Bootstrap Finance - DramatisPersonae.org Dramatis Personae

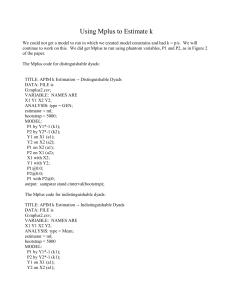

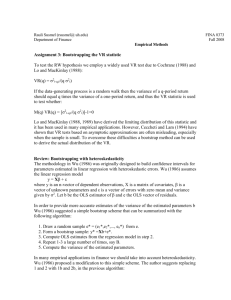

advertisement

Bootstrap Finance •How can you start a great business with no (or little) money down? •How do you get ‘table stakes’ so you have a place in the game? Bootstrap Finance •CDN Banks lend only to people who don’t need the money •Only Grameen Bank led by Nobel Peace Prize Winner Dr Muhammad Yunus lends money to people who need it •Sir Terence Matthews: “We’ll lend you $7.5m provided you establish a cash collateral acct of $7.5m for Newbridge •Only uses CDN Banks to clear funds Bootstrap Finance •The rule today is, if you have cashflow, you will get financed •Not the other way round •Mark McCormack started IMG, International Management Group, with $500, his law degree and Arnold Palmer as first client •Doesn’t hurt if your first client is Arnold Palmer Bootstrap Finance •Golden Rule? •S/he who has the Gold, Rules Bootstrap Finance •Probably less than 1% of all startups ever get any funding from VCs •Means that at least 9,900 out of the next 10,000 new enterprises will bootstrap •Stronger enterprises •More focused on results and clients Bootstrap Finance •‘Bootstrap Capital’ on UrbanDictionary.com Also known as self-capitalization, this is how most start-ups actually capitalize themselves. Sources of bootstrap capital include: soft capital (Mom/Dad/Rich Uncle Buck), home equity loans, supplier credit, consulting, credit cards, retainers, deposits, progress payments, receivables factoring, partners, sponsorships, guarantors, pre-sales, launch clients and more. Bootstrap capital allows the ownership to keep control of their own enterprises and not lose them to VCs and other debt or equity holders. Bootstrap Finance •Terry Matthews again: “Get close to the customer—early and often.” •All new personnel in his Wesley Clover startups spend six months in sales •Same thing at Ottawa Senators—start everyone in sales •Next time star player or agent wants extra million, everyone understands how many season tickets or hot dogs or signs have to get sold Bootstrap Finance •Other ‘Terryisms’: “Follow the fastest (least effort) route to revenue.” “Pursue only those goals that are consistent with the overall objectives of the enterprise.” “Leverage your investment with government grants and OPM, Other People’s Money.” To read all of Terry’s 10 Rules, See: http://www.eqjournalblog.com/?p=780 Bootstrap Finance •Is lack of access to capital really main barrier to entry for entrepreneurs? •More of an excuse in my view Bootstrap Finance The reasons most VCs aren’t interested in most startups are as follows: 1. Most business startups don’t have the growth prospects to attract VC funding. 2. Most startups are in industry sectors that don’t appeal to VC funds anyway. 3. Most startups should be much further along in their development before they go after VC funding, if they ever do. If their business has real cashflow and real customers and clients, they are on a much more even footing with respect to negotiating a fair agreement with VCs, if that is what they choose to do. 4. Finally, it is much more efficient for Canada if VCs fund more mature companies that are at a stage where large capital injections are: a) less risky, b) more inclined to be put to wise use by (now) experienced entrepreneurs. Bootstrap Finance •Shopify.com’s experience •Established by Tobi Lutke and Scott Lake in 2005 •Original mission was basically to fund the guys’ interest in snowboarding •Unhappy with then e-commerce offerings, Tobi, who was a sophisticated developer originally from Germany, built a better mousetrap using Ruby on Rails Bootstrap Finance •RoR is an open-source web framework •Inspired choice– coding was no longer an indecipherable, exclusive priesthood •Friends started asking them if they could build online shops for them •What business are they really in? Bootstrap Finance •So typical–business plans or models introduced into RL (Real Life) transmogrify into something quite different when they greet first customers •Shopify’s business model based on SAS, Software as a Service •They have CMRR, Committed Monthly Recurring Revenues– Holy Grail of Techdom Bootstrap Finance •Profitable in first 12 months •> 10,000 clients •Fastest growing e-commerce platform in the world (1,000s of new stores on their platform ea mth) •In Dec. 2010– they take in $7m in VC funding from Bessemer Ventures, 3rd largest and oldest VC in US Bootstrap Finance •This is after they had established annual run rate of $135 million and become No. 7 on Canadian Business’ List of Canada’s Fastest Growing Businesses •Founders retain control •Doesn’t hurt that Bessemer can intro them on 1st name basis to tech titans like Twitter, FB and Google Bootstrap Finance •“…we work in a business of tough competitors,” Jerry McGuire •When I was a boy, there were about 3 billion people on this planet and perhaps 20% participated in a modern economy •Now there are nearly 7 billion and probably 60% participate in the modern economy Bootstrap Finance •Good news– more people to sell to •Bad news– much more competition Bootstrap Finance •Eseri.com, started by PhD entrepreneur, Bill Stewart •Provides lightweight Internet-based (actually cloud-based) desktops using proven freeware •Eseri based in Ottawa and Montreal •Started with nothing •Bill still gives $1,000 per day seminars on project management software •Uses stock options to keep his core group of developers on the job. •Leverages what money he puts in with GOC (Government of Canada) IRAP grants Bootstrap Finance •Great Depression of 1930s •King Clancy built old Maple Leaf Gardens same way •Paid his workers with ‘script’ •If ‘Carleton Street Cash Box’ failed, script wld be worthless •Fortunately for workers and Toronto Maple Leaf fans, it wasn’t •Able to redeem it for more familiar currency and