The Hotel Industry - Haas School of Business

advertisement

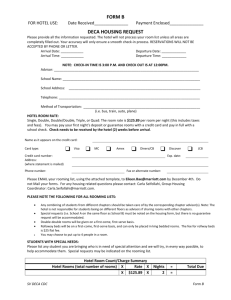

The Lodging Industry The Ritz-Carlton Naples, Florida Industry Scope 35,000 Hotels in U.S. 3.7 million Rooms in U.S. Annual Revenues of $95 Billion Profit of $19 Billion Hotel Industry Profits Net Profit or Loss $Billion 20 15 10 5 0 -5 -10 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 Changing Sentiment in the Capital Markets General anxiety over trouble abroad and their impact on the US economy. Concerns about overbuilding. General feeling that easy money has been made in the sector. Growth and momentum investors have sold their positions and have not been replaced by value investors. Capital market response has led to equilibrium. 1992 - 1998 Lodging Equity Offerings $7,172 $6,000 $4,520 $4,500 $2,783 $3,000 $1,649 $1,367 $1,500 $871 $122 $0 1992 1993 1994 Source: NationsBanc Montgomery Securities 1995 1996 1997 1998 Key Players Management Company e.g. Marriott, Sheraton, Hyatt Franchisor e.g. Holiday Inn, Best Western, Sheraton Owner - numerous possibilities REIT Hotel Co. Private Owner or Ownership Group Joint Ventures Average Management & Franchise Fees Limited Service Suite Resort Convention Full-Service MANAGEMENT FEES FRANCHISE FEES % of Total Rev. Per Room % of Total Rev. Per Room 4.8% $ 725 3.3% $ 481 4.4% $ 1,530 3.9% $ 1,264 3.6% $ 2,336 1.9% $ 1,224 3.3% $ 1,753 1.2% $ 575 3.1% $ 1,177 3.0% $ 995 Public C-Corporations Marriott Int’l Starwood Hilton Promus Four Seasons Market Cap ($ Millions) P/E Ratio 8,500 23.8 5,800 5.1 3,800 12.9 2,900 19.3 1,400 28.2 Public REITs Host Marriott Felcor Patriot American Meristar Innkeeper USA ($ Millions) P/E Ratio 2,600 14.5 1,600 11.9 1,000 NA 971 13.8 351 11.3 REIT Structures Normal REIT Paired Share Stapled or Paper Clip REIT Private Hotel Companies Hyatt Destination Hotels & Resorts KSL Resorts Kimpton Group Joie de Vivre Hospitality Structure Example #1 Hyatt Regency Kauai Owner Mgmt Co. Hyatt Hotels Hotel Hyatt Regency Kauai Structure Example #2 San Francisco Marriott Owner Host Marriott REIT Mgmt Co. Marriott International Hotel San Francisco Marriott Structure Example #3 Best Western Victorian Inn, Monterey Owner/Operator Mom & Pop Franchisor Best Western Hotel Best Western Victorian Inn Structure Example #4 Los Angeles Marriott Owner Mgmt Co. Meristar Hospitality Corp (REIT) MeriStar Hotel & Resorts Franchisor Marriott Int’l. Hotel Los Angeles Marriott Structure Example #5 Ritz-Carlton, Philadelphia Owner Mgmt Co. Hotel Starwood Hotels Ritz-Carlton/Marriott Int’l. The Ritz-Carlton Philadelphia Renaissance Hotels Ritz-Carlton LIMITED SERVICE No Food & Beverage Midscale Economy Budget FULL SERVICE Food & Beverage Deluxe Luxury Upscale Midscale Suites/Extended Stay Resorts Convention Suites/Extended Stay Deluxe Four Seasons Regent Ritz-Carlton The St. Regis Luxury Collection Ritz-Carlton The Regent Beverly Wilshire Full Service Luxury Hilton Hotel Sofitel Hyatt Meridien Inter-Continental Nikko Omni Marriott Hotels Westin Renaissance Omni Mandalay Las Colinas, Texas Full Service Upscale Doubletree Crowne Plaza Hotel Novotel Radisson Embassy Suites Red Lion Double Tree San Diego -Mission Valley Full Service Midscale with F&B Best Western Courtyard Sheraton Four Points Holiday Inn Holiday Inn Select Howard Johnson Ramada Howard Johnson’s, Vermont Full Service Resort Lots of recreational activities. Trend towards mixing business (conferences) with pleasure. Ritz-Carlton Kapalua Full Service Conference Center Typically located near convention centers. Large meeting and banquet areas. High volume. San Antonio Marriott Rivercenter Full Service Casino Cost: $1.6 Billion 3005 Rooms @ $185 ADR. $300 Million Art Collection. 