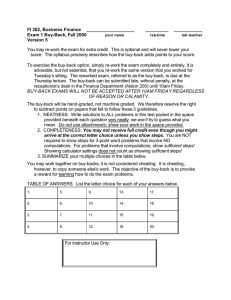

Lecture 5 Problems

advertisement

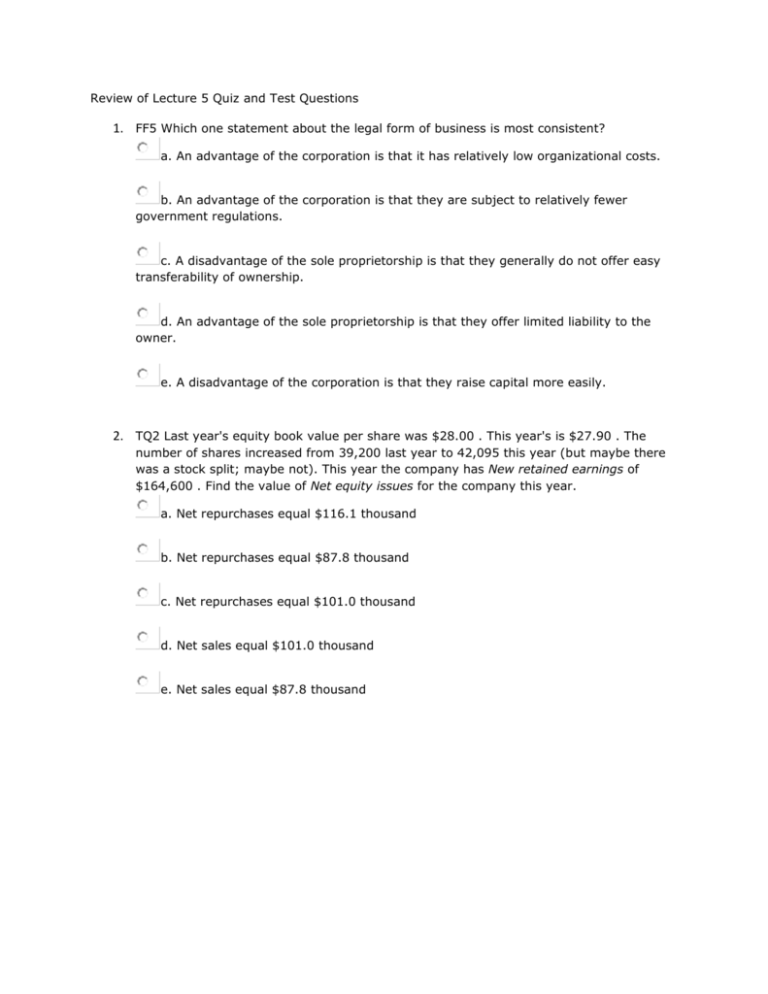

Review of Lecture 5 Quiz and Test Questions 1. FF5 Which one statement about the legal form of business is most consistent? a. An advantage of the corporation is that it has relatively low organizational costs. b. An advantage of the corporation is that they are subject to relatively fewer government regulations. c. A disadvantage of the sole proprietorship is that they generally do not offer easy transferability of ownership. d. An advantage of the sole proprietorship is that they offer limited liability to the owner. e. A disadvantage of the corporation is that they raise capital more easily. 2. TQ2 Last year's equity book value per share was $28.00 . This year's is $27.90 . The number of shares increased from 39,200 last year to 42,095 this year (but maybe there was a stock split; maybe not). This year the company has New retained earnings of $164,600 . Find the value of Net equity issues for the company this year. a. Net repurchases equal $116.1 thousand b. Net repurchases equal $87.8 thousand c. Net repurchases equal $101.0 thousand d. Net sales equal $101.0 thousand e. Net sales equal $87.8 thousand 3. BA12b At year-end 2525, Stockholder's Equity is $4,500 and there are 180 common shares outstanding. For 2526, sales should equal $22,500 , the net profit margin (= net income / sales) is 5.50%, the payout ratio (=dividends / net income) is 30%, and no shares are issued or repurchased. If the equity price-to-book ratio at year-end 2525 is 1.38, and it moves to 1.29 at year-end 2526, what is the shareholder's annual rate of return for 2526? a. 11.9% b. 15.9% c. 17.4% d. 14.4% e. 13.1% 4. BA13 On January 1, the company has Total assets of $7,700 financed by Debt of $3,900 and Stockholders' equity of $3,800 ; for 170 common shares outstanding, the equity price-to-book ratio is 0.74. During the subsequent year the company does not issue new shares. They also expect an asset turnover ratio (= Salest / Total assetst-1) of 2.7; a 7.10% net profit margin; and a 40% payout ratio. If the year-end equity price-to-book ratio were 0.81, what year-end shareprice is forecast? a. $15.25 b. $16.78 c. $22.33 d. $18.45 e. $20.30 5. BA14 At year-end 2525 the company has total assets of $8,400 financed by Debt of $4,300 and Stockholders' equity of $4,100 . For year 2526 the company forecasts an asset turnover ratio (= sales2526 / total assets2525) of 2.6, a net profit margin of 5.1%, and a dividend payout ratio of 45%. There are 160 shares outstanding and, at year-end 2525, the price-to-earnings ratio is 10.7. Throughout year 2526 no additional shares are issued, and the price-to-earnings ratio remains unchanged. Suppose that the net income is 6.3% larger in 2526 than in 2525. Find the shareholder annual rate of return for year 2526. a. 11.9% b. 8.9% c. 8.1% d. 9.8% e. 10.8% 6. BA9c The Company balance sheet for year-end 2525 shows that Total assets of $7,400 include Plant, property, & equipment (PP&E) of $5,700 . The assets are financed by Debt of $1,800 and Stockholders' equity of $5,600 (there are 800 shares outstanding). For year 2526 the company forecasts sales of $28,860 , a net profit margin (= net income / sales) of 7.6%, a dividend payout ratio (=dividends / net income) of 75%, and depreciation that is 22% of beginning-of-year PP&E. Throughout year 2526 Debt remains unchanged. The company expects to make capital expenditures such that for the yearend 2526 balance sheet PP&E is $200 larger than it is on the 2525 balance sheet above. Suppose the Capital expenditure is financed exclusively by issuing new equity at the stock price of year-end 2525. Also, suppose the equity price-to-book ratio is constant at 1.3 . Find the stockholder's annual rate of return for year 2526. a. 42.6% b. 35.2% c. 32.0% d. 38.7% e. 29.1% 7. BA11a For year 2526 the company forecasts sales of $55,000 , an asset turnover ratio (= salest / total assetst-1 ) of 1.5,a net profit margin (= net income / sales) of 5.5%, a dividend payout ratio (=dividends / net income) of 80%, and a debt-to-equity ratio (= total debt / stockholders equity) of 138%. The company expects the equity price-to-book ratio of 1.50 to remain constant. Contrast for year 2526 the shareholder's book returnon-equity (= net incomet / stockholder's equityt-1 ) and market rate of return. a. the book return-on-equity is 26.0% whereas the market rate of return is 16.6% b. the book return-on-equity is 19.6% whereas the market rate of return is 14.4% c. the book return-on-equity is 22.6% whereas the market rate of return is 14.4% d. the book return-on-equity is 19.6% whereas the market rate of return is 16.6% e. the book return-on-equity is 26.0% whereas the market rate of return is 14.4%