feed themselves and their families Bootstrap Finance •In the US, number one source of finance for SMEEs in 2009 was supplier credit •Sometimes called Trade Credit (TC) •Amounted to $2.15 trillion •Dwarfed bank lending to SMEEs of just $1.5 trillion Bootstrap Finance •Suppliers want new enterprises to be successful—that way they will have helped create new client for themselves •Supplier credit and funding from your clients– cheap sources of capital and FAST Bootstrap Finance •Siavosh Noruziaan: Empire Fences and Decks •Order for new deck for $8,000 •Asks client for a deposit of 50% •Balance due on completion of job •Orders $5,000 worth of materials from his suppliers who have extended credit Bootstrap Finance •Now has $4,000 in cash in the bank and $5,000 worth of supplies on site •Plus $4,000 receivable •Enough cash on-hand to pay workers and himself and later pay his suppliers… Bootstrap Finance •What is cheaper—debt or equity? •Many people think equity is free •Not so •VCs want at least a 20% p.a. •ROI and Vulture Funds are aiming for a ROE of ~ $40% •Today you get variable rate home LOC for just 2.15% Bootstrap Finance •Say you need $10k worth of software development •Pay the developer in cash not, say, 10% of your equity •You only have ten, 10s to ‘give’ away •If one day, a few years later, you sell the biz for say $1m, you gave the developer $100k to do $10k worth of work Bootstrap Finance •Even if you use 2nd mortgage type debt, say, 8% to 12%, still cheaper than most forms of equity •So now you know, debt is (usually) much less expensive Bootstrap Finance •But what is cheaper than debt? •It’s supplier credit and launch client money! •They usually charge you nothing for it Bootstrap Finance •Clients give you their money in the form of deposits, retainers and progress payments for free because they want to buy your products and services •And they want you to survive •And they trust you Bootstrap Finance •What is the most important thing in business (and life)? •Trust! •Marketing Brand Trust Sales Bootstrap Finance •Cash Conversion Cycle (basically, Accounts Receivable + Inventory – Accounts Payable) must be short or, better yet, negative •Means as sales grow, you generate cash instead of needing to raise more cash •Crucial to entrepreneurial, bootstrapped startups See: http://www.eqjournalblog.com/?p=2257 Bootstrap Finance •Fuel Industries •One of top three advergaming businesses •CCC is out of whack •Client base to die for: Pepsi, Coors, GM, MTV Networks, McDonalds Europe… •$1m orders •10% down, 1 year to complete, balance due: delivery + 30 days Bootstrap Finance •Hire expensive developers •Build the ‘pipeline’ •RBC calls their LOC •What to do? Bootstrap Finance •Four Places to go for help •Shareholders and Directors •Employees •Suppliers •Clients ____________________________________ Possibly your competitors (co-opetition): eg Microsoft bailed out Apple to avoid more anti-trust Bootstrap Finance •All stakeholders want you to survive (but for different reasons) •For FI, clients to the rescue •Why? Bootstrap Finance •If FI goes out of business, competitors too busy to deliver their work on time •Prices will increase •Now, 30% down, two 30% progress payments upon achievement of milestones •Only 10% on delivery + 30 days •CCC is –ve, paid from ‘retainers’ (like lawyers) •Faster they grow now, the more cash on hand Bootstrap Finance •How would you like to own a business that made you $100,000 per year and took about 200 hours of your time ($500 per hour)? •Richard Rutkowski, former Kanata City Councillor, REALTOR, Owner, Best of Kanata •$600 per page to advertise in book/lots of pages •Books sell at retail for $20 each •Two main sources of revenues Bootstrap Finance •Each book buyer becomes a member and gets 10% off at all participating retailers using BOK CARD •“Secret sauce”: his advertisers are also one of his main distribution channels •They buy books to sell to their customers at $20 and keep $10 •If a full page advertiser sells 100 books, the cost of their ad is -$350! (Negative Cost Selling!) •What a great value proposition: BUY AN AD IN THE BEST OF KANATA FOR A –VE $350 Bootstrap Finance •Another channel– charities and minor hockey/soccer groups buy the Books for $5 and sell them for $20 •Low tech •Richard can SELL •Richard is trusted •Advertisers pay 50% on signing contract and balance on delivery of books Bootstrap Finance •Pre-sold enough advertising to pay for first printing and then some •Cash required to start BOK: -ve! •This biz is scalable •Maybe there is a market for: Best of Dartmouth, Best of Orleans, Best of Mississauga, Best of Manhattan! Bootstrap Finance •The Disney Company (Fortune 67, 2008 with more than $35 billion in revenues) used BC! •They bought the Mighty Ducks of Anaheim for $50 million in 1993 •Paid the NHL $25 million and Bruce McNall and the LA Kings $25 million, $5 million/yr. x 5 yrs– a payment plan! Bootstrap Finance •They weren’t done yet! •They got a $20 million leasing inducement from Ogden to sign a long term lease at Honda Center (formerly Arrowhead Pond) •They secured a $30 million LOC based on the franchise value from a Lender •Cost of the Ducks? •–ve $20,000,000 •They had more cash > than < •This is called accretive buying, another form of BC. Bootstrap Finance •I could bootstrap a Lunar Colony! •Just ask me how! Bootstrap Finance •There is a lot of real estate on the moon– it has a surface area of approximately 37.8 million sq. kilometres •That’s about the size of the US, Canada and Russia •What if living in 1/6th gravity helped you live 20, 30, 40 or 50 years longer and let you boogie like a teenager too? Bootstrap Finance LIVE FOREVER…! Bootstrap Finance •Now maybe I could convince 100,000,000 people to move to my Lunar Colony when they turn 70 or 80 •I might charge them $15,000 per month for their condos •That’s $18,000,000,000,000 in revenue per year (18 trillion