Sample MIS

advertisement

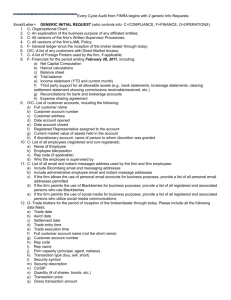

Microcap Security Investigations FIRMA Conference William Sweeney March 28, 2012 Agenda DTCC History Structure Participants Partners Microcap 101 & FINRA Notices Deposit Process and DTCC’s View Investigation Process 314(b) Guidance Questions? 2 DTCC History Structure Participants Partners DTCC Past and Present Wall Street’s “Paperwork Crises” Solution: 1. 2. Immobilization Netting DTCC established in 1999 combines DTC & NSCC DTCC currently operates through 10 subsidiaries 4 DTCC Structure 5 DTCC Participants Banks and Broker Dealers are among DTCC’s Participants Not all banks and brokers access DTCC directly – they go through Clearing brokers Custodians DTC and NSCC Participants must go through a membership process DTCC Risk Management monitors the financial health of its DTC and NSCC members 6 Partners FINRA Guidance on Reg D Offerings FINRA reminds firms of their responsibilities to ensure comply with the federal securities laws and FINRA rules when participating in unregistered resales of restricted securities. These that they responsibilities are particularly important in situations where the surrounding circumstances place the firm on notice that it may be participating in illegal, unregistered such as when a customer physically deposits certificates or transfers in large blocks of securities and the firm does not know the source of the securities. resales of restricted securities, Firms may not rely solely on others, such as clearing firms, transfer agents, or issuers’ counsel, to fulfill these obligations. 9 Section 5 of the 1933 Act "unlawful for any person” to offer or sell a security unless the security is either the subject of a registration statement or exempt from the registration requirement. The term "any person" in Section 5 is defined broadly and easily includes Holders. Holders that wish to resell securities, therefore, may only do so if those securities are the subject of a registration statement or are exempt from the registration requirement.” 10 Microcap Stock 101 Low priced stocks issued by the smallest of companies (limited assets) Lack of publicly available and reliable information Many microcaps trade on the Pinksheets or OTC No minimum listing standards (net assets or shareholders) Any size trade can have a large impact on the price of stock Microcaps pay promoters to tout their stock Disseminate misleading information Officers and promoters own significant amounts of stock (easy to manipulate) 11 Deposit process and DTCC’s view Dematerialization Movement away from printing paper certificates in the first place Registered owners can hold securities on the books of the Issuer/Issuer’s Transfer agent (away from DTC) or, Certain Transfer Agents and certain securities can be created in “book entry” format only, with actual inventory held at the TA, and DTC maintaining a book-entry inventory which is reconciled with the TA Cost efficient Mandated for exchange traded securities Limits DTC’s insight into underlying beneficial owner DTC Deposit Process Types of deposits Receipt of deposits Accounting on DTC’s books Transfer of ownership Receipt of new certificates Asset servicing Participant submits physical (securities) deposits to DTC Participant notifies DTC of incoming book-entry deposits Deposits are imaged to capture certificate details Transfer agent confirms deposits into DTC’s account Participant’s account is credited for the CUSIP and shares deposited Physical securities are shipped to agent for re-registration DTC receives new certificates from agent and stores in Vault Participants request withdrawals and book-entry deliver orders to settle trades. DTC collects principle and income payments and process corporate actions. 14 DTC Transaction Monitoring Process Low-priced securities focus Aggregation of deposit activity and alert generation Alert review and research Related historical activity for each CUSIP DTC focuses on physical and book-entry deposits of low-priced securities made by participants to identify potential suspicious activity DTC aggregates all incoming deposit activity at the end of each month and generate alerts that meet certain rules and criteria for low-priced securities DTC looks up the registration and other issuance information on the certificates from the imaging system DTC creates reports of historical transactional activity for alerted CUSIPs and performs additional research Alert closure or escalation Alerts are resolved and closed or escalated to Investigations for additional due diligence - lookups of issuer officers, registrants, 314(b) with participant, etc. Case conclusion Based on the findings of the investigation, a decision is made to escalate for further investigation 15 DTC’s Insight Into Microcap Share Activity DTCC Specific information 314(b) Information sharing with DTC Participants Deposit volumes (any patterns) Registrants depositing the security Corporate reorganization information (splits/name changes etc.) Continuous Net Settlement (CNS) data Publically available Information SEC Litigation and indictment history Issuer and Principal Information (other companies, prior history, associations, etc.) Gatekeepers (prior infractions, associations, etc.) Trade volatility & price fluctuation Stock promotion and press releases 16 Investigation Process Security and Exchange Act-1933 Enacted after the great depression. Must be registered or exempt from registration. Rule 144(b)- selling Restricted Securities Rule 504 Reg D Rule 505 Reg D Rule 506 Reg D 18 www.SEC.gov Perform search by issue name or symbol 19 SEC actions 20 Read the SEC Filings! Form 8-K- Current report pursuant to Section 13 or 15D Form 10- General form for registration of Securities pursuant of Section 12(b) or (g) Form 10-K- Annual report pursuant to Section 13 or 15(d) Form 10-Q General form for quarterly reports under Section 13 or 15(d) Form 15- Certification and notice of termination 21 Useful Websites 22 Bloomberg Businessweekwww.businessweek.com 23 OTC Markets- www.otcmarkets.com/pink/index 24 British Columbia Securities Commisionwww.bcsc.bc.ca 25 Corporation Wikihttp://www.corporationwiki.com 26 Secretary of State Corporate Searchesnvsos.gov/sosentitysearch/CorpSearch.aspx 27 FINRAwww.finra.org/Investors/ToolsCalculators/BrokerCheck/index.ht m 28 Price fluctuation 52 week high was .0042 and the low was .0009 That’s 367% shift 29 www.LexisNexis.com 30 Facebook 31 Power of Google Simple searches uncover substantive info. 32 Simplify searches 33 Precious metals company? 34 Telephone Number Search A simple search can identify multiple different companies who may also share the same address and officers. 35 Website registrant 36 314(b) Information Sharing 314(b) Guidance DTCC investigations have benefited from shared information through 314(b). Title 18 > Part I > Chapter 95 > § 1956 - “transaction” includes a purchase, sale, loan, pledge, gift, transfer, delivery, or other disposition, includes a deposit, withdrawal, transfer between accounts, purchase or sale of any stock, bond, certificate of deposit, etc. 38 Any Questions? Thank you.