Loan impairment JE Styles Comparison (textbook vs instructor)

advertisement

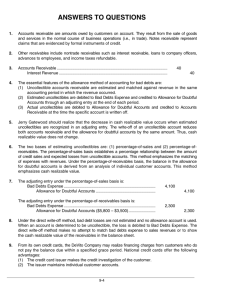

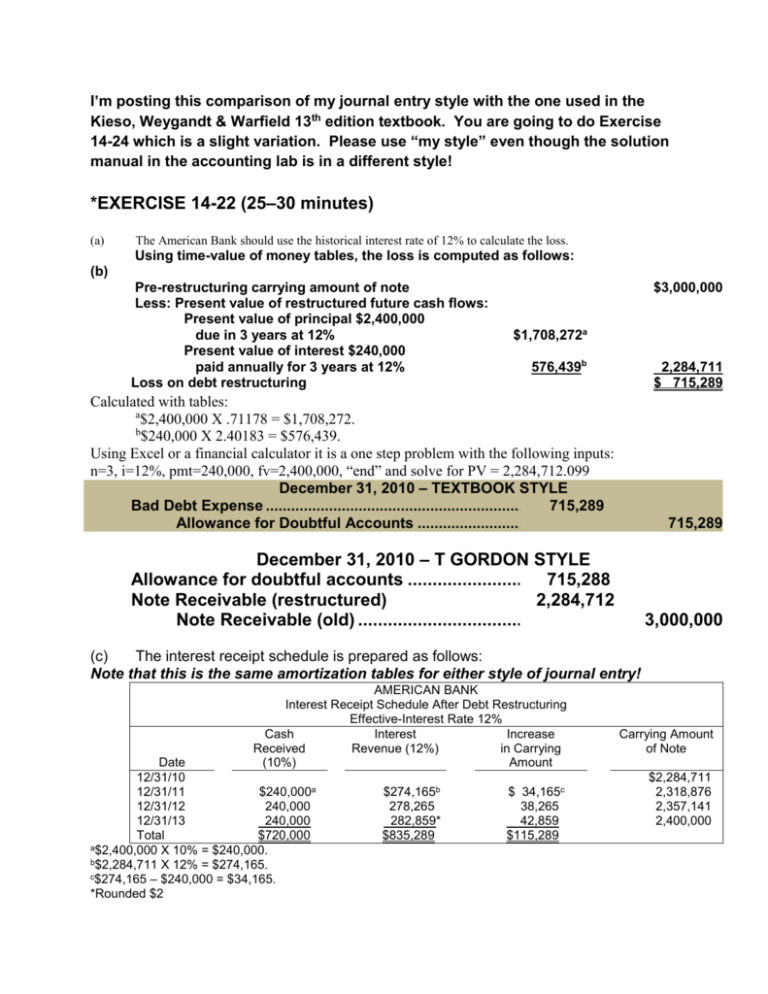

I’m posting this comparison of my journal entry style with the one used in the Kieso, Weygandt & Warfield 13th edition textbook. You are going to do Exercise 14-24 which is a slight variation. Please use “my style” even though the solution manual in the accounting lab is in a different style! *EXERCISE 14-22 (25–30 minutes) (a) The American Bank should use the historical interest rate of 12% to calculate the loss. Using time-value of money tables, the loss is computed as follows: (b) Pre-restructuring carrying amount of note Less: Present value of restructured future cash flows: Present value of principal $2,400,000 due in 3 years at 12% Present value of interest $240,000 paid annually for 3 years at 12% Loss on debt restructuring $3,000,000 $1,708,272a 576,439b 2,284,711 $ 715,289 Calculated with tables: a $2,400,000 X .71178 = $1,708,272. b $240,000 X 2.40183 = $576,439. Using Excel or a financial calculator it is a one step problem with the following inputs: n=3, i=12%, pmt=240,000, fv=2,400,000, “end” and solve for PV = 2,284,712.099 December 31, 2010 – TEXTBOOK STYLE Bad Debt Expense ........................................................................... 715,289 Allowance for Doubtful Accounts ....................................... 715,289 December 31, 2010 – T GORDON STYLE Allowance for doubtful accounts ................................... 715,288 Note Receivable (restructured) 2,284,712 Note Receivable (old) ............................................. 3,000,000 (c) The interest receipt schedule is prepared as follows: Note that this is the same amortization tables for either style of journal entry! AMERICAN BANK Interest Receipt Schedule After Debt Restructuring Effective-Interest Rate 12% Cash Interest Increase Received Revenue (12%) in Carrying (10%) Amount Date 12/31/10 12/31/11 $240,000a 12/31/12 240,000 12/31/13 240,000 Total $720,000 a$2,400,000 X 10% = $240,000. b$2,284,711 X 12% = $274,165. c$274,165 – $240,000 = $34,165. *Rounded $2 $274,165b 278,265 282,859* $835,289 $ 34,165c 38,265 42,859 $115,289 Carrying Amount of Note $2,284,711 2,318,876 2,357,141 2,400,000 TEXTBOOK STYLE ENTRIES: (d) Interest receipt entry for American Bank is: December 31, 2012 Cash .................................................................................................. 240,000 Allowance for Doubtful Accounts .................................................. 38,265 Interest Revenue ................................................................... (e) 278,265 The receipt entry at maturity is: January 1, 2014 Cash .................................................................................................. 2,400,000 Allowance for Doubtful Accounts .................................................. 600,000 Note Receivable .................................................................... 