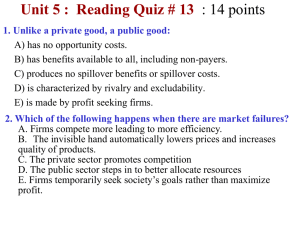

PUBLIC GOODS

advertisement

Chapter 4: The Market System Characteristics of the Market System: 1. Private Property -- the name “capitalism”: most capital is privately owned -- incentives to invest, innovate, trade, and maintain come from ownership -- in addition to land, property means tangible goods and intellectual property 2. Freedom of Enterprise -- firms can obtain and use resources to produce and sell the products they want in the places they want. 3. Freedom of Choice: -- Owners of property can use property as they choose -- Workers can choose education/training and occupations -- “consumer sovereignty”: personal income can be spent maximize personal utility Characteristics of the Market System (cont.) 4. Self-interest -- firms, workers, consumers 5. Competition -- large numbers of buyers/sellers prevent the drawbacks of monopoly/monopsony 6. Prices -- equilibrium price (and quantity) by market supply and demand -- a change in price signals a market change -- quick response to market signals results in profits and income 7. Reliance on technology and capital goods -- direct methods of production are often inefficient -- “roundabout production”: using technology and capital to increase efficiency Characteristics of the Market System (cont.) 8. Specialization -- Division of Labor: allows workers to specialize; specialization triggers refinement and efficiency -- Geographic Specialization: regional crops; international competencies 9. Money -- Money substitutes for barter (which requires a coincidence of wants). -- Money is socially defined, has little inherent value 10. Active, but Limited, Government shortcomings of the market system include: • externalities • cyclical instability • inequitable income distribution • allowance for monopoly power Government involvement can increase the effectiveness of the economic system. Chapter 5: The U.S. Economy 2012 U.S. GDP ≈ $15.5 trillion per capita: $49,226 THE PRIVATE SECTOR HOUSEHOLDS The Distribution of U.S. Income: • Wages and salaries approx. 70 % • Proprietors’ income ≈ 30% - e.g. earnings of self-employed and capitalist income (e.g. realized investment gains) Personal Distribution of Income and Wealth • Top 20% (“quintile”) of U.S. households earn about 50% of total income • Top 1%: earns 24% of total income (9% in 1977) & owns 40% of total wealth (33% in 1977) • Bottom 20% earns less than 5% of total income • Bottom 80% owns 7% of wealth • Median net worth: U.S. households, $93,100; U.S. Congress members, $891,506 Spending of Income • Personal taxes (approx. 15%) • Savings (approx. 0% … but >$5 billion) • Durable goods (10%) • Nondurable goods (25%) • Services (50%) BUSINESSES Plant: physical location where “production” takes place (factory, farm, store, office, etc) Firm: business organization that owns and operates the plant(s). Industry: a group of related firms producing the same or similar products. Horizontal integration: many plants in the same stage of production (e.g. retail stores) Conglomerate: a firm that owns plants in different industries (e.g. Newell Rubbermaid) Vertical integration: a firm that owns plants at different production stages (e.g. Perdue) Legal forms of businesses: Sole proprietorship Partnership Corporation (legal entity distinct from its owners) Principal-Agent Problem Refers to the difficulties that arise under conditions of incomplete information when a principal hires an agent. The principal-agent problem is found in most employer/employee relationships, for example, when stockholders hire top executives of corporations. The Public Sector: Government’s Role The government’s role in the economy includes: 1. providing a legal structure 2. maintaining competition 3. the redistribution of income 4. promoting stability 5. providing public goods and services 1. Providing legal structure: • Legislative, judicial, and – to some extent – executive branch • enforce contracts, mediate disputes that arise in the market 2. Maintain / support competitive markets: • Justice Department (DOJ), Federal Trade Commission (FTC) • avoid the shortcomings of monopoly enact and enforce anti-monopoly laws (Sherman Act of 1890) • regulate in cases of natural monopoly 3. Gov’t Redistribution of Income • transfer payments such as welfare, social security, unemployment, and Medicare • price ceilings, price floors, subsidies • progressive taxation 4. Promoting Stability • Limiting unemployment government spending; lowering taxes and interest rates • Controlling inflation Inflation: occurs when consumers try to buy more than can be produced government may raise taxes, increase interest rates 5. Gov’t Resource Reallocation: Public goods and Services “market failure”: when the market system produces too much or too little of a good or service. Spillover Costs (a.k.a. negative externalities): • are incurred when the market overallocates resources to production of a good. • Pollution is a spillover cost of many production methods. • Car accidents may be