here - UC Davis Graduate School of Management

advertisement

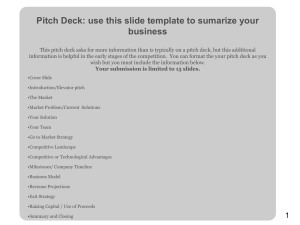

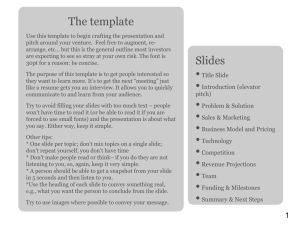

Pitch Deck: Use this template to write your business summary and pitch deck. The business summary should have DETAILED information on each slide. It will have more information than a typical PPT presentation. • Cover Slide • Introduction/Elevator pitch • The Market • Market Problem/Current Solutions • Your Solution • Your Team • Go to Market Strategy • Competitive Landscape • Competitive or Technological Advantages • Milestones/ Company Timeline • Business Model • Revenue Projections • Exit Strategy • Raising Capital / Use of Proceeds • Summary and Closing 1 [your company here] Date Purpose of the presentation (maybe) name & title of the presenter Include a one line company slogan The Market On this slide, you are setting up your market so that immediately after, you can discuss the pain points and why your company can solve this! Demonstrate that you understand the market and customer Total Addressable Market What is the Overall Market? • What is the size and definition of the market? Units? Revenue? Is it growing? Are you entering an existing market or creating a new one? Define your Total Addressable Market • What’s Your Target Market? How can the Overall market divided? Geographic, Demographic, Behavioral, psychographic • What are the attributes of each customer that makes them unique, and how can you extrapolate on those features to define a market segment? Define your target customer and key characteristics • Who has the problem you are trying to solve? Ex. Small vs. Large businesses, independents vs. agencies, examples of ideal clients or individuals Potential Customers/Clients What are the current needs of your customer? 3 The Introduction/Elevator Pitch Your front slide is important in order to grab the attention of your audience as well as give an introduction to your company. Briefly and succinctly cover: 1 2 3 What is your vision and your ultimate solution for your customers? What is the business? Service? Product? What is the core problem you are solving for the customer? 4 Market Problem / Current Solutions This is where you define the customer’s problem and show that there are existing solutions in the marketplace that are just not cutting it . . . Industry reports and news articles Customer quotes What is the Big Market Problem or Big Unmet Need? Are the Current Marketplace solutions solving the existing unmet need or problems? Are they causing additional headaches? Clearly demonstrate the pain of the problem – how much pain and money is this costing the customer Convey the strong desire that is being unfilled, it’s not enough just to say it The market has either changed or the existing solutions do not fulfill or solve the big needs or problems of the customers – this is the opportunity 5 Your Solution Present the solution. This is your value proposition and why your company can solve this problem more elegantly, more effectively, less expensively or more quickly Describe your Solution and convey its core value proposition to the client • Brief and centered around the customer who has the identified problem. • Discuss the benefits of the solution to the customer (and detailed technical info IF APPLICABLE) and how it provides value based on the problem you’ve identified. Demonstrate or illustrate your solution by bringing it to life Live Demo Screen Shots Video Tell a Story About a future client or an example of a future client Convince people this is a “MUST HAVE” solution, not a “nice to have” solution 6 Your Team Describe your current (and planned) management team and advisors Team Members: current, planned •Current team members •Assess and acknowledge skill gaps & future needed hires Accomplishments, Experience, Education •Describe experience, education, and accomplishments that are meaningful to the proposed venture •Be realistic Advisory Boards, Outside Directors •Important to establish credibility and connections •Actual contributions are needed not just names only Why are you the right team to execute on this business plan? What is your particular expertise and passion? 7 Go To Market Strategy How will you launch the product and quickly gain momentum and market share? Targeting Strategic Partnerships / Channel Marketing Customer Retention • • • What segment will you target first and why? What does the sales cycle look like and how will you obtain your customers? What is your potential to leverage, scale, and grow quickly? • • • Channels: How to reach / market to customers? Strategy: How to convert, acquire or close clients? Unique Strategic Relationships / Partnerships? • Describe your marketing, communications and advertising strategy? What sort of time/energy/expenses do you need to expend to generate revenue? • • • • How to keep clients and build recurring sales? Average cost to acquire a customer, average revenue per user/customer What is the lifetime value of a customer? 