Lecture 5

advertisement

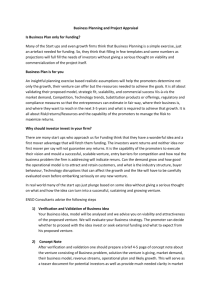

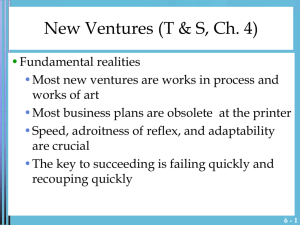

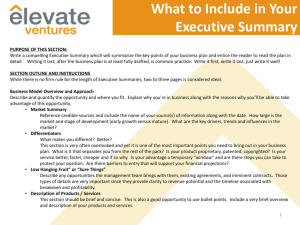

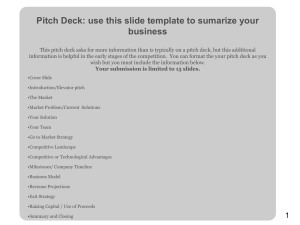

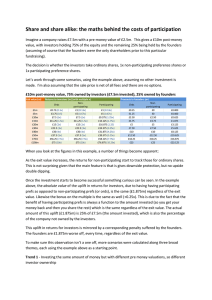

The Business Plan 6-1 The Business Plan • Objectives • Carefully articulate the merits, requirements, risks, and potential rewards of the opportunity and how it will be seized • Demonstrate how the four anchors reveal themselves to the founders and investors by converting all the research, careful thought, and creative problem solving from the Venture Opportunity Screening Exercises into a thorough business plan 6-2 What Does It Reveal? • A business plan for a high potential venture reveals the business’ ability to: • Create or add significant value to a customer or end user • Solve a significant problem, or meet a significant want or need for which someone will pay a premium • Have robust market, margin, and moneymaking characteristics • Fit well with the founder(s) and management team at the time, in the marketplace, and with the risk-reward balance 6-3 Who Develops the Plan? • Reasons not to hire an outside professional to prepare the business plan • Consequences of different strategies and tactics can be considered • Human and financial requirements for launching and building the venture can be examined 6-4 Writing a Business Plan • Steps outlining the process by which a business plan is written • Segmenting information • Creating an overall schedule • Creating an action calendar • Doing the work and writing the plan 6-5 Business Plan • I. EXECUTIVE SUMMARY • Description of the business concept and the business opportunity and strategy • Target market and projections • Competitive advantages • Costs • Economics, profitability, and harvest potential • The team • The offering 6-6 Business Plan • II. THE INDUSTRY AND THE COMPANY AND ITS PRODUCT(S) OR SERVICE(S) • • • • The industry The company and the concept The product(s) or service(s) Entry and growth strategy • III. MARKET RESEARCH AND ANALYSIS • • • • • Customers Market size and trends Competition and competitive edge Estimated market share and sales Ongoing market evaluation 6-7 Business Plan • IV. THE ECONOMICS OF THE BUSINESS • • • • • Gross and operating margins Profit potential and durability Fixed, variable, and semivariable costs Months to breakeven Months to reach positive cash flow • V. MARKETING PLAN • • • • • • Overall marketing strategy Pricing Sales tactics Service and warranty policies Advertising and promotion Distribution 6-8 Business Plan • VI. DESIGN AND DEVELOPMENT PLAN • Development status and tasks • Difficulties and risks • Product improvement and new products • Costs • Proprietary issues • VII. MANUFACTURING AND OPERATIONS PLAN • Operating cycle • Geographical location • Facilities and improvements • Strategy and plans • Regulatory and legal issues 6-9 Business Plan • VIII. MANAGEMENT TEAM • • • • • • • • Organization Key management personnel Management compensation and ownership Other investors Employment and other agreements and stock option and bonus plans Board of directors Other shareholders, rights, and restrictions Supporting professional advisors and services • IX. OVERALL SCHEDULE • X. CRITICAL RISKS, PROBLEMS, AND ASSUMPTIONS 6 - 10 Business Plan • XI. THE FINANCIAL PLAN • Actual income statements and balance sheets • Pro forma income statements / forma balance sheets • Pro forma cash flow analysis • Breakeven chart and calculations • Cost control • Highlights 6 - 11 Business Plan • XII. PROPOSED COMPANY OFFERING • Desired financing • Offering • Capitalization • Use of funds • Investor’s return • XIII. APPENDICES 6 - 12 Adams On Plans • The business plan is not the be-all and end-all for getting funded • Sometimes investors don’t even read plans • Writing a business plan is not the problem • Viewing the business plan as your primary goal is the problem • More evidence of output rather than execution orientation • Myth: Investors fund business plans 6 - 13 The Work • Don’t focus on the plan…do the work • Put together a great team • • • • Execution intelligence Great idea, poor team = no Great team, so-so idea = maybe Great advisors and directors are crucial for legitimacy and guidance • Validate the market • Get to market fast • Define value inflection points • Presentation and executive