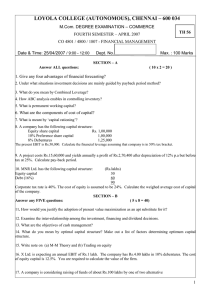

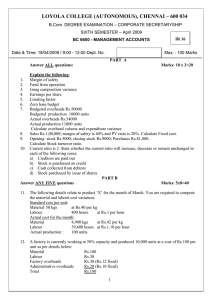

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

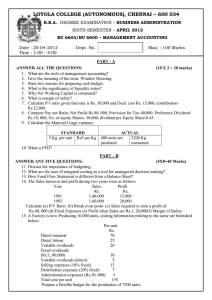

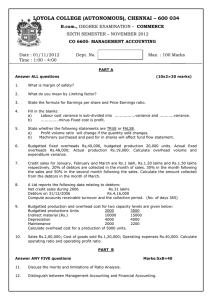

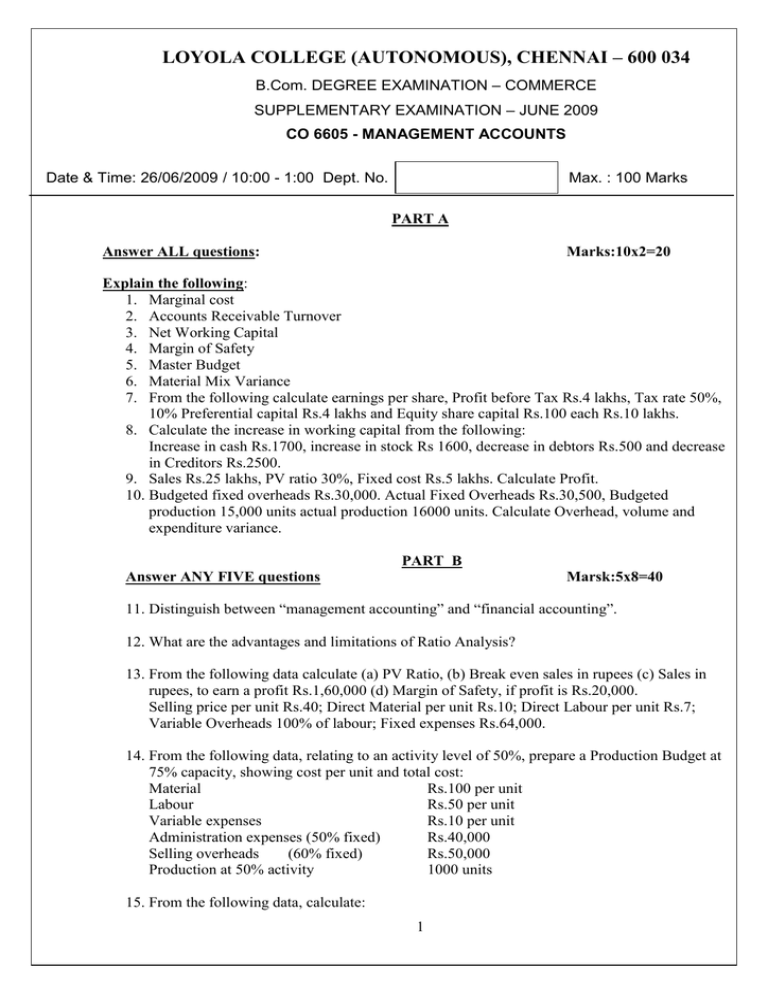

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION – COMMERCE SUPPLEMENTARY EXAMINATION – JUNE 2009 CO 6605 - MANAGEMENT ACCOUNTS Date & Time: 26/06/2009 / 10:00 - 1:00 Dept. No. Max. : 100 Marks PART A Answer ALL questions: Marks:10x2=20 Explain the following: 1. Marginal cost 2. Accounts Receivable Turnover 3. Net Working Capital 4. Margin of Safety 5. Master Budget 6. Material Mix Variance 7. From the following calculate earnings per share, Profit before Tax Rs.4 lakhs, Tax rate 50%, 10% Preferential capital Rs.4 lakhs and Equity share capital Rs.100 each Rs.10 lakhs. 8. Calculate the increase in working capital from the following: Increase in cash Rs.1700, increase in stock Rs 1600, decrease in debtors Rs.500 and decrease in Creditors Rs.2500. 9. Sales Rs.25 lakhs, PV ratio 30%, Fixed cost Rs.5 lakhs. Calculate Profit. 10. Budgeted fixed overheads Rs.30,000. Actual Fixed Overheads Rs.30,500, Budgeted production 15,000 units actual production 16000 units. Calculate Overhead, volume and expenditure variance. PART B Answer ANY FIVE questions Marsk:5x8=40 11. Distinguish between “management accounting” and “financial accounting”. 12. What are the advantages and limitations of Ratio Analysis? 13. From the following data calculate (a) PV Ratio, (b) Break even sales in rupees (c) Sales in rupees, to earn a profit Rs.1,60,000 (d) Margin of Safety, if profit is Rs.20,000. Selling price per unit Rs.40; Direct Material per unit Rs.10; Direct Labour per unit Rs.7; Variable Overheads 100% of labour; Fixed expenses Rs.64,000. 14. From the following data, relating to an activity level of 50%, prepare a Production Budget at 75% capacity, showing cost per unit and total cost: Material Rs.100 per unit Labour Rs.50 per unit Variable expenses Rs.10 per unit Administration expenses (50% fixed) Rs.40,000 Selling overheads (60% fixed) Rs.50,000 Production at 50% activity 1000 units 15. From the following data, calculate: 1 a) Interest coverage ratio b) Return on capital employed c) Price earnings ratio 50% equity shares of Rs.10 each 10% Preference shares of Rs.10 each Reserves 10% Debentures Profit before interest and tax Market price of equity share Tax rate Rs.5,00,000 Rs.4,00,000 Rs.11,00,000 Rs.5,00,000 Rs.10,50,000 Rs.67 50% 16. From the following data, calculate Labour Variances: Standard overhead rate per hour Rs.50 Standard hours per unit 10 During a month 1000 units were produced, 12000 hours were worked and the actual Labour cost was Rs.7,20,000. 