Chapter 7-Financial Statements for a Proprietorship

advertisement

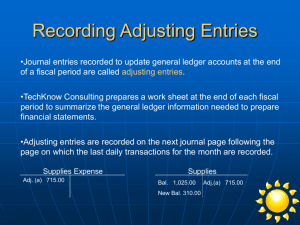

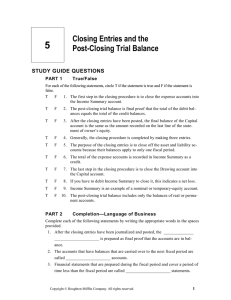

Accounting Theory Accounting Period Cycle Adjusting Entries Matching Expenses with Revenue Adjustments are analyzed and planned on a worksheet ◦ Preparing financial statements at the end of each fiscal period ◦ Journal entries recorded to update general ledger accounts at the end of the fiscal period ◦ Recorded on the next journal page following the page on which the last daily transaction for the month are recorded ◦ The revenue earned and the expenses incurred to earn that revenue are reported in the same fiscal period Supplies and Supplies Expense are adjusted for the amount of supplies used during the period ◦ Supplies Expense debit shows the supplies used ◦ Supplies credit shows supplies used Prepaid Insurance and Insurance Expense are adjusted for the amount of insurance used during the period ◦ Insurance Expense debit shows the insurance used ◦ Prepaid Insurance credit shows insurance used Accounts used to accumulate information from one fiscal period to the next ◦ Assets, Liabilities and Capital Listed on the post-closing trial balance Ending balances are the beginning balances for the next accounting period cycle The capital account’s new balance after all closing entries are posted is verified by checking it with the amount of capital shown on the balance sheet at the end of the fiscal period Accounts used to accumulate information until it is transferred to the owner’s capital account ◦ Sales, Expenses, Income Summary, and Drawing Balances are summarized and transferred to the owner’s capital account Must start each fiscal period with a zero balance by making closing entries ◦ To close a temporary account, an amount equal to its balance is recorded in the account on the side opposite its balance ◦ Information needed for closing entries is found in the work sheet income statement and balance sheet columns Sales, Expenses, Income Summary and Drawing ◦ Debit Sales, Credit Income Summary ◦ Debit Income Summary, Credit Expenses ◦ Depending on the balance of income summary When expenses are greater than revenue, income summary has a debit balance Debit Capital, Credit Income Summary When expenses are less than revenue, income summary has a credit balance Debit Income Summary, Credit Capital ◦ Debit Capital, Credit Drawing There is not a source document for closing entries 1. 2. 3. 4. 5. 6. 7. 8. ◦ ◦ Analyzing Transactions Journalize the Transactions to the General Journal Post the Transaction to the Ledger Prepare a Worksheet Prepare Financial Statements Journalize Adjusting and Closing Entries Post Adjusting and Closing Entries Prepare Post-Closing Trial Balance Verifies debits and credits Only ledger accounts with balances are included Assets, Liabilities and Capital Numbers come from ledgers not the worksheet