Lecture 6 Problems

advertisement

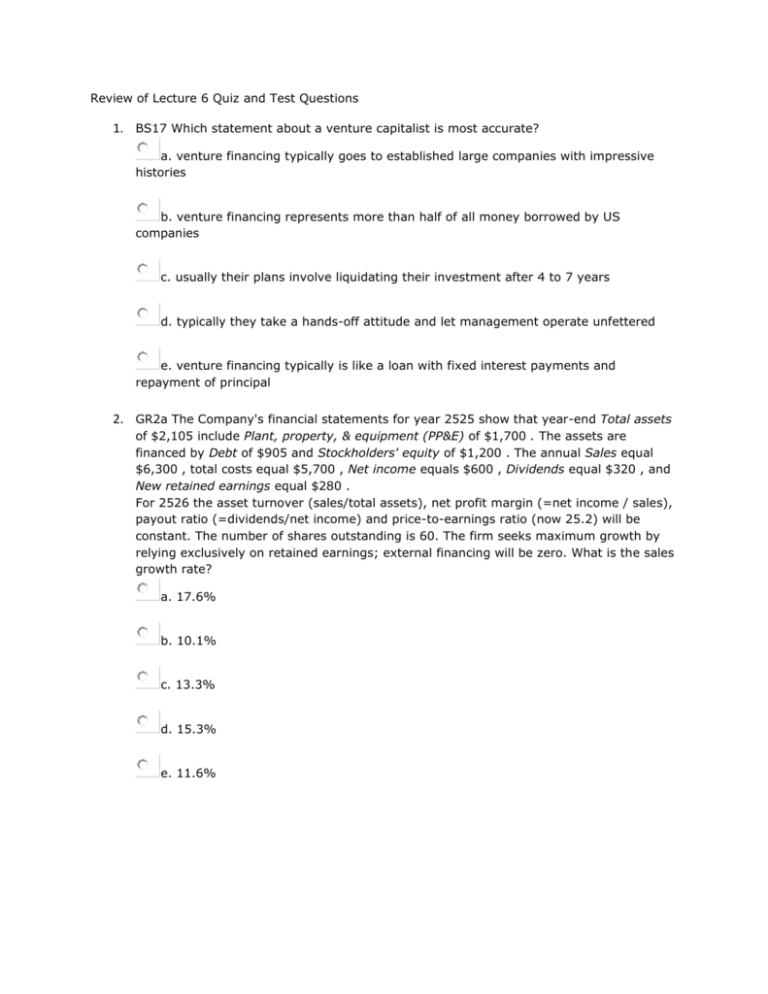

Review of Lecture 6 Quiz and Test Questions 1. BS17 Which statement about a venture capitalist is most accurate? a. venture financing typically goes to established large companies with impressive histories b. venture financing represents more than half of all money borrowed by US companies c. usually their plans involve liquidating their investment after 4 to 7 years d. typically they take a hands-off attitude and let management operate unfettered e. venture financing typically is like a loan with fixed interest payments and repayment of principal 2. GR2a The Company's financial statements for year 2525 show that year-end Total assets of $2,105 include Plant, property, & equipment (PP&E) of $1,700 . The assets are financed by Debt of $905 and Stockholders' equity of $1,200 . The annual Sales equal $6,300 , total costs equal $5,700 , Net income equals $600 , Dividends equal $320 , and New retained earnings equal $280 . For 2526 the asset turnover (sales/total assets), net profit margin (=net income / sales), payout ratio (=dividends/net income) and price-to-earnings ratio (now 25.2) will be constant. The number of shares outstanding is 60. The firm seeks maximum growth by relying exclusively on retained earnings; external financing will be zero. What is the sales growth rate? a. 17.6% b. 10.1% c. 13.3% d. 15.3% e. 11.6% 3. EFN2b The Company's financial statements for year 2525 show that year-end Total assets of $3,460 include Plant, property, & equipment (PP&E) of $2,200 . The assets are financed by Current liabilities of $460 , Debt of $1,000 , and Stockholders' equity of $2,000 . The annual Sales equal $19,700 , total costs equal $19,300 , Net income equals $400 , Dividends equal $160 , and New retained earnings equal $240 . For 2526 the company plans 17.40% sales growth. They plan to hold constant the asset turnover (sales/total assets) and payout ratio (=dividends/net income). They plan to increase Current Liabilities spontaneously with sales, while holding Debt constant. Suppose the company decides to institute cost-cutting measures that should increase the net profit margin (=net income / sales) by 2.70% above its value of year 2525. Given the above plan, how much external financing is needed for year 2526? a. ($148) b. ($111) c. ($122) d. ($134) e. ($101) 4. BS29 Venture capitalists represent a financing source for many businesses in the USA. Select the statement that best describes the typical venture capital investment. a. the typical length of the commitment is 10 to 20 years b. one of the four most typical means of liquidation is for the venture capitalist to sell shares to banks that are looking for profitable investments c. the venture capitalist makes an equity investment in the company with the expectation of eventually liquidating the position d. Two choices, A and C, are correct e. The three A-B-C choices are all correct 5. BA3a The Company balance sheet for year 2525 shows that Total assets of $3,400 are financed by Debt of $300 and Stockholders' equity of $3,100 . There are 240 shares outstanding at year-end 2525. The company plans to obtain venture capital by selling 60 additional shares at their current book value to a venture capitalist. The company agrees to repurchase the shares at year-end 2526 at a price equal to 146% of that year's book value. For year 2526 the