dollars, about 1.35 times the GDP of the United States)! •I would ask for one year’s rent up front! •I could build a lot of spaceships and lunar condos with 18 trillion dollars! Bootstrap Finance •So don’t tell me you can’t pull yourself up by your bootstraps– you can Bootstrap Finance Kevin Rose, Founder, Digg.com Kevin Rose made $60 million in 18 months How did he do that? a) JOB? b) Entrepreneurship? Bootstrap Finance “If you spend our last $10,000 on launching this site instead of a deposit on a home for us, I’m going to leave,” Kevin’s ex-girlfriend Kevin and his partner populated their site by CALLING 3,000 of their friends They didn’t push on a string– an email campaign might have gotten them 15 users I wonder how she feels now? Bootstrap Finance DIGG.COM’S DIFFERENTIATED VALUE? It is a new model for a newspaper uniquely adapted to the Internet It is not simply the online version of the New York Times or some classified advertising page transferred to the Internet It is a digital community made up of a fairly homogenous demographic—80% are male, mainly young techie readers Readers are also contributors Readers dig up interesting stories from all over the web and post brief synopses to the site and links to them whereupon other readers vote on them—the most popular ascend the page Bootstrap Finance The site harnesses the competitive instincts of the readers/contributors to compete to see whose story will lead The site works because of its homogeneous demographic—contributors only post stories that will be of interest to the group The site is dynamic—leading stories change by the minute or hour Digg.com’s cost for headline writers = ZERO Digg.com’s cost for journalists = ZERO Digg.com’s cost for editors = ZERO Digg.com’s cost for distribution = ZERO (at least, the marginal cost is practically zero) Bootstrap Finance Digg’s sustainable competitive advantage is its business model and its readership You might be able to knock off its business model but it is extremely difficult to knock off its millions of dedicated readers which form a community The key is that the readership and community are relatively homogeneous and have similar interests Bootstrap Finance Keys to success: a. Sound biz model: humans curate the news b. Community makes Digg.com tough to knock off/beaucoup differentiated value c. Scalable/Reversed out the work d. Guts e. Bootstrap marketing that worked– did not need SUPER BOWL COMMERCIALS TO LAND 1ST CLIENTS! Bootstrap Finance Craig Schoen, former student Winner of Wes Nicol Business Plan Competition Serial entrepreneur Hi ECQ Test Score: http://www.dramatisp ersonae.org/ECQTest/E CQ(ns)TestAuto.htm Sold (Cutco) knives door-to-door! Bootstrap Finance Problem: car dealers and REALTORS taking forever to upload their info to Kijiji.com Answer: www.Kijiji-Feed.com Irresistible value proposition Servers do the work! From his apartment! Financed by dealers– pre-sales, deposits Profitable from Month 3 Bootstrap Finance Ryan North, (now famous) online comic: Can’t draw (he is a brilliant IT specialist). In 2003, he creates Qwantz.com, an online dinosaur comic. Six panels using clip art/characters that never move. Only dialogue changes, day-to-day. Bootstrap Finance Bootstrap Finance Key facts: Turns disadvantage (can’t draw) into advantage. Guinness Book of Records application– longest running comic strip where characters never change/move Quirky personality Revenue streams: merchandise sales/book sales/appearance fees/advertising by Project Wonderful, PW Bootstrap Finance Startup Budget: $15.00 for domain name: www.poo.ca. $15.00 for domain name www.qwantz.com. Web hosting: $35 per month. Fulfillment costs: outsourced. Won $500 in 2003 Business Model Competition. Startup Budget = -$400. Bootstrap Finance Marketing: T-Rex cardboard cutouts. Placed around campus with this domain on them: www.poo.ca. Resolves to: www.qwantz.com. Ryan is a wealthy person today with plenty of time to explore new ideas… Bootstrap Finance Launched ProjectWonderful.com Democratic advertising platform Qwantz.com was the main marketing engine Value of a “celebrity” endorsement Profitable within 10 days of launch Bootstrap Finance Bootstrap Finance Remember Internic.ca • Pixie Dust = its name • Lawyers, patent agents and TM/copyright specialists and speculators know “Internet Nickname” • CIRA releases dot-ca • “Gold” rush • DOC sues in Canada for “Intermic.ca” (owned “Intermic.com” in USA) • Rob Hall had GOC protection (Federal incorp. of “Internic.ca Corp.”) and TM of name in Canada Bootstrap Finance • DOC loses • (DOC controls the Internet – 13x root servers around the world) • Rob sets up multiple channels to ping CIRA’s server (DAC, Internic, others – all accredited) • 80,000 dot-ca backordered • 75% success rate • 60,000 domains at $50/yr (then) x 2 yrs • $6m in cash in < 72hrs Bootstrap Finance • Remember Pool.com • Snap names $60/backorder up front • Pool.com: “free to backorder/only pay if successful” • several million backorders port over to Pool.com • e.g. if you have Manchester.ca and want Manchester.com, if Manchester.com deletes from VeriSign registry, Pool.com will get the domain for you • $60 if successful or highest bid (when >1 backorder) • Again multiple channels against VeriSign server. Bootstrap Finance Make money while you lie on a beach! Bootstrap Finance So here is our list: 1. Soft Capital: Mom, Dad and rich Uncle Buck; basically this is a family and friends round of financing either formally or informally organized. Angel investors may also take part at this stage. Bootstrap Finance 2. Home equity loans. This is the number one source of equity for entrepreneurs across the globe. It is usually accessible at low cost (i.e., low interest) and can be put in place relatively quickly. Student entrepreneurs should, in my view, make home ownership an early priority not only as a storehouse of value but