for maturities greater than eight years the spot rates are virtually the same for each maturity. There is simply no theory that explains a term structure with this shape.”