mgmt588_week2 - Cal State LA

advertisement

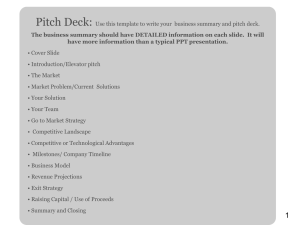

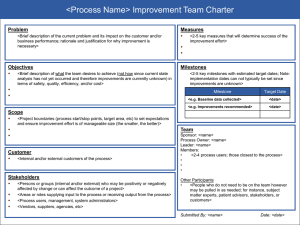

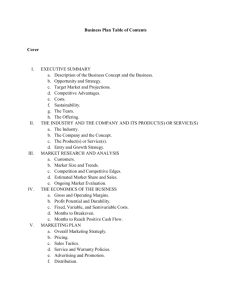

New Ventures (T & S, Ch. 4) •Fundamental realities •Most new ventures are works in process and works of art •Most business plans are obsolete at the printer •Speed, adroitness of reflex, and adaptability are crucial •The key to succeeding is failing quickly and recouping quickly 6-1 New Ventures • Fundamental realities • Success is highly situational, depending on time, space, context, and stakeholders • The best entrepreneurs specialize in making “new mistakes” only • Starting a company is much harder than it looks, or you think it will be; but you can last a lot longer and do more than you think if you do not try to do it solo • Last week we saw several examples of people of all ages, experience and education levels, gender, and ethnicity – we can’t predict who is a successful entrepreneur. 6-2 Where are Opportunities Born? •Drivers: • Technology sea change • Market sea change • Societal sea change •Caution: • Brontosaurus Factor (arrogance, lack of adaptability) • Irrational Exuberance 6-3 Where are Opportunities Born? •Ethnographic research •Learning about people and what they do in their own environment. Entering someone else’s world without preconceived notions. 6-4 Brainstorming Rules to enhance creative visualization •Define your purpose •Choose participants •Choose a facilitator •Brainstorm spontaneously, copiously •No criticisms, no negatives 6-5 Brainstorming Rules •Record ideas in full view •Invent to the “void” •Resist becoming committed to one idea •Identify the most promising ideas •Refine and prioritize 6-6 Exhibit 4.7 It takes time to realize revenues 6-7 Evaluating • Criteria for evaluating venture opportunity (pgs. 128129, T&S) • Industry and market – focus, niche, growing, attainable • Economics – ROI, Break-even, positive cash-flow • Harvest issues – future strategic value to buyers • Competitive advantage issues – SWOT, costs/control, barriers to entry • Management team issues – knowledge, skills, experience • Personal criteria – goals, fit, managing the downside • Strategic differentiation – timing, opportunity 6-8 The Business Plan (Ch. 6) • Is not the business • Will not define what your business looks like • Is required to acquire capital and support • Must present your idea firmly (while you remain flexible) • Adjust your plan to fit the investor group • Ultimately investors must believe in YOU 6-9 The Business Plan:What Does It Reveal? • A business plan for a high potential venture reveals the business’ ability to: • Create or add significant value to a customer or end user • Solve a significant problem, or meet a significant want or need for which someone will pay a premium • Have robust market, margin, and moneymaking characteristics • Fit well with the founder(s) and management team at the time, in the marketplace, and with the risk-reward balance 6 - 10 Who Develops the Plan? • Reasons not to hire an outside professional to prepare the business plan • Consequences of different strategies and tactics can be considered • Human and financial requirements for launching and building the venture can be examined 6 - 11 Writing a Business Plan •Steps outlining the process by which a business plan is written •Segmenting information •Creating an overall schedule •Creating an action calendar •Doing the work and writing the plan 6 - 12 Business Plan •I. EXECUTIVE SUMMARY •Description of the business concept and the business opportunity and strategy •Target market and projections •Competitive advantages •Costs •Economics, profitability, and harvest potential •The team •The offering 6 - 13 Business Plan • II. THE INDUSTRY AND THE COMPANY AND ITS PRODUCT(S) OR SERVICE(S) • The industry • The company and the concept • The product(s) or service(s) • Entry and growth strategy • III. MARKET RESEARCH AND ANALYSIS • Customers • Market size and trends • Competition and competitive edge • Estimated market share and sales • Ongoing market evaluation 6 - 14 Business Plan • IV. THE ECONOMICS OF THE BUSINESS • Gross and operating margins • Profit potential and durability • Fixed, variable, and semivariable costs • Months to breakeven • Months to reach positive cash flow • V. • • • • • • MARKETING PLAN Overall marketing strategy Pricing Sales tactics Service and warranty policies Advertising and promotion Distribution 6 - 15 Business Plan • VI. DESIGN