2.30

advertisement

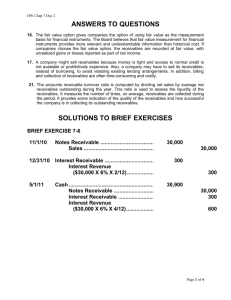

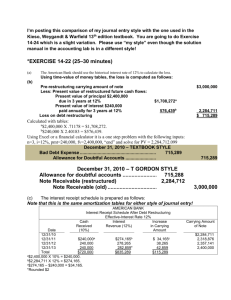

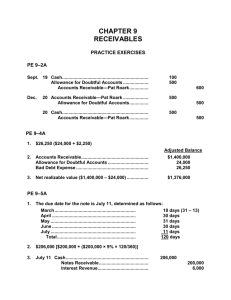

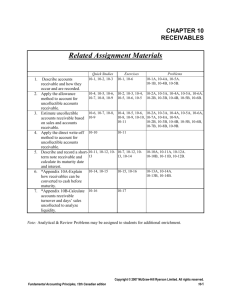

BUS312A/612A Financial Reporting I Homework 10.8.2014 Receivables Chapter 7 E7-3 (Financial Statement Presentation of Receivables) Jim Carrie Company shows a balance of $181,140 in the Accounts Receivable account on December 31, 2013. The balance consists of the following. Installment accounts due in 2014 $23,000 Installment accounts due after 2014 34,000 Overpayments to creditors 2,640 Due from regular customers, of which $40,000 represents accounts pledged as security for a bank loan 79,000 Advances to employees 1,500 Advance to subsidiary company (due in 2015) 81,000 . How would the information above be shown on Jim Carrie’s balance sheet on December 31, 2013? Case 7-1: (a) Deficiencies of direct write-off method? (b) Two allowance methods, and justification for each: (c) How should Simms account for the collection of the specific accounts previously written off as uncollectible? P7-3 (Bad Debt Reporting-Aging) Manilow Corporation operates in an industry with high rates of bad debts. Before any year-end adjustments, the Accounts Receivable account was $555,000 and Allowance for Doubtful Accounts had a credit balance of $40,000. The year-end balance reported in the balance sheet for the Allowance account will be based on the aging schedule shown here: Days Account Outstanding Amount Less than 16 days $300,000 Between 16-30 days $100,000 Between 31-45 days $ 80,000 Between 46-60 days $ 40,000 Between 61-75 days $ 20,000 Over 75 days $ 15,000 Probability of Collection .98 .90 .85 .80 .55 .00 a. What is the appropriate balance for Allowance for Doubtful Accounts at year-end? b. Show how accounts receivable would be presented on the balance sheet. c. What is the dollar effect of the year-end bad debt adjustment on the before-tax income? Balance Sheet Presentation Classification Valuation accounts contra to receivables Disclose – Assignment or pledging – Loss contingencies – Significant credit risk Net Sales in Financial Statements • Eli Lilly: • NIKE Accounts Receivables in the Financial Statements • Income Statement – Bad Debts Expense is typically included in Selling Expense, which is often combined with General and Administrative Expense (SG&A) • Balance Sheet – Accounts Receivable may be shown in any one of the following ways: WALMART: NIKE Balance Sheet and footnote: WALMART footnote: Eli Lilly footnote: Coca Cola Balance Sheet disclosures for 2011 and 2010: Excerpt from Coca Cola’s 2011 10-K is a typical footnote disclosure of the activity in the Allowance for Doubtful Accounts: • Cash Flow Statement (Indirect Method) – may be shown as an adjustment to net income for the change in Accounts Receivable, Net, such as with Eli Lilly below: Or as a separate adjustment for the Provision for Bad Debts and the remaining change in Accounts Receivable: Disposition Sale or Factoring – without recourse – with recourse . Factoring Example On 5/1, Dexter, Inc. factored $800,000 of A/R with Quick Finance without recourse. Under the arrangement, Dexter was to handle disputes concerning service, and Quick Finance was to make the collections, handle the sales discounts, and absorb the credit losses. Quick Finance assessed a 6% finance charge and retained 2% to cover sales discounts. 1. Dexter’s JE on May 1? 2. Quick Finance’s JE on May 1? 3. If Dexter factors the $800,000 of A/R with Quick Finance with recourse, and the recourse provision has a fair value of $14,000, what is Dexter’s JE on May 1? E7-12 Presented below is information related to James Garfield Corp. July 1 Garfield sold Harding merchandise having a sales price of $80,000 at 2/10, net/60. Garfield records its sales and receivable net. 5 Accounts receivable of $9,000 (gross) are factored with Jackson Credit Corp. Without recourse at a finance charge of 9%. Cash is received for the proceeds; collections are handled by the finance company. (all past the discount period). 9 Specific accounts receivable of $9,000 (gross) are pledged to Landon Credit Corp. as security for a loan of $6,000 at a finance charge of 6% of the amount of the loan. The finance company will make the collections. (All past the discount period). . Dec. 29 Harding notifies Garfield that it is bankrupt and will pay only 10%.