AP Macroeconomics

advertisement

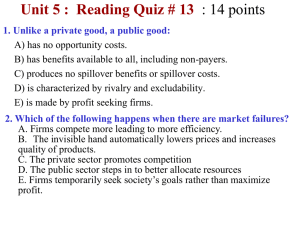

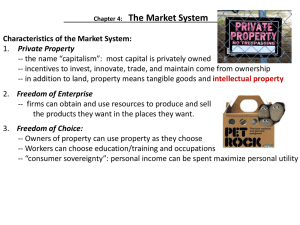

AP Macroeconomics Chapter 5: Adding the Government to the Economic Equation 5 key roles of Government 1-legal framework 2-maintain competition Monopolies vs. natural monopolies 3-redistribution of income Transfer payments Market intervention taxes 4-reallocation of resources Market failure Spillovers or externalities CAN BE A SPILLOVER COST OR SPILLOVER BENEFIT Spillover costs How to fix this?? Spillover Benefits Gov’t wants more of a good produced because it is good for society Market demand curve understates total benefits How to fix this? TYPES OF GOODS PRIVATE Competitive market Rivalry excludability PUBLIC No rivalry No exclusion Free rider problem QUASI PUBLIC -could be done thru market system But would be underproduced 5th-promote stability UNEMPLOYMENT What can the gov’t do to fix this? Gov’t spending Taxes Central bank* INFLATION What can the gov’t do to fix this? Gov’t spending Taxes *central bank Adding Gov’t to the Circular Flow Net Taxes= Taxes in reverse Exhaustive vs. Non-Exhaustive Purchases Exhaustive Directly absorb resources thru gov’t purchase Examples: Non-Exhaustive Transfer payments No current use of resources No contribution to domestic output Gov’t Spending vs. Revenue Taxes Taxes levied on taxable income after exemptions Progressive Marginal tax rate State and Local Gov’t State Gov’t Revenue 47% sales & excise 36% income tax Expenses Local Gov’t Revenue 36% education 25% public welfare 8% health/hospitals 72% property taxes 17% sales & excise Expenses 44% education 12% health/welfare & hospitals Other— state/fed/utilities