a spill over cost of a restaurant serving alcohol. • The cost is not fully paid by the firm but “spills over” to third parties. Spillover Benefits (a.k.a. positive externalities): • Benefits of a product realized by more people than just the consumer • Education and public health vaccinations produce spillover benefits. • The market system underallocates resources to goods that produce spillover benefits. Private goods are divisible; subject to the “exclusion principle”: those unable/unwilling to pay are excluded from the benefits of the product Public goods are indivisible; not subject to exclusion: • a lighthouse, public park, a police force, Main Street. • “free riders” necessitate public goods Government Revenue and Spending Federal Government receipts come from several sources: 1. Personal income tax (≈ half of receipts) federal income tax is progressive … higher incomes taxed at a higher % 2. Payroll taxes (e.g. social security contributions; ≈ one-third of receipts) 3. Corporate income taxes (≈ 10%) 4. Excise taxes (on alcohol, tobacco, phone service, gasoline, etc.; ≈ 4%) Federal Government Expenditures emphasize four important areas. 1. Income security (social security, welfare, etc.) 2. National defense 3. Health (medicare, medicaid, etc.) 4. Interest on national debt. State revenues primarily come from 1. sales taxes (≈ 50%) & 2. income taxes (≈ 33%) State spending goes for public welfare, education, highways, and health care. Local government revenue is primarily from property taxes. Largest component of local government spending is education (≈ 43%) Chapter 30: Government and Market Failure Why doesn’t the private sector provide the goods and services provided by the public sector? What is the governments role in better allocating scarce resources? PUBLIC GOODS • indivisible, no exclusion principle, free-rider problem. Demand The demand for public goods differs from the market demand for private goods. a “phantom” demand; consumers do not pay for public goods directly Supply The supply curve for a public good is its MC curve. Like private goods, law of DR applies. The optimal quantity of a public good can be determined equating MC (supply) with the MB (demand). challenging because the benefits of a public good are often difficult to measure MARKET FAILURE EXTERNALITIES • spillover costs represent an overallocation of resources • spillover benefits represent an underallocation of resources Minimizing the Impact of Spillovers: • direct government involvement production of public goods taxes/subsidies for negative/positive externalities • bargaining or mediation (with or without direct gov’t intervention; Coase Theorem) • litigation to assign liability (plaintiffs may be gov’t or individuals) • Externality markets (“cap and trade”) Graphically: • Spillover costs are shown as “extra” supply • Spillover benefits can be shown as allocatively insufficient demand or supply. MARKET FAILURE INFORMATION FAILURE In addition to externalities and the need for public goods, “information failure” is another shortcoming of the market system. Government intervention is needed when: • Buyers or sellers have incomplete or inaccurate information, and, • the cost of obtaining good information is prohibitive. One party to a transaction may have better information (unfair advantage) than the other: • need for Dep’t of Weights & Measures (gov’t regulation of gas pumps, supermarket scales) • licensing requirements ensure that certain “sellers” meet minimum standards (doctors & nurses, barbers, teachers, boiler inspectors, etc.) • need for OSHA (Occupational Health & Safety Administration) to protect employee safety Information Failure (cont.) • “moral hazard problem” a person insulated from a risk acts differently than he may have if he was exposed to the risk (e.g. NFL player v. MLB player) • “adverse selection problem” information asymmetry results in significant costs to one party (e.g. used car dealer or injured professional athlete) The private sector – without government involvement – often helps to mitigate the problem of information failure: • Product warranties • credit checks • “Consumer Reports” • quality reviews of newspaper/TV/internet • amazon.com and eBay ratings for sellers THE LORENZ CURVE AND GINI COEFFICIENTS (not from Ch. 4, 5, 30; p669 – 670) LORENZ CURVE • graphical representation of inequality - (developed by U.S. economist Max Lorenz 1905) • Distance of curve from the straight diagonal line represents inequality. GINI COEFFICIENT • commonly used measure of income inequality • calculated by dividing the area between the actual curve and the line of perfect equality by the total area of the triangle beneath the line. • coefficient of zero expresses perfect equality (everyone has the same income) • coefficient of one expresses maximal inequality (one person has all the income) • difficult to interpret as a single value; more compelling as a relative value US Gini coefficient: 1970 – 0.394 1980 – 0.403 1990 – 0.428 2000 – 0.462 2010 – 0.468