15 Restaurants. Estimated EBITDA of $309 million on $950 million in revenue. Bellagio, Las Vegas Mirage Resorts Limited Service Mid Scale without F&B Comfort Inn Hampton Inn Hilton Garden Inn Holiday Inn Express La Quinta Comfort Inn, West Virginia Limited Service Economy Days Inn Fairfield Inn Budgetel Red Roof Inn Travelodge Red Roof Inn, Ohio Limited Service Budget Motel 6 Budget Host Inn Budget Inn Econo Lodge Great Western Super 8 Knights Inn Motel 6 Prototype Extended Stay Upper Tier Hawthorn Suites Homewood Suites Residence Inn Candlewood Suites Comfort Inn, West Virginia Hotel Census Full Service Deluxe Luxury Upscale Midscale with F&B Subtotal Full-Service Limited Service Midscale without F&B Economy Budget Subtotal Limited-Service Upper Tier Extended-Stay Lower Tier Extended-Stay Subtotal Extended-Stay Total All Branded Hotels Independents Total U.S. Hotels As of 9/98 Properties Rooms 173 48,644 802 351,957 925 229,131 5,305 698,509 7,205 1,328,241 3,656 339,195 3,992 346,323 4,736 346,891 12,384 1,032,409 435 655 1,090 51,060 72,327 123,387 20,679 2,484,037 14,496 1,196,040 35,175 3,680,077 Hotel Lingo Average Daily Rate (ADR) = Total Room Revenue / # of Rooms x 365 Occupancy % = Total Room Nights / # of Rooms x 365 Revenue Per Available Room (RevPAR) = ADR x Occupancy % EBITDA = Earnings before Interest, Taxes, Depreciation and Amortization Top Markets # of Rooms 1998 Rank 1 Las Vegas, NV 2 Orlando, FL 3 Los Angeles-Long Beach, CA 4 Atlanta, GA 5 Chicago, IL 6 Washington, DC-Metro Area 7 New York, NY 8 Dallas, TX 9 Houston, TX 10 San Diego, CA 11 Phoenix, AZ 12 Anaheim-Santa Ana, CA 13 San Francisco-San Mateo, CA 14 Miami-Hialeah, FL 15 Tampa-St. Petersburg, FL Rooms 112,000 95,100 80,800 77,100 73,400 71,800 68,300 54,900 47,700 46,800 45,700 45,400 43,100 41,500 36,900 Hotels 1997 Rank 265 1 350 2 653 3 561 4 418 5 387 6 248 7 361 8 318 12 393 9 310 14 360 10 307 11 255 13 312 16 Statistics of Top 15 MSA’s Occupancy 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 New York, NY San Francisco, CA Orlando, FL Boston, MA San Diego, CA Washington, D.C. Chicago, IL Los Angeles, CA Miami-Hialeah, FL Dallas, TX Atlanta, GA Phoenix, AZ Tampa-St. Pete, FL Houston, TX Norfolk, VA ADR 82% 81% 77% 76% 75% 73% 73% 71% 71% 68% 67% 66% 66% 66% 62% New York, NY San Francisco, CA Boston, MA Chicago, IL Washington, D.C. Miami-Hialeah, FL Phoenix, AZ San Diego, CA Los Angeles, CA Orlando, FL Dallas, TX Atlanta, GA Tampa-St. Pete, FL Houston, TX Norfolk, VA RevPAR $175 $130 $127 $109 $106 $101 $100 $99 $89 $85 $82 $79 $79 $74 $68 New York, NY San Francisco, CA Boston, MA Chicago, IL Washington, D.C. San Diego, CA Miami-Hialeah, FL Phoenix, AZ Orlando, FL Los Angeles, CA Dallas, TX Atlanta, GA Tampa-St. Pete, FL Houston, TX Norfolk, VA $143 $105 $96 $80 $78 $75 $72 $66 $66 $63 $56 $53 $52 $49 $42 Hotel Organization Chart General Manager General Manager Rooms Division Director Front Office Manager Reservations Manager Housekeeping Switchboard Supervisor Food & Beverage