Unit 8: Insurance

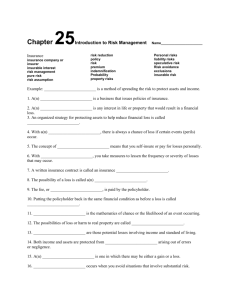

advertisement

Unit 8: Insurance Section 14.1 – Insurance Basics Section 14.1- Insurance Basics • Goals: ▫ Describe how insurance works to protect consumers. ▫ Explain the basic kinds of insurance and how to determine the amount to buy. Understanding Insurance • Risk- the chance of financial loss resulting from damage, illness, injury or death. • Risk management means limiting possible financial losses to amounts you can handle. • To manage this risk, you can buy insurance. • Insurance- a risk management tool that limits financial loss due to illness, injury or damage in exchange for a premium. • Premium- regular payments required to purchase insurance. How insurance works • When you buy insurance, you sign a legal contract called a policy, which makes you a policyholder. • The policy spells out the specific loss that it covers and the financial compensation the company will provide if you suffer that loss. • If you do have a loss covered by the policy, you file a claim, which is a formal request for payment from the insurance company. Shared Risk • Insurance companies diversifies the risk by selling policies to thousands of people. • Each policy holder pays a premium that is small compared to the cost of a possible loss. • Insurance works by transferring fund from a large group to the relatively few who suffer losses. • Through this method, all policyholders share the cost of losses. This is the concept of shared risk. Premiums and Statistics • Insurance companies use statistics from past events to ▫ Predict how many losses are likely to occur within any large group of people. ▫ Help estimate how much they will need to pay to reimburse particular types of losses. • Insurance companies have such statistics about all types of losses they insure. They use this knowledge to set premiums and by charging a little more than the expected losses, they earn a profit. What Insurance Protects? • Remember the purpose of buying insurance is to protect against the loss of something of value. Insurance is designed to restore your financial position to where it was before the loss, not to allow you to profit from the loss. • To insure something you must have an insurable interest in the item. That means, it must be something of value that, if lost, would cause you financial harm. Determining Value • Before you can insure property, the value must be measured in financial terms. • To determine value of property, you or the insurance company can have it appraised. An appraisal is an expert’s determination of the value of a piece of property. • For items not automatically covered you must purchase a rider. A rider is a special addition to an insurance policy that covers a specific type of loss. ▫ i.e. home insurance & diamond ring Determining the amount of Life & Health Insurance • Your life & health don’t carry a price tag, so they are insured differently. • The greater the amount of coverage you choose, the higher the premium. Life expectancy also affect premiums. ▫ (Life expectancy is an estimate of the average number of years remaining in people’s lives based upon gender, current age & health). • For example, if you are an 18 year old female, nonsmoker, in good health. From statistics, insurance companies know that people like you live to be an average of 78.6 years old. At 18, your life expectancy is 60.6 more years. • Companies also use statistics of medical conditions to determine premium costs. Three types of insurance • Property Insurance: insurance that protects you form financial loss when things are stolen, damaged or destroyed. • Two ways of determining value: ▫ Market value: is the amount the item is worth now. (i.e. A car that cost you $20,000 three years ago may be worth $10,000 now. If someone stole the car the company would pay you $10,000- not buy you a new car.) ▫ Replacement value: the cost of replacing the item regardless of its market value at the time of the loss. (i.e. You spent $600 for a couch 5 years ago. If you sold the couch today you would get $200 for it. If your house burned down, it would cost you $800 to buy comparable couch. Under replacement value the insurance company would pay you $800.) Three types of insurance • Liability Insurance : protects you from losses that you cause others. (also called casualty insurance.) • Up to a stated maximum, it will pay the cost of damage, medical expenses and legal fees if you are sued. Three types of insurance • Personal insurance : insurance that protects you, your spouse, and your children against loss due to illness, disability or death. • Two common forms of personal insurance ▫ Health ▫ Life