17. From the following details ascertain Fund From Operations: 2007 2008 (Rs.) (Rs.) P/L balance 50,000 60,000 General reserve 30,000 40,000 Goodwill 20,000 12,000 Preliminary expenses 6,000 4,000 Depreciation provided during the year was Rs.15,000 and Income received from Non-trading investments Was Rs.20,000. Preference shares of the face value of Rs.1,00,000 were redeemed during the year at 10% premium. The premium was charged to Profit and Loss account. 18. An automobile company finds that the cost of making a component is Rs.6, whereas the same item is available in the market at Rs.5.60. The cost data to manufacture the part, comprises of: Material Rs.2; Direct Labour Rs.2.50; variable overheads Rs.0.50 and fixed overheads (allocated) Re.1. a) Should the part be made or bought? b) What would your answer be, if the market price is Rs.4.60? Show your calculations clearly. PART C Answer any TWO questions 19. Marks:2x20=40 X Ltd., gives you the following budgeted data from which you are required to prepare a cash budget for the months of April and May 2008. Month Sales(Rs) Purchases(Rs) Wages(Rs) Production Overheads(Rs) February 60,000 30,000 20,000 10,000 March 70,000 40,000 25,000 12,000 April 90,000 50,000 30,000 15,000 May 1,00,000 50,000 30,000 14,000 a) 50% of the sales are for cash. Credit sales are collected as follows: 60% in the month following the sale, 30% in the next month following and 10% are bad debts. b) 20% of the purchases are for cash. Suppliers allow 1 month credit. c) Lag in payment of wages ½ month. 2 d) Production overheads are payable in the same month and include Rs.2,000 p.m. as depreciation. e) The company plans to buy a computer for Rs.25,000 in May 2008, making a down payment of Rs.5000 and 5 monthly installments of Rs.5000 each, payable at the end of each month, including month of sale f) A fixed deposit of Rs.20,000 will mature in April 2008 together with Rs.2000 interest. g) Budgeted cash balance on 1st April 2008 Rs.40,000/20. 21. Prepare a Balance sheet from the following data: Gross Profit Ratio 20% Debtors turnover 6 times Fixed assets to net worth 0.8 Reserves to capital 0.5 Current ratio 2.5 Liquid ratio 1.5 Net working capital Rs. 3 lakhs Stock turnover ratio 6 The Balance Sheet of AB Ltd. as on 31/12/2007 and 31/12/2008 are given below: Equity capital P/L a/c General Reserve 12% Debentures Creditors Tax provision a) b) c) d) e) 2007 (Rs.) 2008 (Rs.) 1,00,000 30,000 30,000 1,00,000 60,000 80,000 ---------4,00,000 2,00,000 80,000 50,000 2,00,000 50,000 90,000 ----------6,70,000 Fixed assets Investments Stock Debtors Bank 2007 (Rs.) 2008 (Rs.) 2,00,000 30,000 60,000 50,000 60,000 4,00,000 60,000 50,000 70,000 90,000 ---------4,00,000 Fixed assets of the book value of Rs.30,000 was sold for Rs.32,000 Depreciation provided on fixed assets during the year 2008 was Rs.48,000 Investments costing Rs.20,000 was sold during the year for Rs.18,000 Tax provided during the year Rs.85,000 Interim dividend paid during the year Rs.20,000 Prepare statement showing sources and application of funds. ****** 3 ---------6,70,000