also as a way of diversifying their asset mix and doing some creditor proofing too. The home would normally go int he name of the spouse or partner with the lowest risk profile. For more on creditor proofing, please refer to:http://www.eqjournalblog.com/?p=526 and http://www.e qjournalblog.com/?p=1138. Bootstrap Finance 3. Business plan competitions for cash (e.g., the Wes Nicol Competition, EIEF or the Celtic House Competition.) Student entrepreneurs get very good at this and often use it to supplement their startup capital. Bootstrap Finance 4. Future customers or launch clients are another large source of startup capital. Home buyers in Ontario, for example, can be asked for deposits of up to $40k in advance. Launch clients are important for other reasons as well: they give the new enterprise additional credibility and feedback on their offering that often results in changes in the product, service or business model. Bootstrap Finance 5. Future suppliers can often be persuaded to extend long term credit to the entrepreneur (e.g., Vendor financing of 30, 60, 90 days or more) or invest cash in your business since they have a lot to gain if you become another (good) customer of theirs. They will probably want a long-term supply agreement though. (In 2009, trade credit (or supplier credit) surpassed bank lending as a source of finance for business in the US. TC amounted to $2.15 trillion this year versus $1.5 trillion in bank lending (which was down more than 6.5%, year over year) according to data from the US Federal Reserve. For more on Trade Credit, please see:http://www.eqjournalblog.com/?p=610.) Bootstrap Finance 6. Strategic partners. (For example, Ogden Corp. was a strategic partner of the Ottawa Senators Hockey Club—in return for a 30 year arena management deal plus a F&B rights deal, they invested, loaned and guaranteed significant capital to/for the nascent team. Valve installer which repairs windows with broken seals might, for example, seek investment from curtain wall manufacturers. Sometimes you can get strategic investors to give you an advance on revenue– won’t even take part ownership. Eg, Billion Price Project– advances from Stats Can and other national stats orgs.) Bootstrap Finance 7. Micro capital lending and grant programs. For example, the GOC’s (Government of Canada’s) SBL (Small Business Loan) Program is run very effectively by the Canadian Chartered Banks. SBLs are available up to $350,000 and the GOC will guarantee 90% of the loan so that if the enterprise fails, the founders are only (personally) responsible for 10%. Bootstrap Finance 8. Supplier rights, product placement and licensing fees. For example, Molson Brewery purchased pouring rights for the Corel Centre (now Scotiabank Place) and the Civic Centre after the City of Ottawa was awarded a franchise by the NHL in December 1990 but before they commenced play in October of 1992. Bootstrap Finance 9. Patent or other IP licensing fees and royalty payments. Noma Industries purchased the rights to LED Xmas light strings designed by the author. Bootstrap Finance 10. Consulting services. A lot of entrepreneurs support their startups by providing consulting services at the same time. Eseri.com, started by PhD entrepreneur, Bill Stewart, provides lightweight Internet-based (actually cloud-based) desktops that use widely-available and proven freeware. Eseri is based in Ottawa and Montreal and was started with nothing—Bill still gives $1,000 per day seminars on project management software so that he can fund his real passion— building a great business of his own. For more on this, refer to: http://www.eqjournalblog.com/?p=752. Bootstrap Finance 11. Partners can bring cash to a business or they can bring sweat equity. The latter reduces the capital the enterprise requires while the former adds to the capital base of the new company. You have to be careful though: “There are still two chairs in Heaven waiting for the first two partners to get there and still like each other,” Anon. Also, if one partner has access to significantly more financial resources than the other, he or she may well end up owing 100% of the business, squeezing out the other partner or partners. Bootstrap Finance 12. Debentures (mostly a form of debt). Family, friends, angels may prefer to invest their money in the form of debt with equity conversion rights or equity bonus. 13. Financial leasing of fixed assets (such as computers and phone equipment, photocopiers and the like although it can apply to almost anything. I have heard of financial leasing for, of all things, roller coasters.) Bootstrap Finance 14. Receivables factoring. If you have clients with strong credit, you can sell your receivables for cash. Car dealers sell their car leases and loans for cash. 15. Publisher’s advance on a book or manuscript. Bootstrap Finance 16. Sponsors. You can get people to sponsor practically anything. A couple of young REALTORS I know raised donations (cash and in-kind) for a local food bank last year while raising their profile in the community. By getting sponsors on board, their costs for the food drive were negative. Sometimes, it’s as simple as just asking for donations and sponsorships. You don’t need to be a charity or NTP to ask for sponsorship: co-marketing/cobranding. For more about this, please see: http://www.eqjournalblog.com/?p=400. Bootstrap Finance 17. Trading activity: buying low and selling high. In essence, you are taking advantage of arbitrage opportunities or asymmetrical information. One domain name registrar I know found out what percentage of dot-CA holders did not have their dot-COM equivalents while the dot-COM equivalents were still available. He sold a ton of dot-COMs that way by making the owners of the dot-CAs aware that they could have their dot-COM extensions. Early in my career, I did a lot of trading up. Check out this story: http://oneredpaperclip.blogspot.com/. This person traded a paper clip for a pen and traded the pen for a … and then for a generator and then for a snowmobile and then for a truck… His idea was to eventually get a home for himself (which he succeeded in doing). Bootstrap Finance 18. Credit cards (oft used strategy but dangerous because of high interest costs and what can happen to you and your credit rating if you fail to make payments). 