The Financial Pillar - Your Return on Investment

advertisement

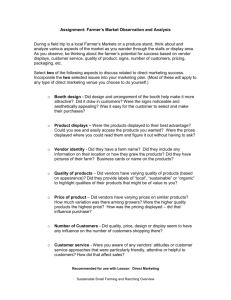

Maximize Your Return on Contracts – The Financial Pillar By Christopher Knudsen, and Mauro Caputi, Partner, Mainspring Consulting Group, LLC Your return on investment - how to maximize financial benefits from contracts By Mauro Caputi, Partner, Mainspring Consulting Group, LLC & Christopher Knudsen, Strategic Sourcing, Expense Management and Organizational Restructuring Consultant [Note: The following article applies only to the buy side for supplies and services.] Companies spend billions of dollars per year buying goods and services to build their products or support their businesses. For most companies, net income is a small fraction of net revenue. Vendor spend represents most of the expenses impacting the bottom line. Managing these expenditures intelligently can make the difference between a quarter in the red or in the black. Extracting value from your supplier relationships is a core activity that follows both a logical and definitive process reinforced by a corresponding set of metrics that should be rigorously utilized for all major spend categories, particularly during the contracting process. This article offers several key leading practices and lessons learned for both process and metrics to help you maximize financial value from contracts with your vendors and suppliers. Together, process and metrics will enact the appropriate deal structure within contracts that squeeze the most out of your spend dollar. The sourcing and contract establishment process Successful Contract Execution with vendors hinges on successful steps of the Sourcing process: Analyze, Strategize, Negotiate, Implement, and Manage Value. (See figure below.) A good process will -- at worst -- reaffirm your company getting the best available pricing in the market for its requirements; it will -- at best -- reduce spend by up to 30% while improving time to market to enhance quality of service and reduce corporate risks. The following sample lessons learned and leading practices can help you drive immediate financial value for your next set of contracts with vendors. Sourcing and contracting process considerations Analyze - Always analyze your current position when initiating a contract review. Too many companies have signed up for “more of the same” due to inertia when their own needs have subtly changed or the market capabilities adapted to allow better situated alternatives. Strategize - Clearly articulate and document the criteria for which a vendor’s success will be judged. Generally this is documented and included as the metrics and Service Level Agreement (SLA) section of the contract. Negotiate – Making a like-with-like comparison of competing vendor’s pricing, qualifications and service offering will provide the most efficient and consistent path to appropriate vendor selection. Implement - Internally communicate strategic, policy or procedural changes associated with new vendors or new objectives to create a smooth transition and launch. Manage Value - Frequent formal and informal vendor communications will help ensure vendors meet SLAs that are continuously tied toward your changing strategic goals. Common leading practices for driving value within your contracts – the process flow 1. Increase negotiation leverage by initiating Vendor Relationship programs that aggregate spend, package multiple requirements and coordinate timing of acquisitions across the organization rather than allow individual divisions to procure identical goods or services separately. Experience shows that leveraging your spend is one of the strongest tactics to getting the best price AND service from your vendors. It also reduces the administrative headache of managing multiple vendors. 2. Challenge business specifications and requirements to confirm they are truly required. Don’t over spec and pay for unnecessary performance or capabilities. 3. Negotiate contract terms, pricing and SLAs in parallel prior to selecting a vendor. Once you are invested with the selected vendor, the vendor’s mindset switches from a cooperative “what concessions must I give to win the business” to a confrontational “what concessions can I recover from the client”. 4. Establish multi-year deals to obtain better pricing. Leverage price inflators if appropriate by identifying a fixed number up front or link to a publically available index. Our experience shows 3 years is the ideal maximum length for a contract. Often, by the fourth year, changes in the market, demand and product require revisiting the market and contract to secure the right deal. 5. Consider backend discounts, such as annual rebates, only after further direct pricing concessions are not possible. Use rebates only as a fallback in case pricing becomes variable, demand is difficult to manage, sales tax may be higher, and time value of money is forfeited to the vendor. Vendors want back end discounts because they put all the risks of uncertainty on their clients and give them all the benefits of time value of money. 6. Consider two possible actions regarding Milestone and Percentage of Completion pricing models for services contracts: Ensure ALL steps and requirements in the Statement of Work (SoW) are sufficiently detailed and itemized to minimize costly Change Orders and Extensions of Time claims. Withhold a sizable portion of total fees as leverage over vendors until delivery and endof-warranty period to ensure end results satisfy expectations. 