company forecasts sales of $16,320 , a net profit margin (= net income / sales) of 10.10%, and a dividend payout ratio (= dividends / net income) of 35%. Assume debt remains unchanged. How much total cash flow (dividends plus repurchase price) does the venture capitalist receive at year-end 2526? a. $1,560 b. $1,418 c. $1,887 d. $1,289 e. $1,716 6. BA4a The Company balance sheet for year 2525 shows Total assets of $5,000 financed by Debt of $200 and Stockholders' equity of $4,800 . There are 340 shares outstanding at year-end 2525. The company plans to obtain venture capital by selling 80 additional shares at their current book value to a venture capitalist. The company agrees to repurchase the shares at year-end 2527 at a price equal to 134% of that year's book value. For year 2526 the company forecasts sales of $40,000 , a net profit margin (= net income / sales) of 8.40%, and a dividend payout ratio (= dividends / net income) of 15%. Assume debt remains unchanged. For year 2527, sales should be higher by 19% but the net profit margin and payout ratio should remain constant. Also, assume that debt remains unchanged. How much total cash flow (dividends plus repurchase price) does the venture capitalist receive at year-end 2527? a. $2,422 b. $3,224 c. $2,202 d. $2,931 e. $2,664 7. EFN1b Company sales equal $38,000 for the year ending December 31, the costs-ofgoods sold (cgs) equal 80% of sales, and the inventory was replaced about every 64 days (inventory turnover in days = 365 / inventory turnover ratio; inventory turnover ratio = annual cgs / Inventory balance). The Company is considering a change in their inventory ordering policy. As a result, they believe that sales would remain constant in the forthcoming year, yet the length of time that inventory stays on the shelf would change by -33 days (shelf time decreases). If the financing rate for inventories is 17% per year, what is the effect on their annual inventory financing costs? a. The policy change results in additional annual savings of $467 b. The policy change results in additional annual savings of $406 c. The policy change results in additional annual costs of $467 d. The policy change results in additional annual savings of $353 e. The policy change results in additional annual costs of $406 8. GR4 Find below the company's income statement. Income, 1/1 - 12/31/2525 $6,500 = Sales $6,200 = Total costs $300 = Net income $140 = Dividends $160 = New retained earnings Total assets at 12/31/2525 equal $1,980 . If the company is growing at their internal growth rate, what are Total assets at 12/31/2526? a. $2,154 b. $1,958 c. $1,471 d. $1,618 e. $1,780 9. EFN3a For year 2525 the company's sales were $320,000 and their annual-cost-ofgoods-sold equaled 85% of sales. The company has followed a policy that set the average payment period (= Accounts Payables / daily-cost-of-goods-sold) at 56 days. The company realizes that relying on Payables as a financing source is free, whereas relying on Debt costs 14% per annum. Suppose they institute a policy that causes the average payment period to decrease by 28 days. Further, suppose the policy has no effect on the firm's Total Assets or Sales. Based on the numbers for year 2525, how much would the new policy affect annual financing costs due to the company's switch between high-cost Debt and low-cost (free) Payables? a. $3,213 b. $3,535 c. $4,277 d. $3,888 e. $2,921