19. Scientific R & E, D Tax Credits from the GOC, IRAP Grants. 20. Finding capital where you least expect it. For example, a services company extracted capital ($800,000 of it) from its below-market office space lease deal: http://dramatispersonae.org/CapitalFromLease.htm. Bootstrap Finance 21. Reverse or Negative Pledging of Assets. Years ago, Olympia and York raised 100s of millions by not pledging the value of their office towers to anyone. They extracted mega loans from their Banks based on the value of their real estate and based on their agreeing to not pledge their assets to anyone… It’s another dangerous strategy because you can end up over-leveraged which O & Y did. Bootstrap Finance 22. Co-guarantor. You can often borrow someone else’s (stronger) credit rating. For example, Suite Leases for Scotiabank Place (when it was called the Palladium) were pledged to support construction financing. Basically, the Bank was loaning money on the strength of the covenant of lessees. Of course, you could also ask Mom or Dad to co-sign for a loan… Bootstrap Finance 23. Accretive buying. This occurs when you buy another company using the target company’s balance sheet as collateral. That way, you may end up with more cash on hand after the purchase is complete than you had before. Disney’s acquisition of the Mighty Ducks is an example of this. More recently, a financial advisor I know by the name of Tim bought a book of business from a retiring colleague. He took over the advisor’s clients in return for monthly payments to the soon-to-be retired individual equal to a percentage of the commissions he would have received for the next three years. This was accretive to Tim– the cash he pays out every month is less than what he receives and it’s guaranteed: if any clients leave, the commissions are reduced accordingly. The reason Tim got the opportunity was because the selling broker trusted him. Bootstrap Finance 24. Accretive Selling. When you sell products or services with third party customer financing in place, you end up with more cash after the sale than before (e.g., Leon’s don’t pay a cent event…. (OAC). Leon’s than turns around and sells the sales contract for cash. Bootstrap Finance 25. Employee ESOPs (Employee Stock Ownership Plans). Employees can invest part of their earnings back into the company. Wesley Clover (an Ottawa based business incubator) uses this extensively not only as another source of capital but as a way to keep highly skilled staff from leaving and to provide further performance incentives for them. Bootstrap Finance 26. Pre-sold services. For example, here is an example from Craig deSchneider, a former student: “In looking for some start-up capital for our automotive related business, myself and my partner offered potential investors future discounts through our business. In selling automotive parts, we had accounts set up with distributors, accounts which could only be set up through having a business license, tax numbers, and some negotiating, so the average person off the street does not have access to these discounts. We set no specific investment amounts, simply the most the person could afford. We kept these contributed amounts a secret among the different investors as we offered them all the same return. Therefore, in return for a fair investment, we extended to our investors cost prices for all of their future purchases through our company. The only limit we set on this agreement was that the investors’ annual purchases could not exceed our company’s sales revenue from our average monthly sales figure (not including cost purchases made from investors). The overall idea was to provide our investors a very fair return on their investment, and at the same time, these investors would promote our company. Why you may ask, well the greater our monthly sales were, the greater the amount of goods they could buy for themselves at a cost price.” Basically, Craig and his partner turned their investors into customers and their customers into investors. Nice going. Bootstrap Finance 27. Collectibles sales and auctions. This was a new one to me. Michael Moshier put the original version of his SoloTrek flyer up for auction on eBay, hoping a museum would pick it up. It didn’t even fly but by January 12th, 2003, the bidding on eBay had already reached $6.5 million USD: money he planed to use to fund his Trek Aerospace startup. Cool. Bootstrap Finance 28. Extended family savings and investment fund—an old style of acquiring start up capital is to have the extended family contribute to a pool of funds to help family members acquire or build businesses. 29. Seller Take Back (STB) mortgages—typically used in real estate transactions, the Seller provides some or most of the financing for the sale by way of a (first or even second) mortgage back to the Purchaser. Bootstrap Finance 30. Sweat equity. Don’t underestimate the contribution you make to the enterprise in ways that are unpaid and often not sufficiently recognized. Youth and energy count for a lot. 31. Investor syndicate or investment club. You might form your own club and some of that investment could be used for funding your new enterprise provided that you disclose and get the agreement of the other investors. Bootstrap Finance 32. Retainers (typical for consulting services or legal and accounting services) and deposits on sales. Lawyers do it but more startups should be asking for retainers and deposits on sales contracts. 