summary may be all you need (and “the pitch”) 6 - 14 The Pitch • Cater your message to the audience’s needs • Clearly articulate features and benefits • Relationships rule • Who can influence the investors? • One or two good referrals cuts through the noise • Supplement the pitch with collateral • Treat the plan as a brochure – it has about the same effect on investor decision making • Ideal: ten slide PowerPoint, an executive summary, and team/advisor bios 6 - 15 The Pitch • Contents • Company Overview • Customer pain/problem • • • • • • • • • What problem are you solving? Why is it a problem? How severe? How big is the market? What segments have the worst pain? How have you validated the needs? Solution Competition Team Business Model • How will you make money? • Revenue model, distribution model, milestones • Financials • When will you be profitable? How much capital? 6 - 16 The Pitch • Process • Have as many team members participate as you can • Investors want to assess your team • Project energy, enthusiasm, confidence • Malleability • You have to be comfortable not keeping your sacred cows • Do you want to be king/queen or rich? • You don’t need to have all the answers but you must be able to respond thoughtfully 6 - 17 Thoughts on Business Plans (Sahlman) • On a scale from 1 to 10, business plans rank no higher than a 2 • Four components that must “fit” • People, opportunity, external context, deal • Three questions • What can go wrong? What can go right? • How can management make more go right than wrong? • The role of management is to increase the fit • POCD Framework 6 - 18 People • Adages • Successful founders have two characteristics: they are “known” and they “know” • I’d rather back an “A” team with a “B” idea than a “B” team with an “A” idea • Citing the need to recruit experienced people is like wishing to draw 4 cards to make a straight – a low prob. Event! • Questions: • Who are the founders? What have they accomplished in the past? What directly relevant experience do they have? What skills do they have? Whom do they know and who knows them? What is their reputation? How realistic are they? Can they adapt? Who else needs to be on the team? Can they make hard choices? How will they respond to adversity? What are their motivations? How committed? 6 - 19 Opportunity • Adages • Is the total market large and/or growing? Is the industry attractive? • Use analogies to describe what the venture will look like if it is successful – the next Walmart • “Invest in industries where growth can overcome the shortcomings of management” • Buy low, sell high, collect early, pay late, have growth options • Questions • Who is the customer and how do they make decisions? is the product a compelling purchase for them? how will you reach the customer? at what price? How much does it cost to acquire a customer? How much does it cost to deliver the product? How much does it cost to support a customer? How easy is it to retain a customer? Who are your competitors? How will they respond? Abnormal profits will go away. 6 - 20 Context & Deals • Context • A shift in context can turn an unattractive business into an attractive one • Deals • From whom you raise capital Is often more important than the deals • How much money to raise and in what stages? • Money is time • time to discover the right team, opportunity, and context • Investors have to decide whether to give you more time • Deals are fair, simple, robust, reflect trust rather than legalese • Questions • What new information would change the likelihood of success? How much time and money are required to “buy” that information? To what degree would more money increase the rate of growth? Without extra money will you lose a winner takes all market? • From whom should the money be raised? How much is needed? What deal terms are fair? 6 - 21 Risk/Reward Management • Myth of entrepreneur as risk seeker • All sane people want to avoid risk • True entrepreneurs want to capture all of the reward and give the risk to others • I hardly ever look at the numbers any more • They are most likely wrong • I like to see the team has thought through the key business drivers • Due diligence is important for investors 6 - 22 Video • http://www.earthclassmail.com/ • Startup Junkies Episode One • http://www.hulu.com/watch/20487/start-up-junkiesepisode-1#x-0,vepisode,1 6 - 23