7. Understand and collaborate on vendors’ immediate objectives to negotiate best deal possible, above and beyond price. Possible joint objectives include: Market Share – Vendor wants to penetrate a new market or increase its market share. Sales Target Timing – If possible, time negotiations and contracts just prior to the end of vendor’s quarter or fiscal year as vendors strive to meet revenue targets. 8. Negotiate prompt payment discounts of 1% to 2% for invoice payment for less than 30 days of receipt of invoice, for example. Eliminate any late payment fees. Prompt payment discounts are great, but if the accounts payable departments don’t know about the discounts and fail to respond on time, the business won’t be able to take advantage of them. 9. Negotiate renewal terms up front. This limits vendors’ ability to renegotiate the contract during a renewal process. All too often we have seen vendors try to renegotiate the terms of a favorable deal as time pressure mounts due to impending contract expiration. Maximum vendor outcome metrics for contracts The above process flow will help select the right vendors and incorporate the right terms into corresponding agreements, but vendor metrics will be your core tool to ensure and incent vendors to provide long-term value. Properly crafted metrics will provide transaction level visibility, identify compliance issues and drive vendor performance around an organization’s critical success criteria. The following three categories of metrics are designed to help you understand the current volume and activities with vendors, determine if you are meeting your long-term strategic objectives as well as determining if the vendor is successful in delivering its objectives, both quantitatively and qualitatively. Finally, the metrics are only helpful if they’re used so be sure to track and review them regularly. (See figure below.) Volume metrics Volume metrics are transactional based metrics, e.g., goods/services purchased, prices, the business unit that purchased goods/services. Key leading practices Include a contractual provision that requires vendors to report these metrics periodically. This data, along with other data requirements, can also be passed along to the Procurement and Payment systems to establish an integrated and seamless Source-to-Pay buy-side process. Consider using third-party firms, particularly for vendors with high order volumes, to audit invoices, ensure compliance of the contracted pricing and collect on overbillings. Identify pricing variations across multiple vendors and track lost savings due to failure to use the most price competitive option. Additionally, the analysis of vendor and commodity metrics puts the buyer in a stronger position when it comes to contract negotiations or renewals. Performance metrics These metrics look to both quantify and qualify the success of vendors in meeting the requirements of the contract and identified goals, including financial penalties or rewards for success or failure. Key leading practices 1. Establish SLAs with vendors that include financial incentives for failing to meet expectations or for exceeding them. Penalties for performance failure can help ensure that vendors are correctly involved and incentivized to meet contracted expectations. Examples include: Delivery of physical goods - 98% of all orders placed prior to 5 PM are to be delivered next business day before 4 PM Problem response time – time it takes for vendor to respond based on the Severity Level (SL): SL1, 1 hour; SL2, 4 hours; SL3, 2 days Refund of credit - 98% of all requests for refunds of unused airline tickets will be completed within 45 days Uptime on vendor-controlled web service - 99% uptime on vendor application based service Call center response time – call center will maintain an average caller wait time of no more than 30 seconds during peak hours of 10 AM to 5 PM Reporting – reports detailing non compliance with preferred items to be submitted daily prior to 7 AM for all transactions booked during the prior calendar day 2. Subjective metrics – these measurements are designed to take the “temperature” of vendor relationships based on the opinions of key users and stakeholders. Generally, this feedback is solicited through customer satisfaction surveys. These surveys should address users’ opinion on vendor’s ability to meet the qualitative metrics included in the contract as well as opinions on non-qualitative factors. In our experience, contracts that lack detailed SLAs or companies that don’t adequately review them are more likely to have negative subjective metrics. Many vendor management headaches can go away by simply detailing what it takes to be successful and periodically talking with vendors about it. Occasionally vendors score low on subjective metrics but high on objective metrics. These scenarios will often be accompanied by a high degree of non-compliance with these vendors. Update SLAs accordingly to reflect subjective key performance metrics. The metrics will reassure the business that the vendors will make adjustments to improve on their measured satisfaction and success. Strategic metrics Of the three categories of metrics, strategic metrics are the most challenging to define and quantify but may exert the greatest financial impact. These metrics are designed to give a high level, holistic view of activities in a spend category and enable “forward-looking” decisions focused on … ensuring that the vendors and contracts deliver goods/services and SLAs meet business requirements, or influencing internal organizational behavior to be compliant with the contract and preferred vendors. Key leading practices Require vendors to provide time-sensitive compliance reports that proactively flag noncompliance orders. For example, a daily report showing planned travel that does