33. Collecting early and paying late (boosts cashflow in the short term). Delayed payments. 34. Progress payments on contracts. Advances for work-in-progress. Bootstrap Finance 35. Advance ticket sales. We sold $22 million in season tickets for the inaugural Senators season 22 months in advance of the first game. These funds are impressed with a trust and are, in fact, a liability on your balance sheet: they can not be recognized as an asset or cashflow until you start actually delivering the service (i.e., playing NHL games). Bootstrap Finance 36. Becoming a reseller (this is big in the Internet age where you can set yourself up for practically nothing as an agent to resell services such as domain names or web hosting). There are a huge number of things that can be resold on the Internet—many sites generate large revenues by reselling ads powered by Google or other providers. Check out this silly site which generates up to 8,000 ‘facts’ on Chuck Norris and got 18 million hits in December 2005. Really the purpose of the site is to generate clicks (by asking people to rate the ‘facts’) which generates a new ad and maximizes revenues for the site’s owner: http://www.4q.cc/chuck/. Or have a look at this site: http://www.milliondollarhomepage.com/. Here the young person (age 21, based in the U.K.) apparently wanted to pay for his tuition and so he created a million pixel home page. You could buy an ad for $1 per pixel (minimum ten pixels) linked to your site. He sold all 1,000,000 pixels so guess what? He got his tuition and a lot more. I presume the ads are for a limited time so he also has the chance to resell the million pixels over and over again. The site gets a LOT OF TRAFFIC… Remarkably, this might be a sustainable business (aPersonal BusinessFor Life!) Bootstrap Finance 37. Importing. 38. Distributing products for other companies. Bundling their products and services in with your own can often add large margins for you since the cost of providing those products and services are often paid for by the suppliers: you take a percentage of the sales you create for them. This is ‘money for nothing’. Consulting companies use and markup sub contractors. Bootstrap Finance 39. Exporting. 40. Exploiting signage rights. We built right into the fabric of SBP ‘Architectural Signage’. $12.5 million per yr vs $3.5 million at the Arrowhead Pond. 41. No money down, land speculation/flipping. Buying more land than you require, developing a portion of it and selling the balance at a higher price per acre since it is more valuable due to the fact that you have added value in the form of the now completed first phase. Bootstrap Finance 42. Using OPM (other people’s money)—raising funds through vehicles such as limited partnerships. Using leverage in your transactions– borrowing money at rates that are less than the IRR (Internal Rate of Return) on your equity. This ‘gooses’ your returns. Finding deals and getting paid a finder’s fee, often in terms of equity at no cash cost to you, the finder. Bootstrap Finance 43. Asset flipping. Buying low/selling high. 44. Buying under power of sale or through foreclosure (again, mostly real estate related). 45. Buying distressed companies or divisions of companies and turning them around. Bootstrap Finance 46. Day trading. 47. Asset speculation. 48. Franchising. 49. Branchising. Bootstrap Finance 50. Training and uniform fees (e.g., GradeATechs.com required each of their contractors to be “Grade A” certified before they could provide services to clients and customers and get access to the billing system and the appointments calendar (a system called GASnet). To be certified the contractors had to pay in advance to take the course…) Bootstrap Finance 51. Pre-sales in real estate allows you not only to ask for cash deposits but also may give you access to Bank or private lender financing. For example, if you pre-sell 50% of your condo or townhouse project, you can usually qualify for construction lending where, in essence, your Bank or private lender is advancing you money to build the condos or townhouses on the basis of the strength of the credit ratings of your customers (buyers) and not your credit rating per se. Bootstrap Finance 52. The same type of thing can help you a lot if you are a manufacturing business—if you have a guaranteed supply contract with a credible client or customer, you can often finance against that. Bootstrap Finance 53. Land options—sometimes you can convince a landowner to give you an inexpensive option to buy his or her land at a fixed price at a later date. You can then use the time to set up a sales office and begin pre-selling. As discussed above, you can then take cash deposits (which are impressed with a ‘trust’ in that the money doesn’t really belong to you until you actually have delivered the condo, townhouse, single family home, whatever), finance against Agreements of Purchase and Sale executed by you and your clients, approach a Bank or private lenders for funding (often through a mortgage broker), arrange for private equity lenders or other investors to invest in your project, etc. Bootstrap Finance 54. I learned about a new method of bootstrap capital from my (then) 13 year old daughter, Jessica. One of her best friends lives in a single parent family. Her friend’s parent is unable to work and lives on a modest income. However, every year they are able to take a family vacation to a nice destination in a rented van. How do they afford to do that? Bootstrap capital. They take with them five other kids—each kid pays $250 for a week’s holiday—that’s a total of $1,250, enough for a camping holiday and some neat adventures too. It pays for the gas, the van rental, food and a few outings. The kids’ parents contribute cash and their children, Jessica’s friend and her parent go for ‘free’ but they provide the opportunity. Everyone wins… Bootstrap Finance 55. Finding money