3,000,000 *EXERCISE 14-22 (Continued) T GORDON STYLE ENTRIES: (d) (e) Interest receipt entry for American Bank is: December 31, 2012 Cash.................................................................................. 240,000 Note Receivable (restructured) ....................................... 38,265 Interest Revenue..................................................... The receipt entry at maturity is: January 1, 2014 Cash.................................................................................. 240,000 Interest revenue ............................................................... Note Receivable (restructured).............................. 42,859 Cash 2,400,000 Note Receivable (restructured) COMPARISON BALANCE SHEETS Immediately after restructuring TEXTBOOK STYLE T GORDON STYLE Note Receivable Note Receivable $2,284,711 Less allowance The adjustment to the allowance account would result in an entry to bad debt expense based. Net Receivable 278,265 282,859 2,400,000 3,000,000 715,289 $2,284,711 One year after restructuring T GORDON STYLE Note Receivable $2,318,876 Any allowance account would be adjusted as part of another process to see what amounts are deemed uncollectible with respect to the OTHER notes receivable TEXTBOOK STYLE Note Receivable Less allowance Net Receivable 3,000,000 681,124 $2,318,876 This is only the specific part of the allowance account related to this particular note – there would be other adjustments to the allowance for other estimated bad debts Allowance balance would be reduced by $ 34,165c so $715,289 – 34,165 = 681,124 Two years after restructuring T GORDON STYLE Note Receivable $2,357,141 Any allowance account would be adjusted as part of another process to see what amounts are deemed uncollectible with respect to the OTHER notes receivable TEXTBOOK STYLE Note Receivable Less allowance Net Receivable 3,000,000 642,859* $2,357,141 This is only the specific part of the allowance account related to this particular note – there would be other adjustments to the allowance for other estimated bad debts *Allowance balance would be reduced by $38,265 so $681,124 – 38,265 = 642,859 Conclusion – the entries get have exactly the same impact on the balance sheet and the income statement. The difference is that we are in essence setting up a “Discount on Notes Receivable” account for each separate loan. In other words, there would be a separate allowance account for each restructured loan that would have to be treated as a “pair of accounts” just like we do for bonds payable with a premium or discount. In practice, it is more common to have a “general allowance” account related to the receivables as a whole - it is tested for accuracy at each balance sheet date. With the textbook method, you would still have to do this testing but it would be more work if you couldn’t analyze GROUPS of receivables using tools such as an aging of receivables analysis!