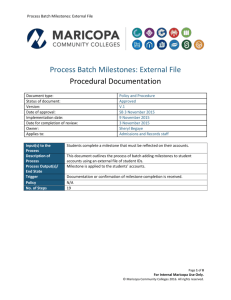

here - UC Davis Graduate School of Management

advertisement

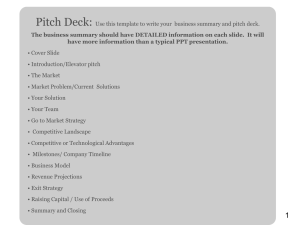

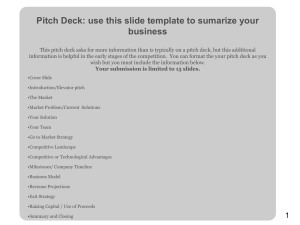

The template Use this template to begin crafting the presentation and pitch around your venture. Feel free to augment, rearrange, etc... but this is the general outline most investors are expecting to see so stray at your own risk. The font is 30pt for a reason: be concise. The purpose of this template is to get people interested so they want to learn more. It’s to get the next “meeting” just like a resume gets you an interview. It allows you to quickly communicate to and learn from your audience. Try to avoid filling your slides with too much text – people won’t have time to read it (or be able to read it if you are forced to use small fonts) and the presentation is about what you say. Either way, keep it simple. Other tips: * One slide per topic; don’t mix topics on a single slide; don’t repeat yourself, you don’t have time * Don’t make people read or think– if you do they are not listening to you, so, again, keep it very simple. * A person should be able to get a snapshot from your slide in 5 seconds and then listen to you. *Use the heading of each slide to convey something real, e.g., what you want the person to conclude from the slide. Try to use images where possible to convey your message. Slides • Title Slide • Introduction (elevator pitch) • Problem & Solution • Sales & Marketing • Business Model and Pricing • Technology • Competition • Revenue Projections • Team • Funding & Milestones • Summary & Next Steps 1 [your company here] your contact information here The introduction Elevator pitch In approximately 50 words or less, describe what the company does, for whom, and why it’s important (i.e., valuable to that customer). You can also very briefly mention any significant accomplishments/milestones reached so far, e.g. have license to patent, proof of concept completed, prototype completed, tested with name brand customers, etc. This can attract interest for the remainder of the presentation. 3 The Problem & Value Proposition The Problem & Solution On this page, describe the customer and their problem (“pain”) in as clear and compelling language possible. Demonstrate you know the market and customer: How much money/pain is the current problem costing the customer? How much would they save/make by using your solution? Also on this page, describe your solution in as clear and compelling language possible. Talk about the benefits of the solution to the customer (not the technical features) and how it provides value based on the problem you’ve identified. Convince people it is a “must have”, not “like to have” solution. 4 The Market The market and sales On this page, describe the particular market segments you are pursuing and identify which you will pursue first. The first one is most important; if it is not successful you may not have the opportunity (resources) to attack the others. Concentrate on talking about this – it should make the business. (A pie chart can be useful to show segments and size.) Who is the customer? What is the size and growth of this segment. 5 Business Model and Pricing The business model Describe how your company will make money solving the customer’s problem. Who will pay for the solution? How will they pay (per unit, subscription, transaction fee, advertising, etc...) Describe your pricing structure and how much you expect to generate in revenue from each customer. 6 The Technology The technology On this page, describe how your solution works (without revealing any enabling information and definitely in language a non-technical investor/advisor would understand). What makes this solution effective, unique, and/or defensible from competitors? Why is it robust and scalable? Why is it difficult to duplicate? Why does it translate into a sustainable business model? Is there any IP protection? 7 Getting To The Market Go to Market Stratgy Describe how you will get to your first market segment: What kind of distribution: direct, channel, distributors, representative, partners? How will you launch the product: quietly to a few to establish a beachhead, quickly to gather market share (e.g., eyeballs are key to many web based companies with advertizing business models) ? What kind of communications (advertising, PR, promotions, web site)? 8 Competitive Landscape Your Company Feature 1 Feature 2 Company 1 Company 2 Feature n The Competition List any direct competitors as well as competing alternatives (including the status quo). Do your research here. Who are they? List them. What makes you different? Describe it! What gives the company an advantage? Describe it too! Company n Depending on the product and competitors it is sometimes easier in terms to depict the competitive landscape of specific features that add substantial value compared to your competitors. This can be shown easily by careful consideration to the row and column headings in the illustrated table. 9 Revenue Projections Revenue Projections A simple table that identifies some of the key metrics of the business (revenue, net income, customers, headcount) and financial information with measurements of financial progress (revenue, gross profit and net profit). Year 1 Year 2 $ 60 $ 401 net income $ -325 $ -858 customers 5 13 revenue (000) headcount ** All $ are in 000 10 14 People often use EBITDA (earnings before deducting of interest, tax, depreciation, and amortization expenses) in place of Net Income because include Year 3 it doesn’tYear 4 these deductions Year 5 and thus is a better view into the mechanics of the business (and not the taxes). $ 1,555 $ 2,401 $ 3,000 A key value of this table is that it reflects how much money the company will need and how $ -85 it will make, $ and -625how other $key -1,500 much metrics (like customers or employees) line up with the financials. 30 40 43 Revenue should be in line with your vision. In 15 words, don’t tell 27 investors it’s conservative 34 other – it always get sniggers. When net income (or EBITDA) turns positive, you can also describe it as a percentage of revenue. Most investors will be making this calculation in their heads anyway. 10 The Team The team On this page, describe your current (and planned) management team and advisors. Most importantly, describe the accomplishments of the founders that are meaningful to the venture, and expected accomplishments that future members can hang their hat on. It is more to know what people have succeeded in, than the years they have been doing it. Be realistic, and be ready to ask for help in identifying the right people to fill out the team. Advisory boards and outside directors are important to establish your credibility and connections; but convince people they really contribute and are not their in name only. Also, be wary of too many names that the audience does not relate to – it just takes up time you don’t have. Acknowledge shortcomings and interim solutions. 11 Funding & Milestones Funding & Milestones This is the essence of your financing plan. Raising funds, whether by grant or from investors, is about meeting milestones that increase the value of the company. Each milestone should be set, then reached, so that it is compelling enough to inspire the next round of money. • Proof of Concept – 6 months • SBIR Phase 1, $75K Typical milestones might be: •Completing a prototype •Getting a first customer •Scaling Marketing/Distribution to extend reach having proven the business model/market/need •Cash flow break even • Build Prototype – 12 months • SBIR Phase 2, $750K Here you don’t need to cover every milestone, just the one for now and the next one plus an estimate of how much you need to raise eventually to become self sufficient – cash flow break even. • Angel Round – 6 months, $500K Associated with each milestone you’ll need a certain • Get 2 Reference Beachhead Customers amount of investment/grant money. Always try for 20% to 50% more than you think you need since 1) your environment (customers, vendors) will never allow you to move as fast as you project, and/or 2) you’ll have some unanticipated internal stumbling blocks somewhere. Sure you may give up more equity, but that has less risk than failing to meet a milestone and then trying to get more money! • $7.5MM needed to reach cash flow break even 12 Summary and Next Steps Summary and Ask Summarize your venture and status, and be clear in what you are asking for from this audience. If you are pitching to investors, tell them again what funding you need now and whether it is for equity or a convertible note. If you are pitching to potential advisors or employees – be clear about what you’re asking of them. your contact information here 13