Chapter 30: Government and Market Failure

advertisement

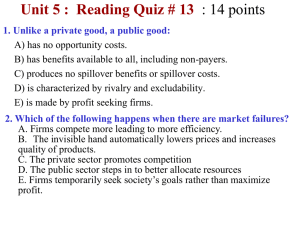

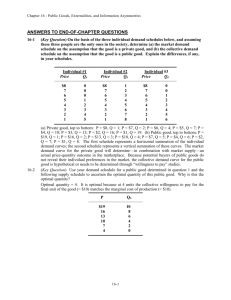

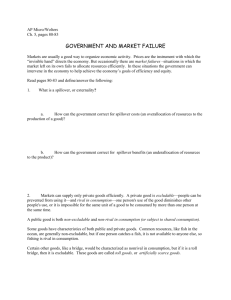

Chapter 30: Government and Market Failure Alexis Morfa Lizbeth Mendoza Public and Private Goods Private Goods -Rivalry means that when one person buys and consumes a product, it is not available for purchase and consumption by another person. -Excludability means that sellers can keep people who do not pay for the product from obtaining its benefits. Public goods have the opposite characteristics: nonrivalry and nonexcludability. -once a producer has provided the good, everyone can benefit -one person’s consumption of the good does not prevent consumption of the same good by others. Demand for Public Goods • The government has to try and estimate the demand through surveys or public votes • Surveys ask hypothetical questions about how much each citizen is willing to pay for various types and amounts of public goods than go without them. • The derived (demand) schedule shows the price people are willing to pay for the extra unit of each possible quantity. For a public good, the total willingness to pay is the vertical summation of each individual demand curve If a city has 30 acres of parkland, Joe is willing to pay $10 for one more acre and Moe is willing to pay $5 for one more acre, so collectively they are willing to pay $15 for one more acre of parkland. Supply and Optimal Quantity of a Public Good •Marginal cost rises as more of a good is produced because of the law of diminishing returns. •In the short run, government has fixed resources with which to “produce” public goods such as parks or national defense. As it adds more units of a variable resource (labor) to these fixed resources, total product eventually rises at a diminishing rate. •The collective demand curve measures society’s marginal benefit of each unit of the public good. •The supply curve measures society’s marginal cost of each unit. •The optimal quantity of a public good occurs where marginal benefit equals marginal cost. Cost-Benefit Analysis • Cost-benefit analysis is the method of evaluating alternative projects or sizes of projects by comparing the marginal cost and marginal benefit and applying the MC=MB rule. • The marginal-cost-marginal-benefit rule tells us which plan provides the maximum excess of total benefits over total costs or, in other words, the plan that provides society with the maximum net benefit. • Helps allocate resources between the private and public sectors to achieve maximum net benefit. Externalities • Externalities is synonymous with spillover (Chapter 5). An externality is a benefit or cost from production or consumption, accruing without compensation to non-buyers and non-sellers of the product. • An example of a negative externality, is the cost of the polluted air with breath. • An example of a positive externality, is having society immune to a disease, like polio. Spillover Costs • When there is any type of spillover costs, suppliers are overallocating resources. Meaning that firms are producing too many units. As a result, firms enjoy lower production costs and transferring cost to society. P($) St S D 0 Q Qo Overallocation Q Spillover costs Spillover Benefits • In this case, firms are underallocating their resources. As a result, equilibrium output is less than the optimal output. P($) St S Dt D 0 Qu Q Q Spillover Benefit Underallocation Fixing Externalities • Coarse Theorem: Is a theorem that states that government intervention is not need when; – Property Ownership is clearly defined – The number of people involved is small – Bargaining costs are negligible. • Liability Rules and Lawsuits: As a result of the government establishing and implementing rules and laws for private property, property owners can sue for compensation. Government Intervention: Correcting Spillover Costs • Is needed when externalities affect large number of people or when community interest are at stake. • Direct Controls: Raise the marginal cost of production because firms must operate and maintain certain standards. – Clean Air Act of 1990 • Specific Taxes: Charging taxes on specific or related goods. – Excise taxes in CFCs Graphs on Correcting Spillover Costs • Government can correct this spillover cost by either imposing taxes to firms or by using direct controls. Both shift S to St thus diminishing the overallocation problem. P($) St P($) St Spillover costs S S D 0 Q Qo Overallocation D Q 0 Q Qo Q Taxes or Direct Controls Government Intervention: Correcting Spillover Benefits • There are three ways government can correct this problem: – Subsidies to buyers – Subsidies to producers – Government provision: The government can provide the public good. Graphs on Correcting Spillover Benefits 1. Spillover benefit P($) St S 0 Qu D Q Dt 2. Correcting the underallocation of resources via a subsidy to consumers P($) St Q S Spillover Benefit Underallocation 0 Qu D Q Dt 3. Correcting the underallocation of resources via a subsidy to producers by x amount. P($) St Q Subsidy S x D 0 Q Qo Q Subsidy Tragedy of the Commons • Is a situation where people, firm, and society have no incentive to maintain these rights because they are held “in common”. As a result, society ends up with a degradation problem, such as pollution. • The government knowing this has come up what is called a “market for externality rights”. – For example pollution control agencies. Market for Pollution Rights S= Supply of pollution rights P($) 200 100 0 D2006 700 1000 D2012 Q Information Failures • Asymmetric information: unequal knowledge possessed by the parties to a market transaction. • In these markets, society’s scarce resources may not be used efficiently, thus implying that the government should intervene by increasing the information available to the market participants. Inadequate Information Involving Sellers • Inadequate information involving sellers and their products can cause market failure in the form of underallocation of resources. • Examples: gasoline market and licensing of surgeons. -The government has established a system of weights and measures, employed inspectors to check the accuracy of gasoline pumps, and passed laws against fraudulent claims and misleading advertising. -Qualifying tests and licensing for surgeons. Inadequate Information Involving Buyers • Moral Hazard Problem is the tendency of one party to a contract or agreement to alter her or his behavior, after the contract is signed, in ways that could be costly to the other party. • Examples: -Drivers may be less cautious because they have car insurance. -Guaranteed contracts for professional athletes may reduce the quality of their performance. Inadequate Information Involving Buyers… Cont’d. • Adverse Selection Problem is when information known by the first party to a contract or agreement is not known by the second and, as a result, the second party incurs major costs. • Example: An insurance company offering “no-medical-exam-required” life insurance policies may attract customers who have a life-threatening diseases. Qualification To overcome information difficulties without government intervention: • Product warranties • Franchising • Periodicals, such as Consumer Reports and Mobil Travel Guide.