Recording Adjusting Entries

advertisement

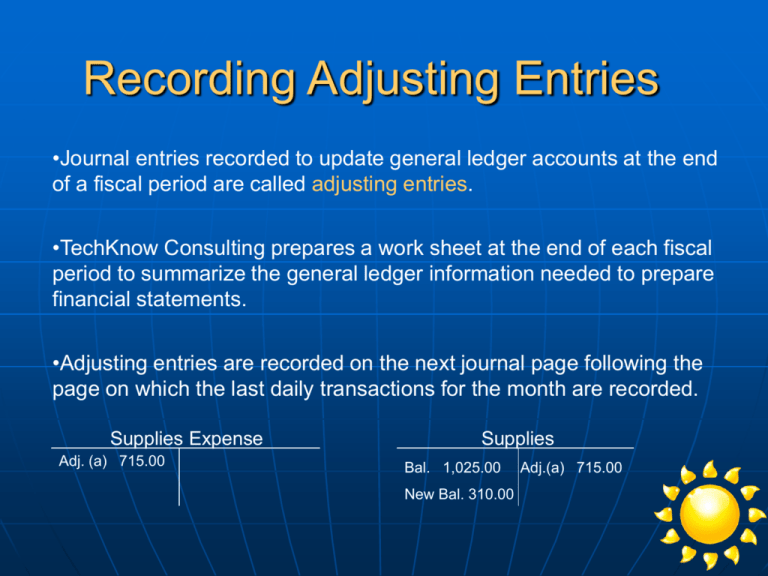

Recording Adjusting Entries •Journal entries recorded to update general ledger accounts at the end of a fiscal period are called adjusting entries. •TechKnow Consulting prepares a work sheet at the end of each fiscal period to summarize the general ledger information needed to prepare financial statements. •Adjusting entries are recorded on the next journal page following the page on which the last daily transactions for the month are recorded. Supplies Expense Adj. (a) 715.00 Supplies Bal. 1,025.00 New Bal. 310.00 Adj.(a) 715.00 Recording Closing Entries Vocabulary Accounts used to accumulate information from one fiscal period to the next are called permanent accounts. Accounts used to accumulate information until it is transferred to the owner’s capital account are called temporary accounts. Journal entries used to prepare temporary accounts for a new fiscal period are called closing entries. Permanent Accounts •Also referred to as real accounts. •Include the asset and liability accounts and the owner’s capital account. •The ending account balances of permanent accounts for one fiscal period are the beginning account balances for the next fiscal period. Temporary Accounts Are also referred to as nominal accounts. Include the revenue, expense, and owner’s drawing accounts plus the income summary account. Show changes in the owner’s capital for a single fiscal period. At the end of a fiscal period, the balances of temporary accounts are transferred to the owner’s capital account, these accounts begin with a zero balance. To close a temporary account, an amount equal to its balance is recorded in the account on the side opposite to its balance. • For example, if an account has a credit balance of $3,565.00, a debit of $3,565.00 is recorded to close the account. • Whenever a temporary account is closed, the closing entry must have equal debits and credits. Recording Closing Entries Cont. The income summary account is unique because it does not have a normal balance side. The balance is determined by the amounts posted to the account at the end of a fiscal period. When revenue is greater than (>) total expenses, the result is net income. When expenses are greater than (>) revenue, the result is net loss. Income Summary Income Summary Debit Credit Debit Credit Total expenses Revenue>expense Total expenses Revenue Net income > Rev. (net loss) Closing Order All temporary accounts must be brought to a “zero” balance and transferred to another account (Income Summary, etc.) The closing order: (1) Sales (Revenue) (debit) transfer to I.S. (credit) (2) All expenses (credit) transfer to I.S. (debit) (3) Income Sum. (N.I.#) (debit) transfer to capital (credit) (4) Drawing (credit) transfer to capital account (debit) Post-Closing Trial Balance A trial balance prepared after closing entries are posted is called a post-closing trial balance. The series of accounting activities included in recording financial information for a fiscal period is called an accounting cycle. Label account numbers on General Journal Label general journal page number on post. Ref. section of general ledger. Do not forget to label the dates before every entry, even if it is the same day every time! Make sure to label adjusting entries on supplies, prepaid insurance and their expenses. Noticing and crossing out accounts on the ledger that may not be used in closing entries is good practice. Finally, make sure debits ALWAYS equal credits!