not use preferred airlines or hotels before travelers start their trips can be extremely useful in proactively eliminating noncompliant travel and reducing your total travel budget. Look for trends in non-compliant spend that identify gaps in coverage for goods and services. For legitimate changes in business needs, update contracts (and pricing) to cover these new goods and services. For cases of maverick spend, work with the business to procure goods and services from approved vendors. Look for significant increases in volume that may warrant a revisit on pricing with your vendors, even before the contract expires. Next steps / impact on business The first step of the journey to maximizing your ROC is to understand and assess one’s own organization against leading practices across all three pillars of Contracts Management success – Operational, Legal and Financial. Often by analyzing a sampling of agreements from a Financial perspective, organizations can save as much as 30% on spend, and lead to a “nobrainer” business case to support additional investments in Operational improvements, such as a new CLM technology platform. After all, when significant dollar savings and/or additional revenue can be made by just reviewing a handful of contracts manually, consider how much more money can be realized and “taken off the table” by expanding the scope in an automated capacity. It should come as no surprise that the greater the scope of contracts being managed, scrutinized, and improved, the greater one’s Return on ContractsTM. Conclusion Overall maximizing the financial value of your contracts is a complex process that runs the lifespan of your relationships with vendors. While we have provided some lessons learned and leading practices that can help tighten the financial variables of contracts to maximize their value, a rigorous process combined with actively measuring performance, value and satisfaction on a timely basis will reinforce a strategic approach for improving the entire buy-side lifecycle. As previously introduced during our four-part series, the Financial pillar can be made more effective by working jointly with both the Operational function and Legal function as the three “Pillars of Success” for optimizing the bottom line value out of contracts. The prior articles in this series addressed each pillar in detail but to briefly summarize the other two: The Operational function of Contracts Management addresses how organizations are able to prepare, negotiate, execute, and analyze contracts efficiently. It comprises components across five dimensions of a Best Practices Contracts Management Framework: Strategy, Organization, Process, Functionality & Enabling Technology, and Metrics. The Legal function of Contracts Management addresses how organizations minimize risks of any business transaction through the legal language that make up the agreement. It explores negotiation tactics, clause inclusion, and clause analysis. Because of the interdependencies and criticality of each business function, it is extremely important that all three pillars are in synch and operate cohesively in order for companies to confidently progress up the Contracts Lifecycle Management maturity curve. The pace in which organizations wish to pursue improvements in Effectiveness, Efficiency and Risk, will largely determine the right balance of Operational-Legal-Finance for moving along the maturity continuum towards maximum ROC and maximum business value. END NOTE 1. To review the series of articles, click on link(s). v. First article, February 2013 issue v. Second article, April 2013 issue v. Third article, June 2013 issue TO CONTACT THE AUTHOR(S), please mail your question toInfo IACCM <info@iaccm.com> or connect using the IACCM Member Search (login required). ABOUT THE AUTHORS Mauro Caputi, Partner for Mainspring Consulting Group LLC, has a 20-year background in Contracts as both as a consultant and subject matter expert. This included supporting numerous clients with their Contracts Management Programs. He has advised close to 50 clients on solutions, policy and process design, and operational governance controls while also providing Delivery Management for global enterprise-wide implementations of variety of Contracts Management applications involving over 20 countries, tens of thousands of users, and supporting millions of transactions annually. Mr. Caputi received both his B.S. in Industrial Engineering, and M.B.A. from Columbia University. He currently serves as Partner for Mainspring Consulting Group LLC. Christopher Knudsen has close to 15 years experience in Strategic Sourcing, Expense Management and Organizational Restructuring. He has led or managed numerous strategic engagements covering indirect sourcing, expense analytics, offshore services, as well as, organizational and process re-engineering, which resulted in millions of USD in savings for the host companies while improving time to market and service quality. Mr. Knudsen held various executive positions in numerous top tier investment banks and consulting houses across the US, India and Asia and is currently an independent consultant for global clients. He has received his B.A. from the University of Florida and his M.B.A. from Georgetown University. Mainspring Consulting Group LLC is a boutique consulting services firm specializing in Contracts Management. Mainspring provides three key services – Implementation, Managed Services and Analytics – that revolve around optimizing the profitability or Return on ContractsTM. Mainspring takes on the administrative burden of contract management for clients and turns their contractual obligations into real dollars