Director Restaurant Managers Room Service Manager Executive Chef Director of Marketing Sales Manager Convention Services Manager Banquet Manager The Income Statement Undistributed Operating Expenses Revenue Rooms Food Beverage Telecommunications Other Departments Rentals & Other Income Total Revenues 67.4% 19.6% 5.0% 2.7% 3.3% 1.9% Total Costs & Expenses 8.3% 1.6% 5.4% 5.0% 4.1% 0.2% Total Undistributed Expenses 24.6% Income Before Fixed Charges 35.0% 100% Costs & Expenses Rooms Food Beverage Telecommunications Other Departments A&G Franchise Fees Marketing Property Operation and Maintenance Utility Costs Other Unallocated Operated Departments 17.2% 17.1% 2.3% 1.3% 2.5% 40.4% Occupancy % ADR Average Size (Rooms) Mgmt. Fees, Property Taxes & Insurance Management Fees Property Taxes Insurance 2.8% 3.2% 1.0% Total Mgmt. Fees, Property Taxes & Insurance 7.0% EBITDA 28.0% 71.1% $ 91.60 199 Hotel Revenues Beverage 5% Other Operated Departments 3% Telecomm 3% Rentals & Other Income 2% Food 20% Rooms 67% Trends in Revenue % of Total Revenue 80% 70% 60% 57.0% 60.5% 61.6% 63.1% 63.7% 63.5% 67.2% 67.4% 50% Rooms Food Beverage 40% 30% 20% 10% 26.1% 9.8% 23.5% 8.9% 23.4% 7.7% 21.6% 21.0% 19.7% 19.7% 19.6% 5.9% 5.6% 5.5% 5.2% 5.0% 0% 1977 1982 1987 1992 1993 1994 1995 1996 Hotel Expenses Utility Costs 6% Management Fees, Property Taxes, & Insurance 10% Cost of Sales 12% Operating Expenses 28% Salaries & Benefits 44% Payroll Costs Rooms Food & Beverage Telephone Other A&G Marketing Property Operations Other Departments Total Payroll 35.0% 32.5% 1.4% 2.8% 13.1% 7.2% 7.8% 0.3% 100% Payroll Taxes & Employee Benefits Employee Meals 33.8% 1.1% Source: PKF Hotel Industry Trends 1998 Profitability Limited Service Suite Convention Full-Service Resort Income Before Fixed Charges 50.6% 44.4% 36.4% 31.5% 29.4% EBITDA 42.8% 35.5% 29.3% 24.7% 23.5% Fixed Charges: Management Fees, Property Taxes & Insurance Hotel Occupancy Rate 66% 65% 64% 63% 62% 61% 60% 87 88 89 90 91 92 93 94 95 96 97 98 Occupancy % by Segment Upper Tier Extended-Stay Luxury Deluxe Upscale Midscale w/out F&B Lower Tier Extended-Stay Midscale with F&B Budget Economy Total U.S. Hotels Source: Bear, Stearns & Co. 1999 1998 79.80% 74.20% 73.90% 69.90% 68.70% 68.50% 64.40% 63.20% 60.20% 66.80% 1997 81.80% 75.30% 74.80% 71.40% 69.60% 70.70% 65.30% 63.00% 60.40% 67.50% ADR & RevPAR by Segment Average Daily Rate Deluxe Luxury Upscale Upper Tier Extended-Stay Midscale with F&B Midscale without F&B Economy Lower Tier Extended-Stay Budget Total U.S. Hotels Source: Bear, Stearns & Co. 1999 RevPAR 1998 $201 $138 $99 $98 $70 $64 $51 $43 $43 1997 $183 $129 $94 $95 $66 $60 $49 $38 $41 1998 $149 $102 $79 $69 $45 $44 $31 $29 $27 1997 $137 $97 $78 $67 $43 $42 $30 $27 $26 $80.03 $76.35 $53.45 $51.52 Cap Rates 12.00% 11.00% Hotel 10.00% Office Industrial 9.00% Retail 8.00% 7.00% 1988 Source: PKF Consulting 1990 1992 1994 1996 1997 Spread between 10 Year Treasury & Cap Rates 6.0% 5.5% 5.0% 4.5% 4.0% Resort 3.5% Full Service 3.0% 2.5% Limited Service 2.0% 1.5% 1.0% 1986 1988 1990 1992 1994 1996 1997 Source: PKF Consulting Hotel Construction Contracts Awarded - F.W. Dodge Million SF 100 80 60 40 20 0 80 82 84 86 88 90 92 94 96 98 Real Estate Cycle Hotel Extended Stay Hotel - 12:00 12 Overshooting Phase Decline Phase 3 9 Growth Phase Absorption Phase 6 Full Service Hotel - 6:30 Rosen Consulting Group