Assessment #1 - Texas Tech University

advertisement

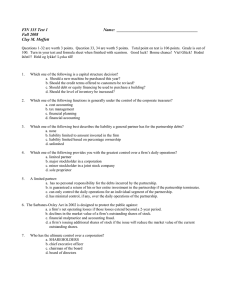

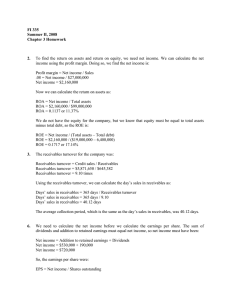

Assessment #1 Texas Tech University Rawls College of Business FIN 5219: Financial Management Tools Professor Harrison Spring 2014 Name (Please Print): Read Carefully: This assessment exercise is worth 70 points and counts for 15% of your final course grade. Partial credit is generally not available on most problems, however, you must show your work to receive any credit for the answers you provide. If you have any questions concerning the wording of a particular problem, please do not hesitate to ask me. Any ex-post misinterpretations will not be accepted. You have 90 minutes to complete this assessment. Good-luck! Honor Code: “It is the aim of the faculty of Texas Tech University to foster a spirit of complete honesty and a high standard of integrity. The attempt of students to present as their own any work that they have not honestly performed is regarded by the faculty and administration as a serious offense and renders the offenders liable to serious consequences, possibly suspension. Answer the following questions by providing the best answer in the space provided to the left of each question. (5 points each) 1. What is THE primary goal of the firm? 2. Which of the following actions are most likely to directly decrease cash as shown on a firm’s balance sheet? a. b. c. d. It issues $3 million of new common stock. It sells existing plant and equipment at a price of $8 million. It reports a large net income for the year. It increases the dividends paid on its common stock. 3. For 2012, Aaron’s Acoustics reported $35 million of sales and $27.5 million of operating costs (including depreciation). The company has $20 million of investor-supplied operating capital. Its weighted average cost of capital is 8%, and its federal-plus-state income tax rate was 35%. What was the firm’s Economic Value Added (EVA), that is, how much value did management add to stockholders’ wealth during 2012? 4. K.R. Camping Supply had $75,000 in cash at year-end 2011 and $60,000 in cash at year-end 2012. The firm invested in property, plant, and equipment totaling $325,000. Cash flow from financing activities totaled +$225,000. If accruals increased by $40,000, receivables and inventories increased by $80,000, and depreciation and amortization totaled $35,000, what was the firm’s net income? 5. A firm has a profit margin of 3% and an equity multiplier of 2.5. Its sales are $150 million, and it has total assets of $60 million. What is its ROE? 6. Kamdon Brothers Automotive has a DSO of 50 days, and its annual sales are $10,950,000. What is its accounts receivable balance? Assume that is uses a 365-day year. 7. Menchaca Inc. recently reported net income of $4 million. It has 800,000 shares of common stock, which currently trades at $50 a share. Menchaca continues to expand and anticipates that 1 year from now, its net income will be $8.0 million. Over the next year, it also anticipates issuing an additional 100,000 shares of stock so that 1 year from now it will have 900,000 shares of common stock. Assuming Menchaca’s price/earnings ratio remains at its current level, what will be its stock price 1 year from now? 8. Dimas Inc. has sales of $500,000, a net income of $40,000, and the following balance sheet: Cash Receivables Inventories Net fixed assets Total assets $20,000 80,000 300,000 150,000 550,000 ======= Accounts Payable Other current liabilities Long-term debt Common equity Total liabilities and equity $40,000 10,000 100,000 400,000 550,000 ====== The new owner thinks that inventories are excessive and can be lowered to the point where the current ratio is equal to the industry average, 4.0x, without affecting sales or net income. If inventories are sold and not replaced (thus reducing the current ratio to 4.0x), if the funds generated are used to reduce common equity (stock can be repurchased at book value), and if no other changes occur, by how much will the ROE change? 11. 9. Kinzer Consignment’s ROE last year was only 4%, but its management has developed a new operating plan that calls for a debt-to-assets ratio of 50%, which will result in annual interest charges of $250,000. The firm has no plans to use preferred stock. Management projects an EBIT of $1,200,000 on sales of $10,000,000, and it expects to have a total assets turnover ratio of 2.4. Under these conditions, the tax rate will be 40%. If the changes are made, what will be the company’s return on equity? 10. LJS Incorporated has $2 billion in assets, and its tax rate is 40%. Its basic earning power (BEP) ratio is 12%, and its return on assets (ROA) is 6%. What is LJS’s times-interest-earned ratio? How can financial ratio analysis be effectively used to evaluate firm and managerial performance? What are the most important rules and caveats associated with ratio analysis? (10 points) 12. What are the most important things you learned from the first weekend of FIN5219, and how will those concepts, skills, and abilities better enable you to succeed in your career? (10 points) Extra Credit (1 point): If you look at a clock and the time is 3:15, what is the angle between the hour and the minute hands?