in the deal flow itself. When we built Scotiabank Place, the contractor was able to complete in 22 months instead of 30— the extra 8 months in a larger structure not only raised revenues over what the Sens could earn in the much smaller Ottawa Civic Centre, it saved about millions in interest payments owed on borrowed money during construction. Bootstrap Finance 56. Getting your partners to lend you the money you need to fund your portion of a new enterprise. A young entrepreneur became a 1/3 partner in a restaurant franchise in a great location because his other two partners loaned him his share of startup capital. Interest and repayments came out of his 1/3 share of profits. After seven years, he owned his interest free and clear. Why did the other two investors agree to this deal? Because the young entrepreneur was the operating partner of the restaurant– his participation at both the operating level and ownership level were crucial to the success of the new store. Here’s another example of how to turn sweat equity into cash equity. Bootstrap Finance 57. Create a Foundation or a Not-for-Profit to fund a worthwhile project you support/can become your front end marketing vehicle too. 58. Create one business that helps launch a 2nd. This is what former student Ryan North did with Dinosaur Comics which built a big community for and around him which let him start Project Wonderful which turned profitable 14 days after launch. Bootstrap Finance 59. Run a competition like Shopify.com did. It was called ‘Build a Business’ and it allowed startups to build their business on Shopify’s e-commerce platform. The fastest growing company after 3-months would win $100,000. But during the competition, nearly 1,400 new stores signed up which generated more than $3.5 million in sales on their platform and over 66,500 orders. The competition was widely covered on influential blogs including the NYT. So between margins generated during and after the competition and the value of the earned media they received, the cost of the competition would, in fact, be negative and, hence, a source of bootstrap capital as well as quality guerrilla marketing. (The actual cash cost of the competition was ~$15,000 > taking into account the profits generated by the new e-stores on the Shopify platform.) Bootstrap Finance 60. If your enterprise ever gets into trouble, sometimes you can just ask for cash—from existing clients or suppliers and they will just gift it to you. Surprised? Don’t be. They have a vested interest in your survival. Bootstrap Finance 61. You can get other types of support from suppliers, customers, your alma mater, business incubators or even friends and relatives or competitors (more on this later): they can provide you with low cost or no cost office or production space; lend you equipment for free; do some testing or R&D; even second staff to you for a period of time to help you get started. Sometimes, all you need to do is ask. Bootstrap Finance 62. You can make use of more social capital in the form of free or low cost advice or introductions (never make a cold call, for example: do some research on the target company and get an introduction if you can) from prestigious law and accounting firms, knowledgeable friends and relatives, former professors, advisory board members and many other sources provided they see future potential either, directly, from having a relationship with you and your new firm or through you to your own network of contacts. Bootstrap Finance 63. Many firms will use barter to get going: for example, a tech company might exchange running a server to provide communications and Internet services for a Landlord and other Tenants in the building in return for lower rent. Bootstrap Finance 64. Many types of Guerrilla Marketing are, in fact, also a form of bootstrap capital. GM happens when you substitute ‘brains for money’ when marketing your firm. Earned media (basically, free mainstream coverage and Internet exposure) is the desired goal of publicity stunts and other forms of GM. Earned media can be much more valuable than other forms of advertising: not only can you gain more exposure, faster and at lower cost, you also gain credibility for your product and services by having third parties talk and write about them. For more on GM, please see: http://www.eqjournalblog.com/?p=643. Bootstrap Finance 65. Strategic investors. If you look at your enterprise as part of a business ecosystem, you can often find others in that ecosystem that will help you. They may not be direct suppliers or customers, they could be suppliers to your suppliers or customers of your customers. You may find ways to exploit those relationships even if there are two or more degrees of separation from you. Strategic investment is usually easier and faster to get than VC funding. Bootstrap Finance 66. Co-opetition can be a huge source of capital. When Microsoft was under investigation by US and European authorities for its monopoly practices, it was to their advantage that the only viable alternative provider of operating systems at the time (Apple), survive. Apple’s on-going viability was in doubt and Microsoft loaned the firm the funds they needed to get through a tough time. Homebuilders like to hunt in packs—if a potential homeowner doesn’t like your product, they can often march across the street and buy from an alternative supplier and, of course, vice versa. So marketing by one becomes, in a way, marketing for all. So if you think you have a product with a lot of differentiated value, you could perhaps convince an established player to back you with some of their capital… Bootstrap Finance 67. Keep your operating or capital costs under control or reduce those costs. If you can’t keep your costs under control, you are DOA. Substitute independent contractors or subcontractors for employees. Reducing capital costs is a form of