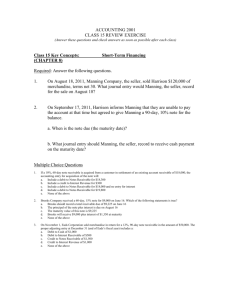

Answer Key Chapter 7 Quiz.f11

advertisement

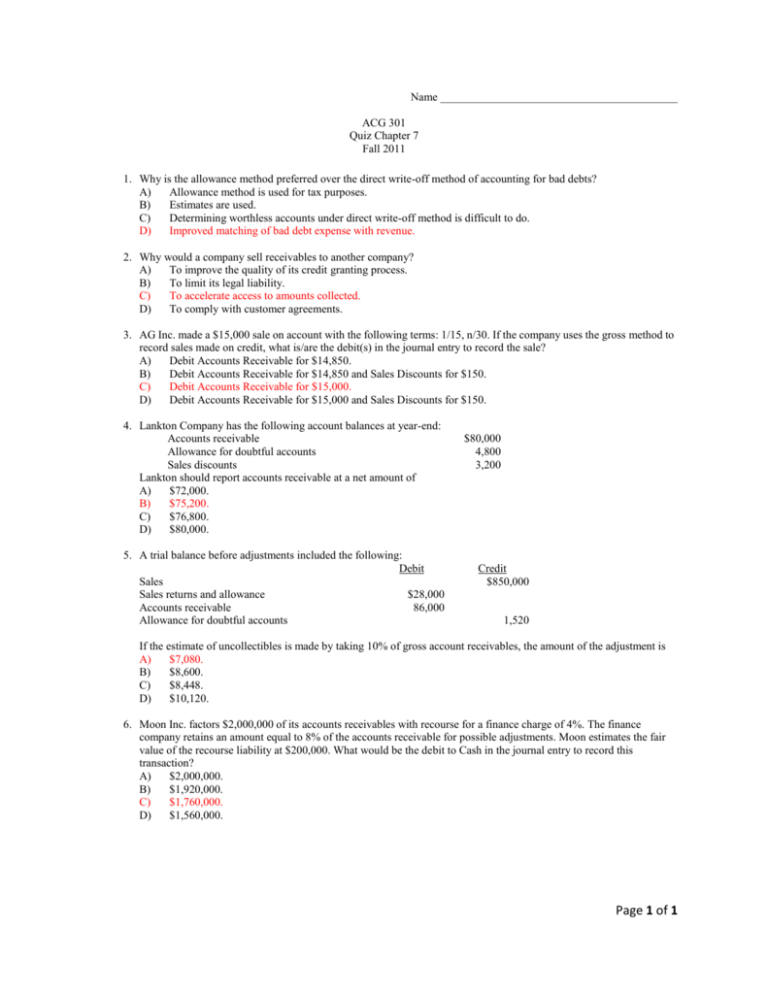

Name __________________________________________ ACG 301 Quiz Chapter 7 Fall 2011 1. Why is the allowance method preferred over the direct write-off method of accounting for bad debts? A) Allowance method is used for tax purposes. B) Estimates are used. C) Determining worthless accounts under direct write-off method is difficult to do. D) Improved matching of bad debt expense with revenue. 2. Why would a company sell receivables to another company? A) To improve the quality of its credit granting process. B) To limit its legal liability. C) To accelerate access to amounts collected. D) To comply with customer agreements. 3. AG Inc. made a $15,000 sale on account with the following terms: 1/15, n/30. If the company uses the gross method to record sales made on credit, what is/are the debit(s) in the journal entry to record the sale? A) Debit Accounts Receivable for $14,850. B) Debit Accounts Receivable for $14,850 and Sales Discounts for $150. C) Debit Accounts Receivable for $15,000. D) Debit Accounts Receivable for $15,000 and Sales Discounts for $150. 4. Lankton Company has the following account balances at year-end: Accounts receivable Allowance for doubtful accounts Sales discounts Lankton should report accounts receivable at a net amount of A) $72,000. B) $75,200. C) $76,800. D) $80,000. 5. A trial balance before adjustments included the following: Debit Sales Sales returns and allowance $28,000 Accounts receivable 86,000 Allowance for doubtful accounts $80,000 4,800 3,200 Credit $850,000 1,520 If the estimate of uncollectibles is made by taking 10% of gross account receivables, the amount of the adjustment is A) $7,080. B) $8,600. C) $8,448. D) $10,120. 6. Moon Inc. factors $2,000,000 of its accounts receivables with recourse for a finance charge of 4%. The finance company retains an amount equal to 8% of the accounts receivable for possible adjustments. Moon estimates the fair value of the recourse liability at $200,000. What would be the debit to Cash in the journal entry to record this transaction? A) $2,000,000. B) $1,920,000. C) $1,760,000. D) $1,560,000. Page 1 of 1