Bonds - CA Sri Lanka

advertisement

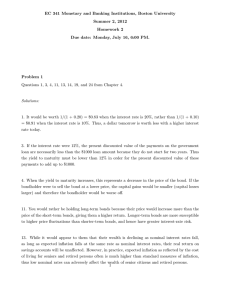

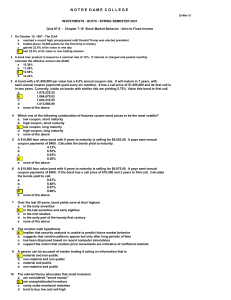

Bonds 1. The yield to maturity of a $1000 bond with a 7% coupon rate, six-monthly coupons, and two years to maturity is 7.6% APR, compounded six-monthly. What is the Bond’s price? 2. The following table summarises prices of various default-free zero coupon bonds. Maturity (years) Price (per $100 face value) 1 $95.51 2 $91.05 3 $86.38 4 $81.65 5 $76.51 a. Calculate the yield to maturity for each bond b. Plot the zero-coupon yield curve (for years 1-5) c. Is the yield curve upward sloping, downward sloping or flat? 3. Consider the following Bonds with annual coupons Bond A B C D Coupon Rate 0% 0% 4% 8% Maturity (years) 15 10 15 10 a. What is the percentage change in the price of each bond if its yield to maturity falls from 6% to 5%? b. Which of the bonds is most sensitive and least sensitive to a 1% drop in interest? Provide an intuitive explanation for your answer 4. The following table summarizes the yields to maturity on several one-year, zero coupon securities. Assume a face value of $100 for each bond Security Treasury Bond AAA Corporate BBB Corporate B Corporate a. b. c. d. Yield 3.1% 3.2% 4.2% 4.9% What is the price of a one-year zero coupon corporate bond with an AAA rating? What is the credit spread on AAA rated corporate bonds? What is the credit spread on B rated corporate bonds? How does the credit spread change with the bond rating? Why?