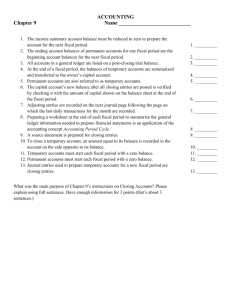

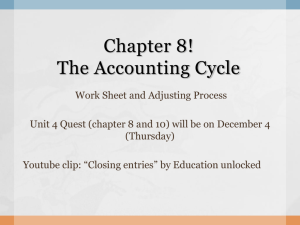

Chapter 8, Section 1 Notes

advertisement

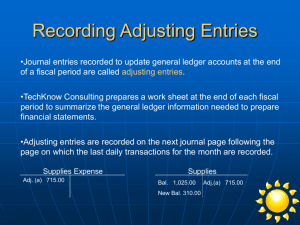

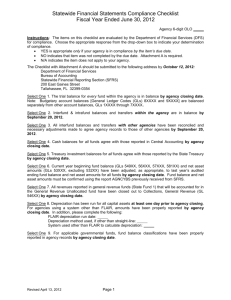

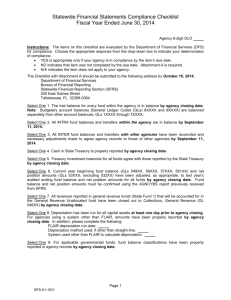

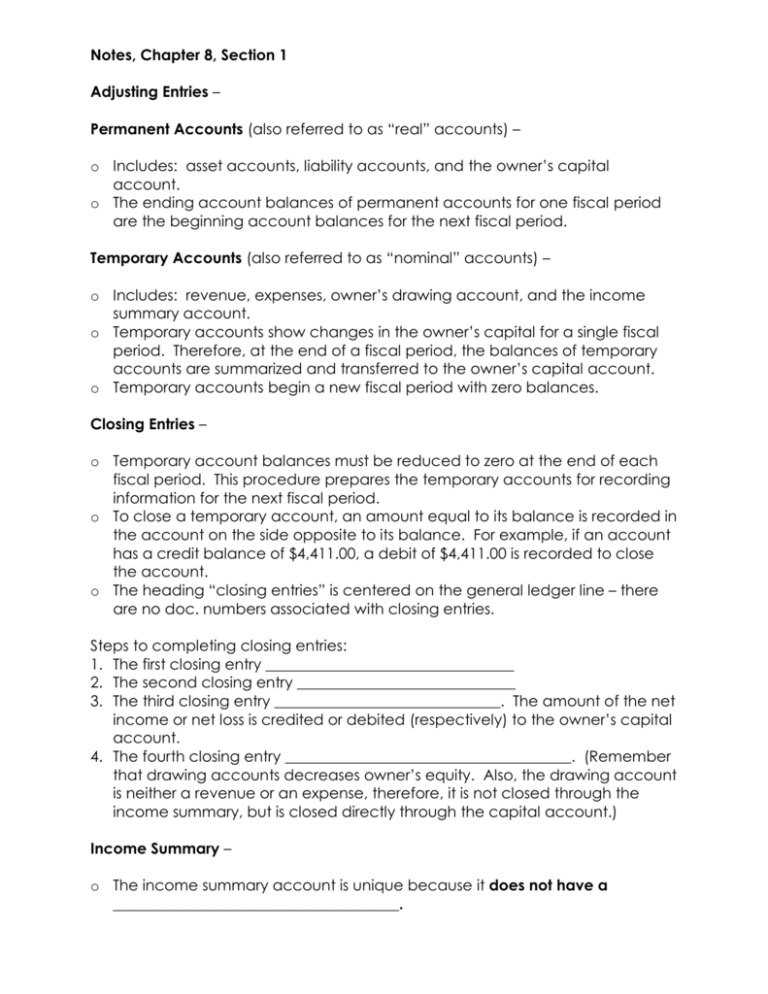

Notes, Chapter 8, Section 1 Adjusting Entries – Permanent Accounts (also referred to as “real” accounts) – o Includes: asset accounts, liability accounts, and the owner’s capital account. o The ending account balances of permanent accounts for one fiscal period are the beginning account balances for the next fiscal period. Temporary Accounts (also referred to as “nominal” accounts) – o Includes: revenue, expenses, owner’s drawing account, and the income summary account. o Temporary accounts show changes in the owner’s capital for a single fiscal period. Therefore, at the end of a fiscal period, the balances of temporary accounts are summarized and transferred to the owner’s capital account. o Temporary accounts begin a new fiscal period with zero balances. Closing Entries – o Temporary account balances must be reduced to zero at the end of each fiscal period. This procedure prepares the temporary accounts for recording information for the next fiscal period. o To close a temporary account, an amount equal to its balance is recorded in the account on the side opposite to its balance. For example, if an account has a credit balance of $4,411.00, a debit of $4,411.00 is recorded to close the account. o The heading “closing entries” is centered on the general ledger line – there are no doc. numbers associated with closing entries. Steps to completing closing entries: 1. The first closing entry _________________________________ 2. The second closing entry _____________________________ 3. The third closing entry ______________________________. The amount of the net income or net loss is credited or debited (respectively) to the owner’s capital account. 4. The fourth closing entry ______________________________________. (Remember that drawing accounts decreases owner’s equity. Also, the drawing account is neither a revenue or an expense, therefore, it is not closed through the income summary, but is closed directly through the capital account.) Income Summary – o The income summary account is unique because it does not have a ______________________________________. o The balance of the income summary account is determined by the amounts posted to the account at the end of a fiscal period. o Whether the balance of the income summary account is a credit or a debit depends upon whether the business earns a net income or incurs a net loss. o Because income summary is a temporary account, the account is also closed at the end of a fiscal period when the net income or net loss is recorded.