Bootstrap Capital since that is money you don’t have to raise. Bootstrap Finance 68. Entrepreneurs often can make a meal from the discards of others. They might find a large company, often a publicly traded one, and convince them to sell them an under performing division. It’s hard to imagine but Bloomberg did this recently to McGraw-Hill when they bought BusinessWeek for a measly $5 million, well within the range of what an entrepreneur could have accomplished. A large US-based company was closing up shop in Canada recently and it was possible to buy both its plant and Canadian business for somewhere between 30 cents and 60 cents on the dollar. Such transactions can lay the foundation for an entrepreneur’s entire career since they can often operate these castoffs more efficiently as well as raising sales and revenues faster. As a result, they can experience outsize returns. For a young person willing to move around, a good place to look would be in the publicly available documents of a publicly-traded firm. Bootstrap Finance 69. Entrepreneurs can use Web 2.0 tools which are amazing with so many available for free or practically no cost. These let you set up a website, blog, social media presence, do basic accounting, make and receive payments, process credit cards, backup your data, transfer data, do your accounting, what have you for no money or very little money. It is much easier to start a business in the 21st Century than at any other time in recorded history. Bootstrap Finance • Many student entrepreneurs when they are building their PBSs (Personal Balance Sheets), forget to add their equity and sweat equity. • For example: http://www.eqjournalblog.com/DealStructure. xls • Planning to open a new restaurant franchise in Baltimore w/ two partners • Needed to raise $1.8 million, part of it debt, part of it equity Bootstrap Finance • Wanted to start with a LTV (Loan to Value) ratio of 50/50 • They needed to raise $900k in equity • Bank loan for $900,000 was contingent on raising the balance in the form of equity • Two wealthy partners were prepared to put in $400,000 each • Bill had his sweat equity plus $70k in saving and soft loan from his aunt for $30k Bootstrap Finance • This would give each outside partner 44.4% of the business • Bill would get 11.1% • Bill, although still young (just 29), was the only partner with experience actually managing a pub • So he had leverage Bootstrap Finance • Partners were willing to enter into shareholder agreement that would let Bill buy more equity over time (to get him to a 20% share eventually) using a complicated formula based on the FMV of the shares less a certain percentage • Ugly deal for Bill Bootstrap Finance • Instead I suggested all go in as equal partners—1/3 each right from the get go • Bill’s concern was: “Where will I get $300,000? I put everything I own on the table just to get to $100k.” Bootstrap Finance • Answer is that you can often capitalize a business (or your share in it in this case) right from the deal flow itself. • It’s easy! Bootstrap Finance • I told Bill: “What you’re going to do is ask your partners to each loan you $100,000 for seven years and you’ll agree to pay them interest at 6.5% p.a. But for the first two years, while you’re building the business, there won’t be any principal or interest payments—interest will be capitalized. Then over the last five years, you’ll pay monthly principal and interest to them.” Bootstrap Finance • “Why would they agree to that?” Bootstrap Finance • Here’s why: 1. Bill is in possession of asymmetric information—he is the only skilled operator amongst the group and they need him. His partners should not even think about going into this business with no experience—they’ll get eaten alive by the competition. Bill has leverage he didn’t even realize. Bootstrap Finance 2. In many ways, his partners are better off by lending Bill their money to become an equal partner. A happy managing partner is a productive one. Plus they will have a Bill deeply ‘intricated’ into the business—he is on the hook personally for one third of the loan from the Bank and he owes them personally $100k each. That means, if the business goes broke, their risk capital has been reduced by $100,000 each—because Bill still has to pay it back using his own resources, which means he’ll have to go get a JOB to repay the loans. Bootstrap Finance 3. They are making a return on their capital (6.5%) which isn’t particularly great but for two middle-aged investors, it’s still better than most of their IRAs and other investments are paying (from 3.15% to 6%). Bootstrap Finance • • • • • From Bill’s point of view, this solution is elegant because, based on his cashflow projections, he will never actually have to pay these loans back himself. Huh? That’s because Bill estimates, based on his experience, that the franchise will produce a reliable stream of free cashflow of ~ $325,000 annually from year 3 to year 7. Bill’s share of free cashflow is one third or $108,333 less what he has to repay to his partners over the five years from year 3 to 7 ($54,383 annually). So his actual distribution is a net of $53,949 per year. So the business is actually repaying his partners, not Bill. Bootstrap Finance • • • During that period, Bill is still seeing a great ROE: he is receiving nearly $54,000 a year from the biz on his actual out of pocket investment of $100k or nearly a 54% p.a. rate of return. After he pays off his two partner loans, his ROE (in year eight) jumps to over 108% p.a. So Bill has, in part, bootstrapped himself to a one third ownership position in a valuable concession by looking for capital in the deal flow itself. He is on his way to becoming wealthy—he will have created an ‘annuity’ for himself—reliable, reproducible, recurring cashflow produced by an asset he owns or controls. More on Bootstrapping at: http://www.eqjournalblog.com/?p=1162