of working capital management

advertisement

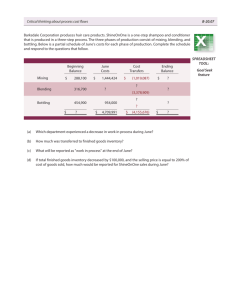

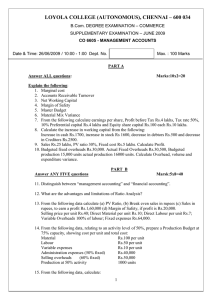

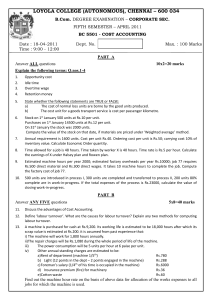

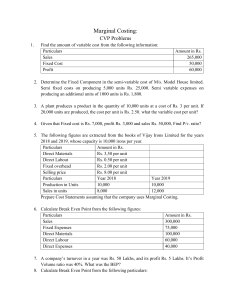

PRINCIPLES OF W0RKING CAPITAL MANAGEMENT CONCEPTS OF WORKING CAPITAL • Gross Working Capital • Net Working Capital KINDS OF WORKING CAPITAL • CONCEPT BASE Gross Working Capital & Net Working Capital • TIME BASE Permanent Working Capital & Temporary Working Capital OBJECTIVES OF W0RKING CAPITAL MANAGEMENT • Ensure optimum investment in Current Assets • Strike a balance b/w twin objectives of LIQUIDITY & PROFITABILITY in the use of funds • Ensure adequate flow of funds for current operations • Speed up the flow of funds or to minimize the stagnation of funds OPERATING CYCLE • The TIME (in days) that ELAPSES to convert Raw materials in to Cash • Operating Cycle procedure (MANUFACTURING FIRM) 1. Conversion of Cash in to Raw materials. 2. Conversion of Raw materials in to Work in process. 3. Conversion of Work in process in to Finished goods. 4. Conversion of Finished goods in to Sales (Debtors & Cash) OPERATING CYCLE • Operating Cycle procedure (NONMANUFACTURING FIRM) 1. Conversion of Cash in to Finished goods in to Receivables. 2. Conversion of Finished goods in to Receivables. 3. Conversion of Receivables in to Cash. Factors Influencing Working Capital • • • • • • • • Nature of Business Size of Business Production Cycle Process Credit Policy or Terms of Purchases & Sales Business Cycle Scarce Availability of Raw Materials Dividend Policy Operating Efficiency From the following information of Z Ltd, estimate the working capital needed to finance a level of activity of 1,10,000 units of production after adding a 10% safety contingency Particulars (per unit) Raw materials Direct Labour Overheads (excluding depreciation) Total Cost Profit Selling Price Amount 78 29 58 165 24 189 Additional Information: Average raw materials in stock: 1 month Average materials in process (50% completion stage): Half a month Credit allowed by suppliers: 1 month Credit allowed to customers: 2 months Time lag in payment of Wages: 1 ½ weeks Overhead expenses: 1 month 1/4th of the sales is on Cash basis. Cash balance is expected to be Rs.2,15,000. You may assume that the production is carried out evenly throughout the year & wages & overhead expenses accrue similarly. Estimation of Working Capital Needs Particulars Amount(Rs.) A. Estimation of Current Assets (i) Raw materials inventory:1 month:(110000 x 78 x 4/52) 6,60,000.00 (ii) Work in process inventory: ½ month Raw materials (110000 x 78 x 2/52) = 3,30,000 Direct Labour (110000 x 14.5 x 2/52) = 61,346.15 Overheads = 1,22,692.31 (110000 x 29 x 2/52) 5,14,038.46 (iii)Finished Goods Inventory: 1 month:(110000x78 x 4/52) 13,96,153.85 (iv) Debtors: 2 months: (82,500 x 165 x 8/52) (v) Cash Balance required Total Current Assets 20,94,230.77 2,15,000.00 48,79,423.08 Amount(Rs.) Particulars Amount(Rs.) Amount(Rs.) B. Estimation of Current Liabilities (i) Creditors:1 month:(110000 x 78 x 4/52) 6,60,000.00 (ii) Expenses: Overheads (110000 x 58 x 4/52) = 4,90,769.23 Labour (110000 x 29 x 3/104) = 92.109 .23 Total Current Liabilities C. Working Capital (A-B) Add: 10% Contingency D. Working Capital required 5,82,788.46 12,42,788.46 36,36,634.62 3,63,663.46 40,00,298.08