Losses

advertisement

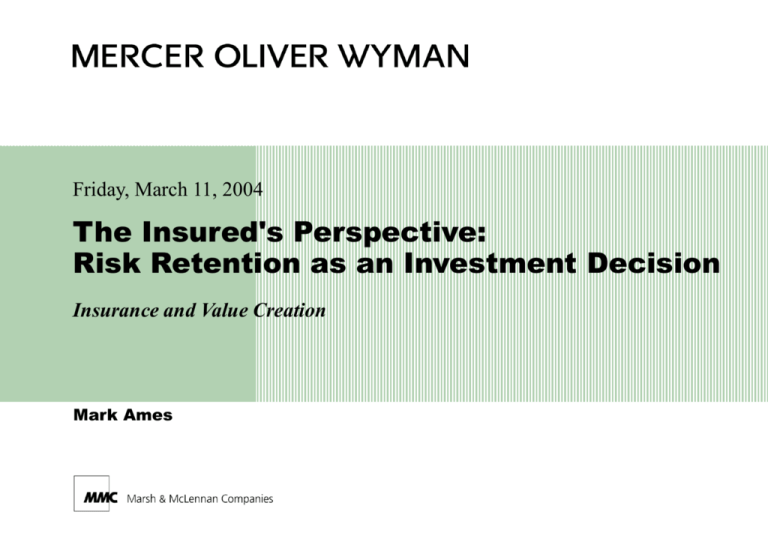

Friday, March 11, 2004 The Insured's Perspective: Risk Retention as an Investment Decision Insurance and Value Creation Mark Ames Outline Background to the Retention Decision – Does RM generate “value”? – Toward a quantitative approach to optimization… Economic Capital – What is it? – Who uses it and why? Mercer Oliver Wyman 2 I. Background to Retentions Practical applications that miss the point Clearly differentiating risk from return Finance Theory and Use of Capital Mercer Oliver Wyman 3 Capacity Does Not Imply Desirability 100 90 “Just because a company may have the capacity to bear substantial risk, does not mean that it’s in the firm’s best interest to do so.” Capacity to Bear Additional Risk (millions) 80 70 60 50 40 30 20 10 0 Working Capital Cashflow Surplus Cashflow Earnings per Share Stockholder's Equity Net Sales Total Assets A firm’s capacity to bear risk can be thought of as a pain threshold above which the decision makers do not wish to experience. – – Pre-Tax Earnings tolerable range for maximum unexpected losses Capacity is often found through an analysis of the firm’s financials, and application of “rules of thumb”. Wall street’s expectations often play a significant role. By definition, capacity goes across all sources of risk, not just insurable risks. Also, as expected losses are budgeted for, expected losses do not erode capacity. A large strong organization with many investment opportunities should not retain large amounts of fortuitous risk, as its capital base may be better employed. Mercer Oliver Wyman 4 Minimizing Expected Values A Traditional Approach that Captures Half the Picture An often-seen approach to choosing the proper retention level is to compare the tradeoff between discounted expected losses and premium. Expected Losses Market Premium – In the example shown at right, the decision maker might well choose to raise retentions to capture the net savings. – This approach can work for risks characterized by high-frequency low-severity losses such as Workers Compensation. Ironically though, this approach completely ignores risk, i.e. the true risk inherent in the retentions is loss volatility or uncertainty. – Naively raising retentions on a low-frequency high severity risk such as Property could result in a bad year producing a significant hit to earnings. Mercer Oliver Wyman 500,000 $135,000 $95,000 375,000 $170,000 $165,000 250,000 $240,000 $280,000 100,000 Current Retention 5 Risk Management Generates Value Foundations in Financial Theory Modern – Modigliani & Miller’s separation theorem. – Convex tax schedules and arbitrage. – Reducing the costs of bankruptcy. Post-Modern – Aligning the interests of stakeholders. – The under-investment model. The Economic Capital Paradigm Mercer Oliver Wyman 6 The Under-Investment Model Increasing Future Cash-flows Risk Management is most appropriately applied to ensure that strategic cash investments may be made from internally generated funds. Froot, Scharfstein, and Stein (HBR 11/94) The value of the firm increases with investment. Risk Management protects liquidity and thus the ability to make value-enhancing investments. Cash-Flow is King. Mercer Oliver Wyman 7 II. Economic Capital provides a buffer against unexpected losses. is a tool for management reporting and performance measurement. Mercer Oliver Wyman 8 Capital as Financial Buffer Distancing operations from Unexpected Losses losses Unexpected Losses Economic Capital Expected Losses Budgeted Expense 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 time A retention implies the use of the Firm’s economic capital in addition to needing to fund retained losses. Mercer Oliver Wyman 9 Defining Economic Capital As a Statistical Measure on a Loss Distribution Probability Size of Loss Unexpected Losses = Economic Capital Expected Losses Tail Estimate Expected losses can be budgeted for. Unexpected losses pose a threat to the P&L, and is an economic measure of exposure to the firm's capital base. Mercer Oliver Wyman 10 Use of Economic Capital Measures in Financial Institutions Management Reporting – Common language. – Setting operational limits that involve the use of capital. Performance Measurement – Example: Rewarding traders in an investment bank. – Distinguishing between value generating and value destroying business activities. Mercer Oliver Wyman 11 When Risk is Capital Insurance Protection Reduces Economic Cost The decision to assume risk is equated to an investment opportunity. – Investors take risks only in hopes of making a return. Optimal insurance structure means efficient use of economic capital. Insurance is a surrogate form of capital. Risk management positively contributes to value generation. Mercer Oliver Wyman 12 Value Creation Through Insurance Reducing the Economic Cost Of Risk (ECOR) Risk imposes economic costs in the form of expected losses and capital exposure. The modelling process allows these components to be estimated both before (gross) and after (net) of insurance. Value is created for the policyholder when insurance reduces these costs to an extent greater than the premium. Mercer Oliver Wyman Economic Cost ($s) Value Creation Capital Costs Premium Capital Costs Expected Losses Before Insurance Expected Losses After Insurance 13