8 Competitive Landscape This is where you characterize your competition and who already is addressing this problem in the marketplace. Make sure you are thorough in your research. For example, don’t miss Apple, Google, or Microsoft as a competitor! List any direct competitors and competing alternatives (including the status quo). •Do your research here. Who are they? List them. •How are you different? Describe it. Your Company Feature 1 Feature 2 Company 1 Company 2 Feature n •What gives your company an advantage? Make sure you highlight. If possible, show the competitive landscape graphically •Depict any specific features that add substantial value compared to your competitors. Company n 9 Competitive or Technological Advantages On this page, describe how your solution works without revealing proprietary information and in language a non-technical investor/advisor would understand •What makes this solution effective, unique, and/or defensible from competitors? •What are the competitor’s advantages or weaknesses? •What is your current competitive advantage, and why is it robust and scalable? Why does it translate into a sustainable business model? •What is your “Moat” or barrier to entry (e.g. money, time, expertise, unfair competitive advantage)? Is what you are creating difficult to duplicate? •Is there any IP protection? Do you have any patents? •Are there any key relationships or partnerships you have? 10 Milestones / Company Timeline Milestones are important to trace company development as well as to signify accomplishments to investors. Each milestone should be compelling enough for an investor to know the company is progressing Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Raise Angel Round of Financing Proof of Concept Prototype Developed and Completed Product Refinements Product Launch 1.0 Complete Business Plan 1st Customer 100 Customers! Cash Flow Positive Develop a meaningful timeline for the stage of your company. You don’t need to cover every milestone, just the one for now and the next one plus an estimate of how much you need to raise eventually to become self sufficient – cash flow break even. Raising funds, whether by grant or from investors, is about meeting milestones that increase the value of the company. Each milestone should be set, then reached, so that it is compelling enough to 11 inspire the next round of money. Business Model Describe how your company will make money solving the customer’s problem by describing the key revenue streams and profit model •Define your Revenue Model. Who will pay for the solution and how will you make money? • What are the key revenue streams? • Discuss the scalability of your business model. Is this high volume? Low volume? Does it lend itself to rapid expansion? • How many customers do you expect to capture and what is their buying decision cycle? • Is there recurring revenue? What is the frequency? • Show an example using basic revenue/math •Describe your pricing structure and how much you expect to generate in revenue from each customer. • Discuss pricing - per unit, subscription, flat fee? % fee? transaction fee, advertising •Define your financial projections. Specify, fixed costs , variable costs and spell out financial projections. • Is your new venture profitable, or, more likely, is it going to reach profitability in the near future? • What are my initial costs to bring the product to market • How much does it cost to run the business? Is there a big difference between gross revenue and net revenue? 12 Revenue Projections A simple table that identifies some of the key metrics of the business (revenue, net income, customers, headcount etc.) and financial information with measurements of financial progress (revenue, gross profit and net profit). Some General Guidelines # Years Projected: • Startups: 6 year projections (accounts for ~1 year of getting started) • Early-mid stage: 1-2 year historical, 3-5 year projections Target Market Size vs. Acquired Clients: It’s important to see how much money the company will need and how much it will make, and how other key metrics line up with the financials. EBITDA is often used in place of Net Income Revenue should be in line with your vision and be realistic, yet optimistic Some general guidelines: • Total # Clients in Target Market (Show each year with growth) • # Clients Acquired or Free Users vs. Revenue Generating Users (shows conversion rate) • % Penetrated (be realistic: growing from 0% to 1%-5% penetration makes sense, 50%-100% is unreasonable) High Level Financials: • Revenue, Expenses, EBITDA, EBITDA Margin % • Optional: Break out key revenue streams or Gross vs. Net Revenue • Optional: Break out key expenses (Ex. # Employees) 13 Exit Strategy You need to think about what is ultimately going to happen to your company – will it be acquired? Will it go public? Will it exist as a going concern? Acquisition: (Most likely exit option) Name potential companies (any unique relationships with them?) Name types / categories of companies that could acquire you Why would they acquire you, how do you fit into their strategy? Why won’t they try to build it themselves? Financial Buyer: Will your company generate excess cash flow that could make it attractive to financial buyers to generate a return? IPO: The least likely exit for a company, but a possibility. Often not preferred to founders or investors compared to top two choices, due to required holding period and volatility 14 Raising Capital / Use of Proceeds What is the ask? Capital? Intros? The goal of the meeting? This can vary depending on the stage of your company. BE CLEAR in what you are asking for • • Capital Raise: Always try for 20% to 50% more than you think you will need. Be transparent about what you need now • Stage / Size? Ex. Seed Round: up to $500K, Series A: $2-3M, what is the structure? • Investment Terms and type: Ex: Pre-Money Valuation Expectations / Range, Discount into next round?, Dividend / Interest Rate?, Equity or Convertible debt? • Current Investors in Round: Founders, Key Angels, VCs • Prior Investment Rounds: Size? Investors? Valuation? Key Terms? • Monthly Burn Rate? / How long will new $ last (runway)? Use of Proceeds: (Name It / $ Amount / % of Capital Raised) • Sales & Marketing • Hire key employees and founders salaries • Build out / further develop technology • Legal and accounting work e.g. file patents • What is needed to achieve Milestones: 1st Client? Get to Breakeven? 3x Rev Growth? Things to remember: you will never move as quickly as you project, and you will have multiple unanticipated stumbling blocks somewhere 15 Summary & Closing Your last slide is important to give a review of what you have presented and leave a lasting impression of your company 1 2 3 4 5 6 16