AND DEVELOPMENT PLAN • Development status and tasks • Difficulties and risks • Product improvement and new products • Costs • Proprietary issues • VII. MANUFACTURING AND OPERATIONS PLAN • Operating cycle • Geographical location • Facilities and improvements • Strategy and plans • Regulatory and legal issues 6 - 16 Business Plan • VIII. MANAGEMENT TEAM • • • • • • • • Organization Key management personnel Management compensation and ownership Other investors Employment and other agreements and stock option and bonus plans Board of directors Other shareholders, rights, and restrictions Supporting professional advisors and services • IX. OVERALL SCHEDULE • X. CRITICAL RISKS, PROBLEMS, AND ASSUMPTIONS 6 - 17 Business Plan • XI. THE FINANCIAL PLAN • Actual income statements and balance sheets • Pro forma income statements / forma balance sheets • Pro forma cash flow analysis • Breakeven chart and calculations • Cost control • Highlights 6 - 18 Business Plan • XII. PROPOSED COMPANY OFFERING • Desired financing • Offering • Capitalization • Use of funds • Investor’s return • XIII. APPENDICES • For the purpose of this class, your business plan must be under 30 pages (not counting appendices) 6 - 19 Business Plan – Final Notes •Many firms begin with little capital (e.g., 46% new start-ups began with $10,000 or less as seed capital, T&S). •Venture capitalists are often wrong about passing up ideas (e.g., Intuit founder Scott Cook was first rejected, T&S) •Many well-known business did not rely on early investment capital (e.g. Cellular One, T&S) •Capital investors reject 60% to 70% of new ventures presented, T&S) 6 - 20 Business Plan •Kawasaki gives some sound action advice: •Business plan required (but not necessarily a navigation tool for entrepreneurs) •Pitch, then plan – write your pitch first, then develop your business plan 6 - 21 Business Plan •Kawasaki says keep it at 20 pages or less • One author only (many contributors) • Simple binding and presentation • Simplify financial projections • Key metrics: #customers, locations, etc. • Define assumptions 6 - 22 Business Plan •Kawasaki says keep it at 20 pages or less • Typically include 5 year projections • More specific in early year(s) by quarter, then annual • Cover timeframe it takes to earn significant revenues 6 - 23 Business Plan •Kawasaki •Write your plan “deliberately” (factual terms as if it will happen precisely as you describe it) •Act “emergently” in a manner that allows you to quickly adapt to the market, opportunities, etc. 6 - 24 Business Plan •Kawasaki •Make your business plan stand out by… 1. Having credible referral source 2. List of potential or current customers 3. Real-world knowledge/experience 4. Diagram and graphics that simplify complicated concepts 6 - 25 Business Plan •HBR provides support for the following points related to business plans: • Projections are uncertain but investors want to know when a positive cashflow will occur • Four critical factors are people, opportunity, context, risk and reward 6 - 26 Business Plan •Give specific information about you and your associates – show that you and your team has the knowledge and skills to make the business successful •Show good evidence that there is a market by finding prospective clients or market testing your product or service 6 - 27 Business Plan •Prove to investors that you are not naïve about the environment (context) within which you will be doing business (i.e., laws, competitors, etc.) •Show investors that you are aware of risks but also understand when and how the payoff or reward will be attained by discussing assumptions and contingencies 6 - 28 Business Plan •HBR “Milestones” article suggests some key measures for success: •Defining milestones (significant events) is a good addition to a business plan •Each of these milestones represents an important learning opportunity •Each milestone could propel or destroy the business 6 - 29 Business Plan •Key milestones: •1. concept or product testing •2. prototyping •3. financing •4. pilot testing •5. market testing 6 - 30 Business Plan •Key milestones: •6. production start-up •7. Bellwether sale (the first major contract or sale) •8. Responding to competitors •9. Redesign or redirection •10. Price change 6 - 31 For Next Time •Begin outlining your business plan and resume •Within each section, define as much as possible and leave sections blank for now, as needed •Review the resources and outlines in T&S •Cover readings for our next class 6 - 32